Binance сообщает о значительном снижении объема торгов биткойном и доминировании продавцов

Недавняя коррекция цены биткойна привела к значительному снижению объема торгов BTC на Binance, крупнейшей криптовалютной бирже. Аналитики выражают обеспокоенность по поводу возможного влияния на стабильность рынка.

Торговая активность на Binance сигнализирует о осторожности для трейдеров биткойна

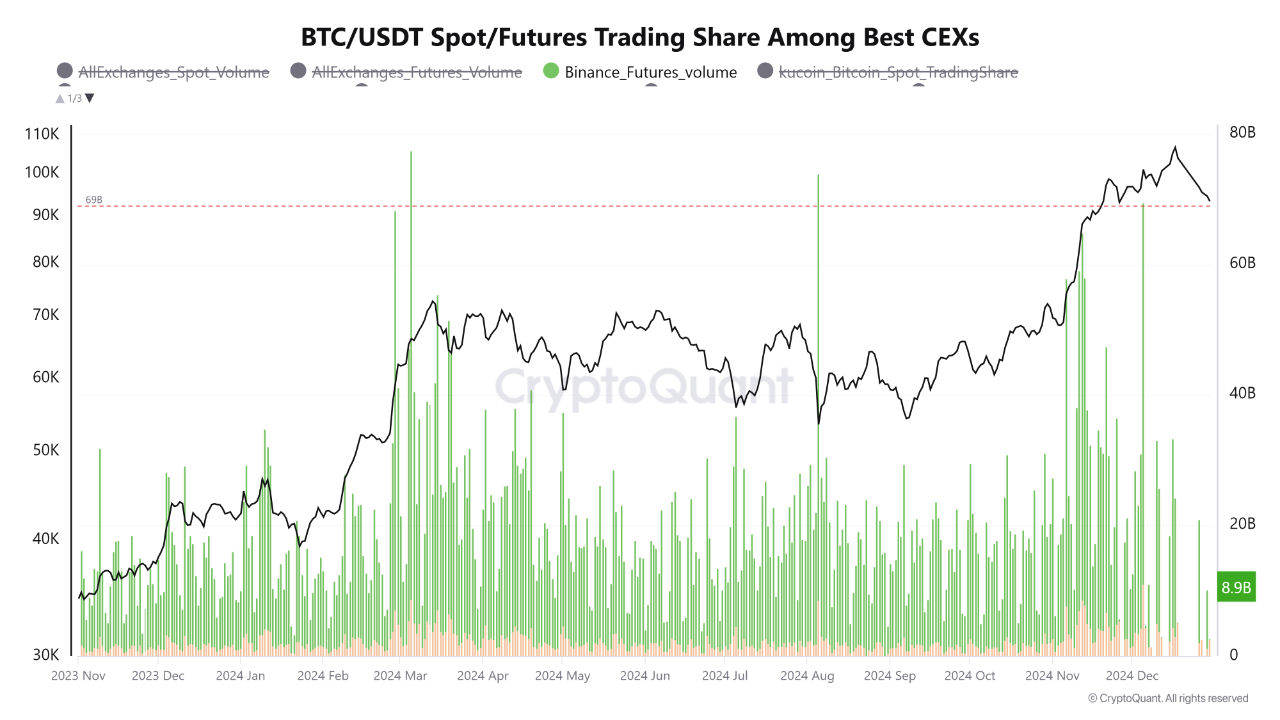

В отчете аналитика Crazzyblockk указано, что объемы спотовых и фьючерсных торгов по паре BTC/USDT резко сократились. Это снижение указывает на уменьшение покупательной способности и ликвидности, которые важны для поддержания стабильности цен.

Снижение торговой активности обычно отражает уменьшение спроса, что увеличивает восприимчивость рынка к колебаниям цен. При меньшем количестве активных покупателей значительные распродажи могут привести к резкому падению цен, усугубляя волатильность.

Crazzyblockk советует проявлять осторожность и рекомендует трейдерам избегать импульсивных решений:

Учитывая текущие рыночные условия, рекомендуется проявлять особую осторожность и избегать импульсивных решений. Даже небольшие изменения в покупательском или продажном давлении могут привести к значительной волатильности на рынке биткойна.

