2

Рынок опционов показывает больший риск для Эфира, чем для Биткоина

Изменение настроений на рынке деривативов

Деривативы для страхования от падения курса эфира стали дороже, чем для биткойна. Это указывает на изменение настроений в сторону эфира, согласно данным Deribit.

- Недавно крупные инвесторы предпочитали эфир.

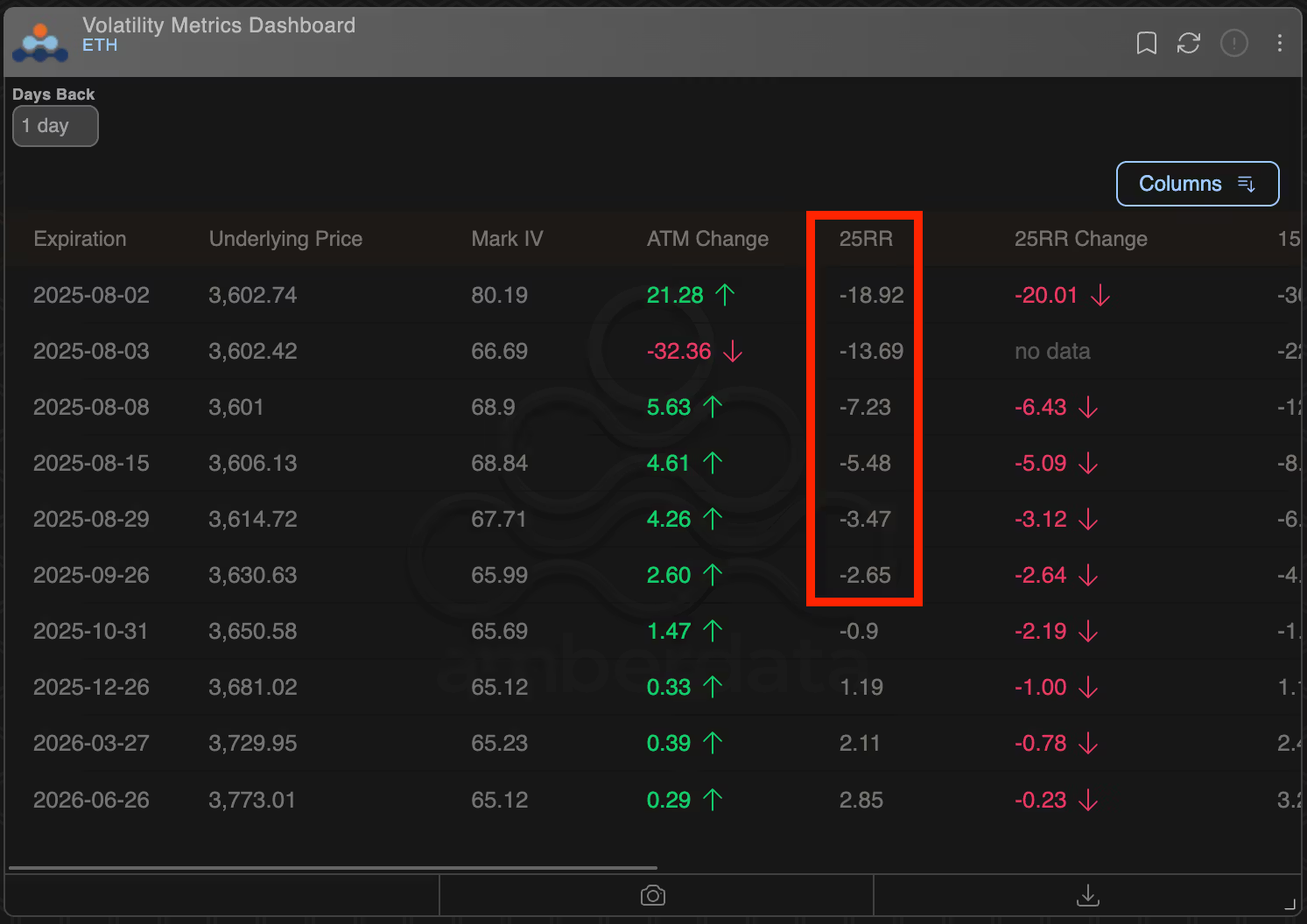

- 25-дельта риск-реверсалы для опционов на эфир за август и сентябрь торгуются на уровне -2% до -7%, что свидетельствует о премии для пут-опционов по сравнению с колл-опционами.

