Биткойн вырос на 10,4% до $103,881 после вывода $312 млн с Binance

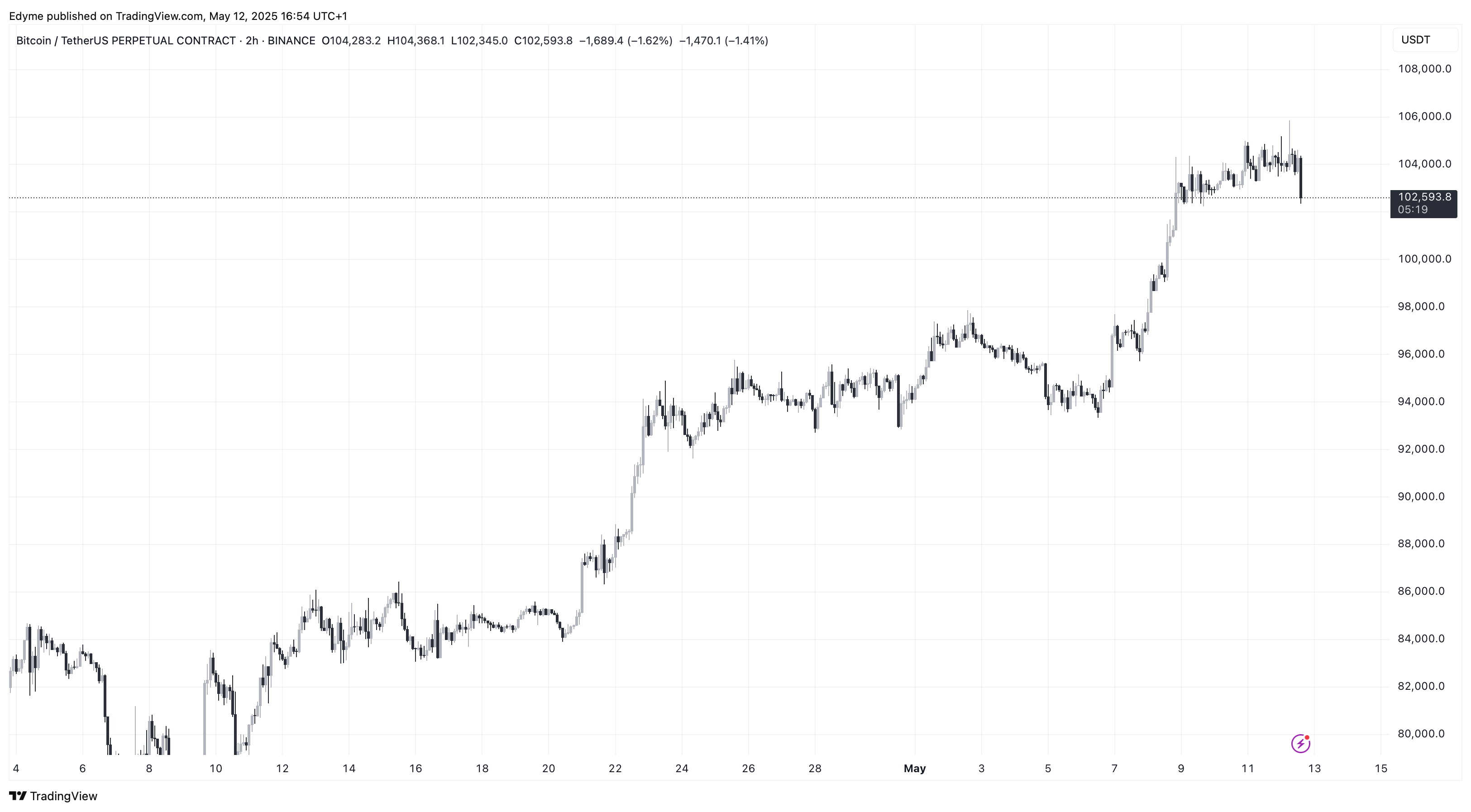

Цена биткойна за последнюю неделю увеличилась на 10,4% и составляет $103,881. За последний месяц рост составил более 24%, что связано с оптимизмом на крипторынке и традиционных рынках.

- Цена остается примерно на 4% ниже рекорда января.

- Значительные движения капитала указывают на бычий тренд, включая крупные оттоки из Binance.

Оттоки из биржи Bitcoin указывают на накопление

12 мая было выведено более 3,000 BTC на сумму около $312 миллионов из Binance. Это один из крупнейших дневных оттоков в последнее время. Событие произошло на фоне нового торгового соглашения между США и Китаем, что привело к росту S&P 500 более чем на 3%.

- Резервы BTC на Binance снизились с примерно 595,000 BTC в конце февраля до 541,400 BTC к середине мая.

- Снижение балансов на биржах говорит о предпочтении холодного хранения, что указывает на накопительное поведение инвесторов.

- Отток совпал с ослаблением тарифной напряженности между США и Китаем, что положительно сказалось на капиталовых рынках.

Крупные держатели перераспределяют активы для потенциальной прибыли, убирая ликвидность с бирж, чтобы снизить давление на продажу. Это отражает возобновленный аппетит к риску среди участников рынка.

Макроэкономические тренды влияют на позиционирование рынка

Недавние оттоки BTC показывают, как капитал перемещается между классами активов из-за макроэкономических изменений. Долгосрочные держатели и институциональные инвесторы демонстрируют растущую уверенность в биткойне как части диверсифицированных инвестиционных стратегий.

- С восстановлением традиционных рынков низкие резервы на биржах и растущие офф-эксчендж-хранения могут позволить провести еще одну проверку рекорда биткойна.

- Следующие несколько недель будут критичными для определения, приведут ли текущие притоки к прорыву или к фазе консолидации.