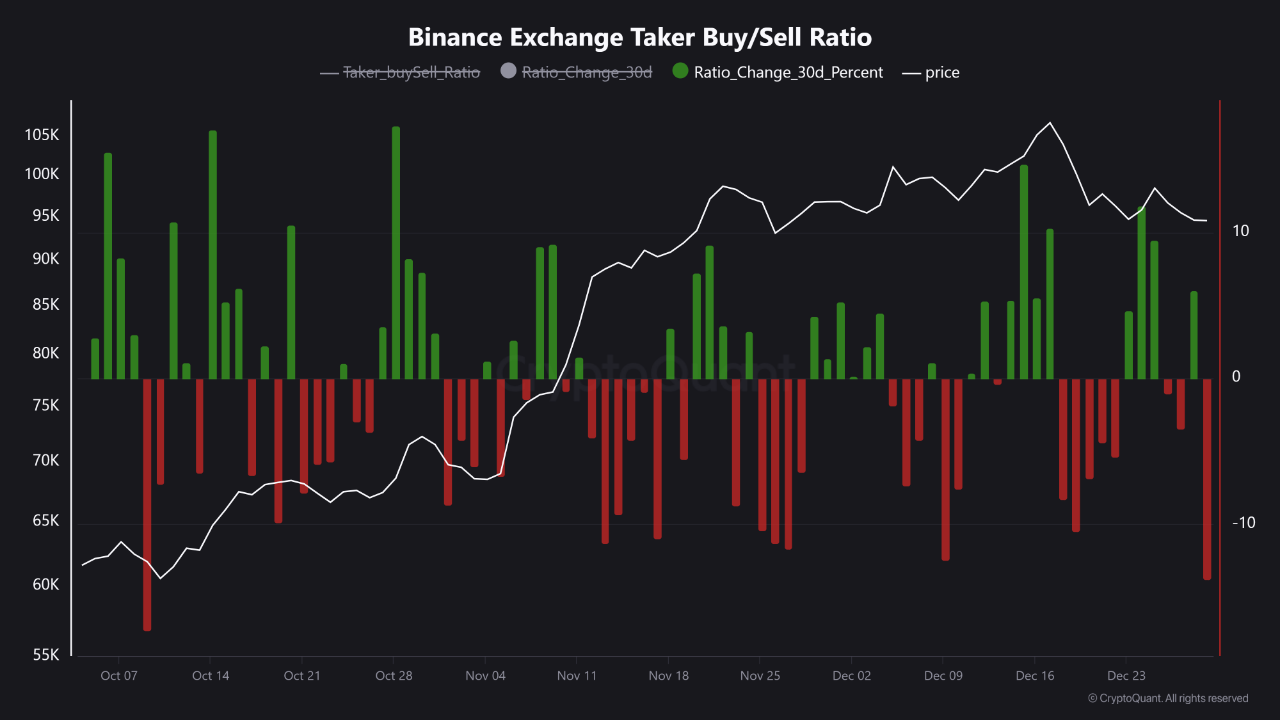

Кроме того, соотношение покупок и продаж на Binance изменилось в пользу продавцов, что указывает на то, что продавцы в настоящее время доминируют в рыночной активности.

Соотношение покупок и продаж указывает на изменение рыночного настроения

Соотношение покупок и продаж является важным индикатором рыночного настроения, особенно на Binance, которая занимает большую долю глобальной торговли биткойном. Crazzyblockk сообщил о заметном увеличении активности продавцов в последние недели, что свидетельствует о медвежьем настроении и повышенной вероятности снижения цен.

Эта тенденция следует за периодом слабой покупательской активности, что указывает на остановку бычьего импульса. Неясно, сохранится ли эта модель. Crazzyblockk отметил:

Если эта тенденция сохранится и наклон останется в сторону продаж контрактов, можно ожидать более глубокую коррекцию на рынке.

С другой стороны, увеличение активности покупателей может стабилизировать цены и восстановить доверие. Несмотря на продолжающиеся опасения, эта ситуация может представлять потенциальную возможность для покупки для долгосрочных инвесторов.