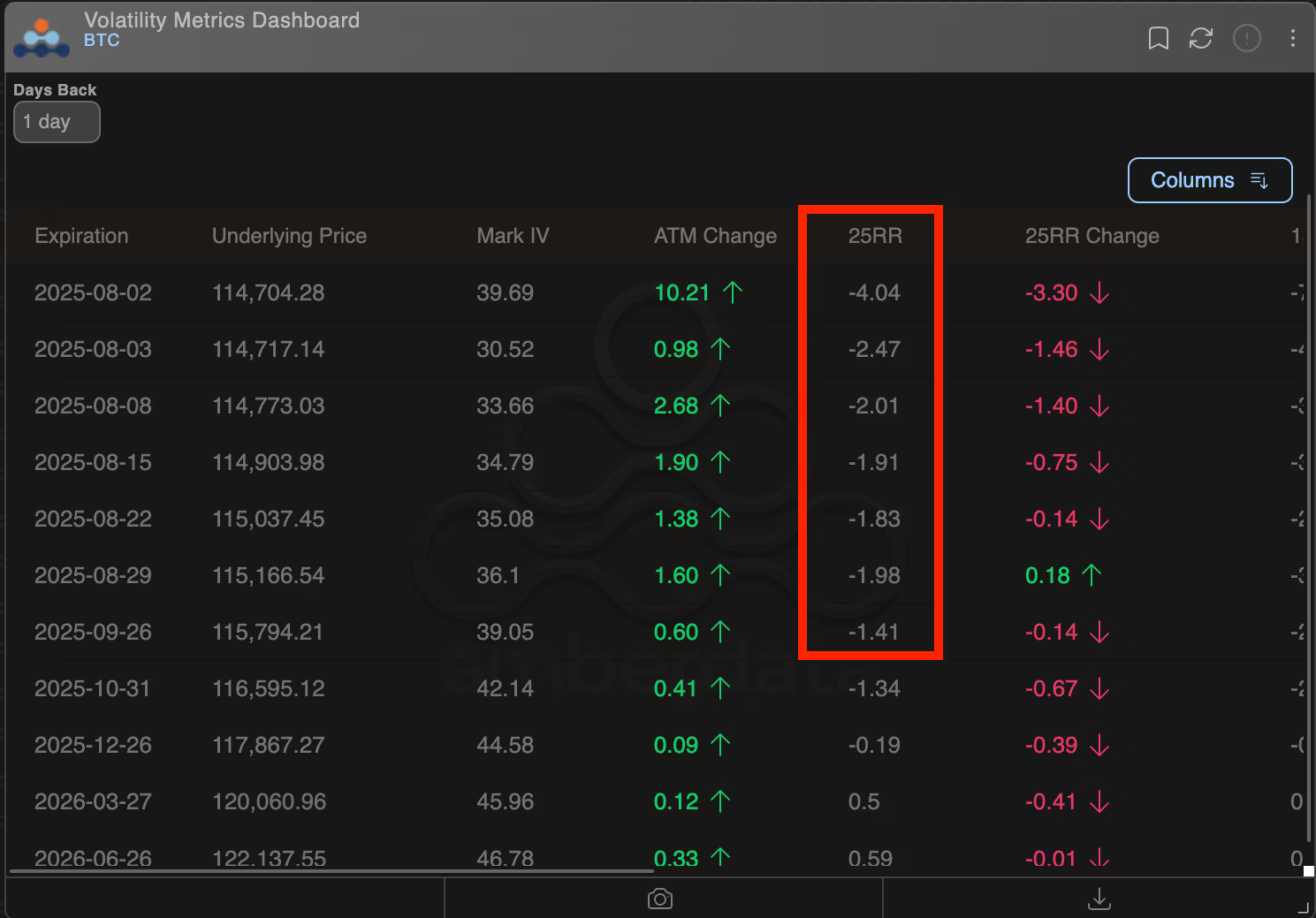

- Краткосрочные пут-опционы на биткойн имеют премию 1%-2.5% над колл-опционами, что отражает меньшие опасения по поводу падения.

- 25-дельта риск-реверсал — это стратегия опционов, включающая длинную позицию по пут-опциону и короткую позицию по колл-опциону с дельтой 25%.

- Эфир вырос на 48% в июле, достигнув $3,941, в то время как биткойн прибавил 8%. Рост эфира замедлился из-за опасений по поводу его устойчивости.

- Текущие цены: эфир — $3,600 (падение на 6%), биткойн — $114,380 (падение на 3%).