Открытый интерес по биткойну стал отрицательным на фоне снижения аппетита к риску

Биткойн превысил $120,000, достигнув внутридневного максимума в $122,300, приближаясь к историческому максимуму в $123,000. Это движение указывает на бычий импульс, однако опытные инвесторы предупреждают о возможной коррекции перед дальнейшей консолидацией.

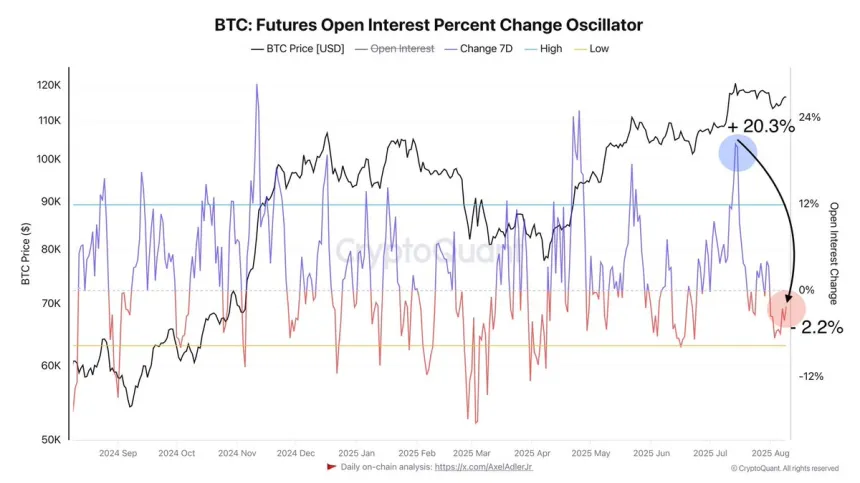

Недавние данные от CryptoQuant показывают значительное снижение среднего недельного открытого интереса с более чем 20% до отрицательных значений. Это отражает уменьшение краткосрочного аппетита к риску, что может ослабить спекулятивный импульс.

- Снижение открытого интереса может сигнализировать о фазах охлаждения после агрессивного использования кредитного плеча.

- Такие откаты, особенно с увеличением ликвидаций, могут представлять возможности для покупки.

Открытый интерес сигнализирует об охлаждении аппетита к риску

Аналитик Darkfost сообщает, что текущая средняя недельная динамика открытого интереса составляет -2.2%, что резко контрастирует с предыдущими +20%. Это снижение указывает на то, что трейдеры сокращают позиции с кредитным плечом после длительной бычьей фазы.

Darkfost отмечает, что значительные падения открытого интереса вместе с резкими всплесками ликвидаций могут указывать на благоприятные точки входа для длинных позиций, так как ликвидируются чрезмерно заимствованные сделки. Мониторинг этих метрик важен для оценки рыночных условий.

Пока Эфириум приближается к историческим максимумам, стабильность Биткойна выше $120K и улучшение настроений по альткойнам могут привести к сильному продолжению в ближайшие недели. Трейдеры будут внимательно следить за деривативными метриками на предмет признаков возобновления кредитного плеча или дальнейшего охлаждения.

Биткойн тестирует ключевое сопротивление чуть ниже исторического максимума

Биткойн достиг $121,337, выйдя из недавней консолидации и приблизившись к историческому максимуму. Суточный график подтверждает бычий импульс, удерживая поддержку на 50-дневной скользящей средней около $114,155.

Это движение приближает BTC к критической области сопротивления $123,217–$124,000. Закрытие выше этого уровня может спровоцировать новые исторические максимумы и дополнительный восходящий импульс.

Производительность Биткойна в ближайшие сессии будет решающей для общего рыночного настроения. Устойчивость выше $124K может катализировать общий рост рынка, в то время как неудача в пробое выше может привести к консолидации перед следующим движением.