0

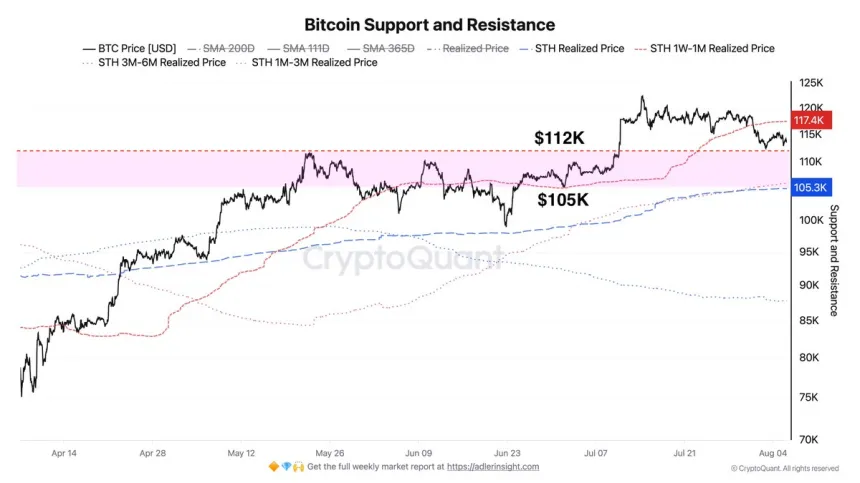

Биткойн испытывает давление ниже сопротивления $116K

Биткойн потерял ключевой уровень поддержки в $115,000. Это привело к увеличению давления на продажу и изменению настроений инвесторов. Основные моменты:

- Краткосрочное сопротивление установлено на уровне $112,000.

- Зона $112K–$105K является структурно слабой; пробой ниже $105K может вызвать ликвидацию длинных позиций.

- Макроэкономическая неопределенность и снижение потоков в ETF влияют на рыночные настроения.

Риск для Краткосрочных Держателей Растёт

Увеличение уязвимости краткосрочных держателей (STH) очевидно, так как их реализованная цена составляет $117,000, что указывает на убытки. Ключевые детали:

- Краткосрочные держатели могут начать панические продажи при возникновении негативных факторов, что приведет к общему падению рынка.

- Уровень $105,000 является критической поддержкой по данным STH Реализованной Цены, что может замедлить нисходящий тренд при его достижении.

- Слабые данные по занятости в США вызывают спекуляции о снижении процентных ставок, что добавляет давление на рыночные настроения.

Биткойн Пытается Восстановиться На Фоне Сопротивления

В настоящее время торгуется около $115,478, Биткойн сталкивается с сопротивлением близко к $116K. Важные наблюдения:

- Ключевые скользящие средние на уровнях $116,596 и $115,799 действуют как верхнее сопротивление.

- Пробой выше зоны сопротивления может привести к повторному тестированию максимума в $122K.

- Низкий объем по сравнению с предыдущими пробоями говорит о осторожности покупателей; неспособность восстановить уровень $116K может вернуть цены в диапазон $112K–$113K.