Исторические тенденции показывают, что низкий объем торгов и медвежье настроение часто предшествуют значительным рыночным восстановлением. Тем не менее, рекомендуется проявлять осторожность в отношении спекулятивных торговых стратегий в текущей обстановке.

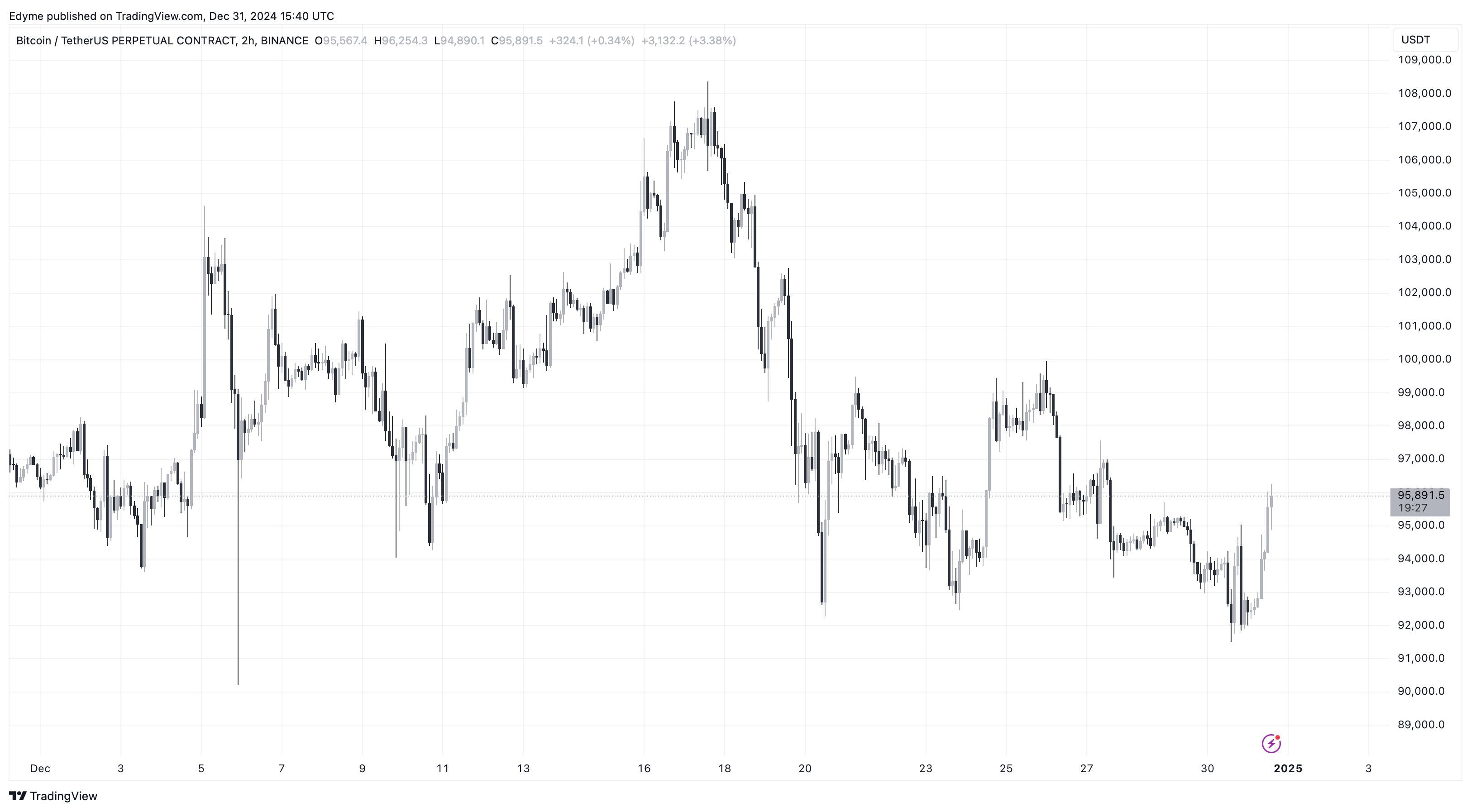

Изображение создано с помощью DALL-E, график из TradingView.