0

Эфир вырос более чем на 50% в июле из-за ETF и корпоративных покупок

Рынок Ether (ETH) в июле

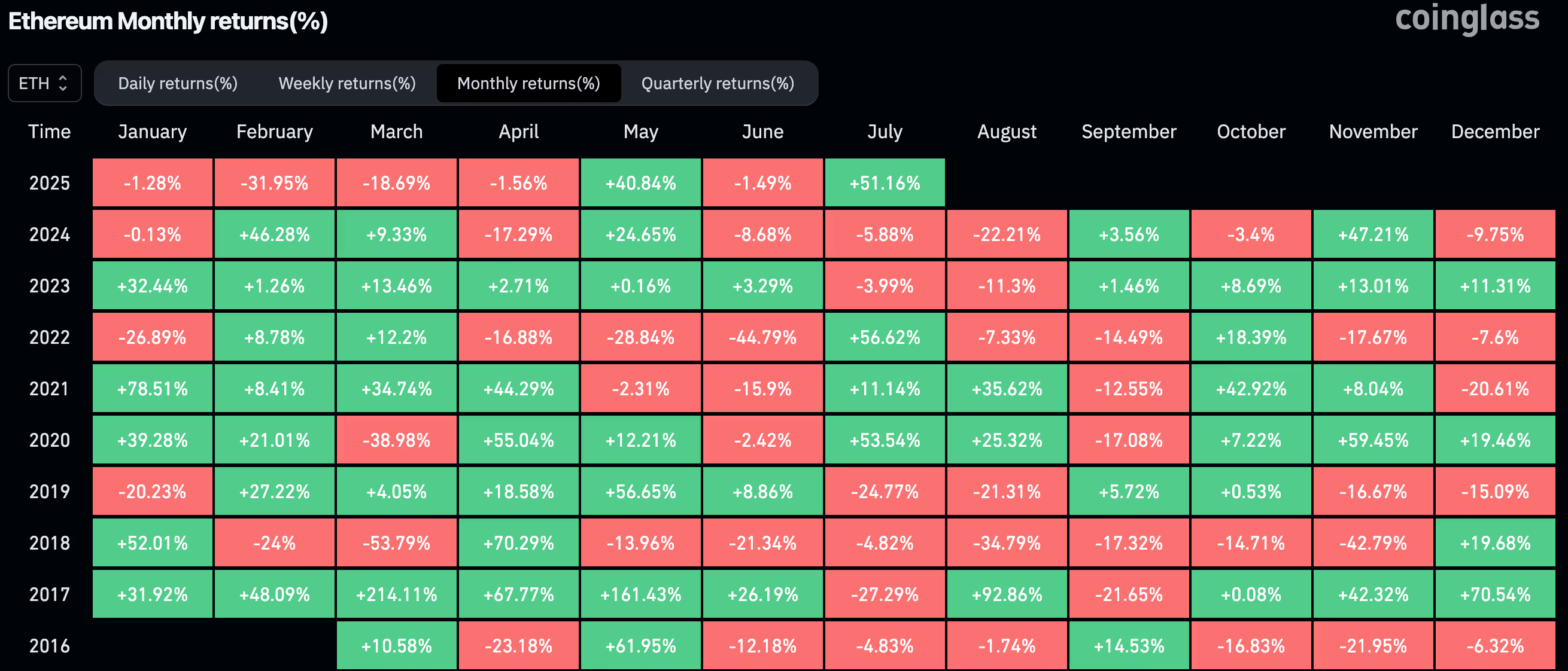

Ether (ETH) показал лучший результат за июль за последние три года, увеличившись более чем на 50% и достигнув пика в $3,940, прежде чем закрыться ниже $3,800.

Ключевые моменты:

- Последний значительный рост был в июле 2022 года после падения крипторынка.

- ETF на основе ETH, зарегистрированные в США, получили чистый приток в $5.4 миллиарда — максимальный с момента запуска в прошлом году.

- Публичные компании приобрели ETH на сумму $6.2 миллиарда, среди них Bitmine и SharpLink.

- Новые игроки, такие как ETHZilla и Ether Machine, привлекли значительные средства для покупки активов.

- ETH выступает в качестве прокси для растущего рынка стейблкоинов, на который приходится более половины от общего объема в $250 миллиардов.

- Текущий уровень сопротивления составляет $4,000; предыдущие попытки преодолеть этот уровень не увенчались успехом.

- Рынок может войти в фазу консолидации, но прогнозы указывают на возможность достижения ETH уровня $4,700.