Кит вложил $23,7 млн в биткойн по $200K к концу года

Рост цены биткойна замедлился, но крупные инвесторы остаются оптимистичными. Один из крупных инвесторов реализовал значительную опционную стратегию с целью $200,000 к концу года, которая включает:

- Покупка 3,500 контрактов колл-опциона на $140,000 с истечением в декабре

- Шорт-продажа 3,500 контрактов колл-опциона на $200,000 с истечением в декабре

Эта стратегия бычьего колл-спреда привела к чистому дебету в $23.7 миллиона. Стратегия направлена на максимальную прибыль при достижении BTC уровня $200,000 до истечения срока. Она предлагает ограниченные прибыли и ограничивает потенциальные убытки до первоначального дебета.

Спотовая цена биткойна достигла пика более $123,000 14 июля и с тех пор колебалась в диапазоне от $116,000 до $120,000.

Рекордная активность на рынке опционов

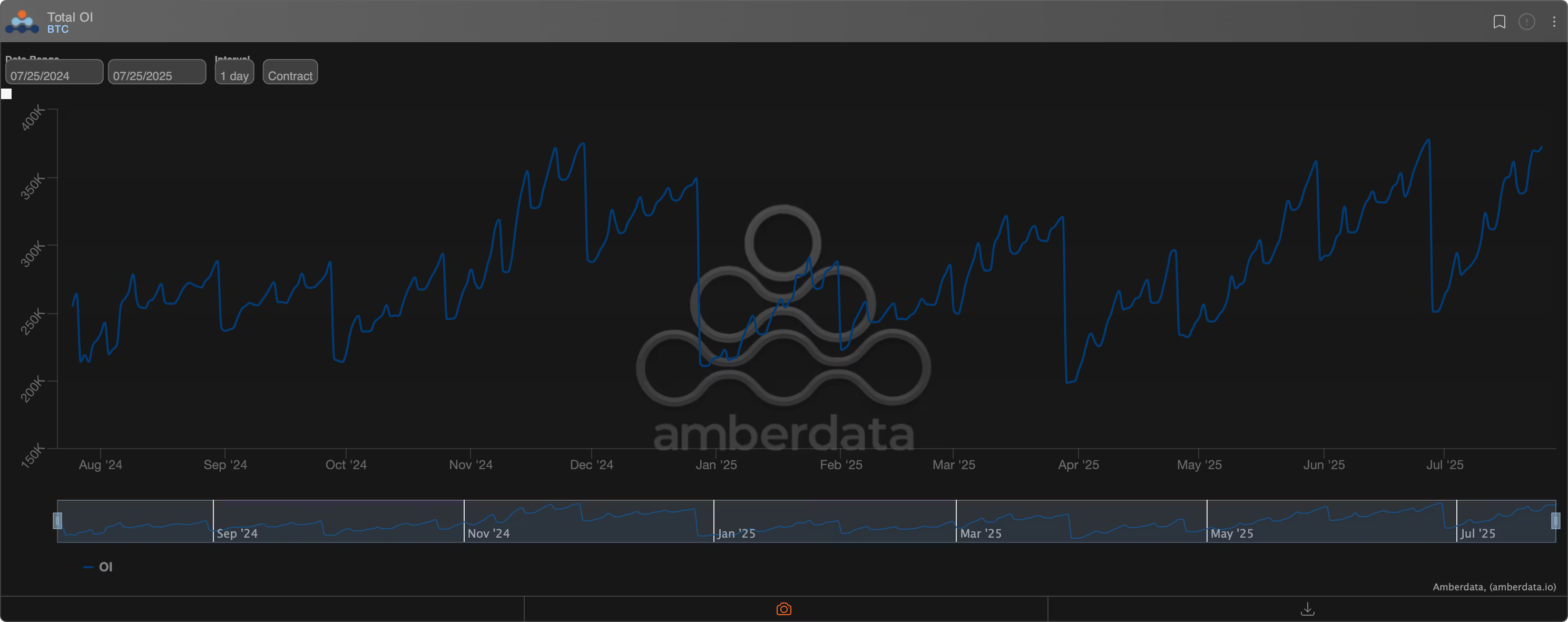

Увеличение институционального интереса повысило активность на рынке опционов. На Deribit, который обрабатывает более 80% мировых торговых операций с опционами, открытый интерес по опционам на BTC достиг 372,490 BTC, приближаясь к рекорду в 377,892 с июня.

Открытый интерес по опционам на эфир также достиг рекорда в 2,851,577 ETH.