0

Имплицитная волатильность Биткойна упала до минимума за несколько лет

Снижение волатильности Bitcoin

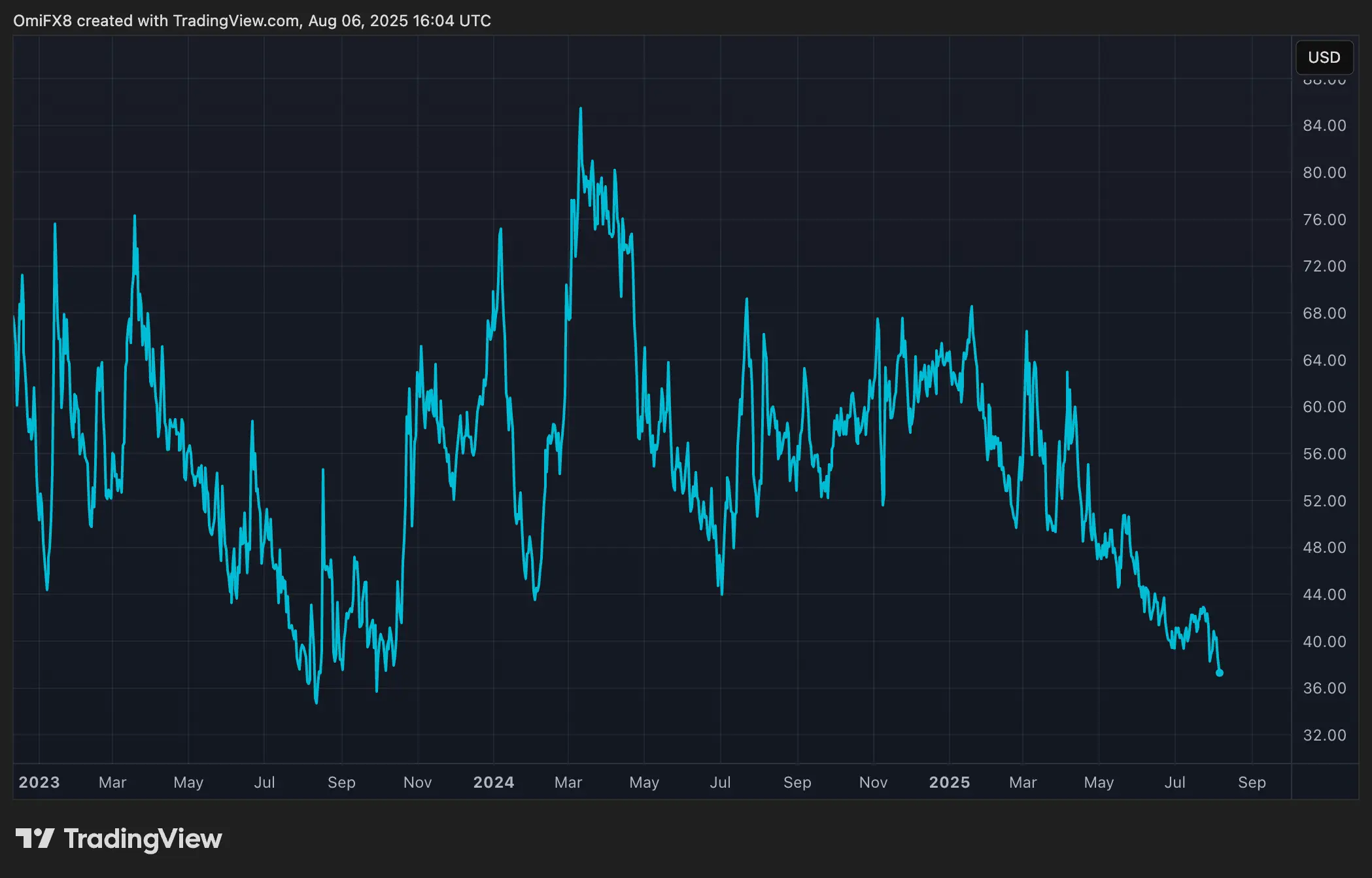

Волатильность Bitcoin продолжает снижаться. Цены стабилизировались в диапазоне от $110,000 до $120,000. 30-дневная подразумеваемая волатильность, измеряемая индексом BVIV от Volmex, упала до 36.5% в годовом исчислении. Это самый низкий уровень с октября 2023 года, когда BTC стоил менее $30,000, согласно данным TradingView.

- Низкая подразумеваемая волатильность указывает на то, что трейдеры опционов не ищут хеджирование, несмотря на возможные опасения по поводу стагфляции в экономических данных США.

- Тренды волатильности BTC расходятся с движениями цен, которые выросли с $70,000 до более чем $110,000 с ноября.

- Это изменение свидетельствует о смене рыночной динамики, где волатильность BTC исторически соответствовала изменениям цен.

- Рост использования структурированных продуктов и опционов вне денег способствует новой корреляционной модели.

- BTC все больше отражает паттерны Уолл-стрит, где подразумеваемая волатильность обычно снижается во время устойчивых бычьих рынков.