1

Вывод $812 миллионов из Bitcoin ETF — второй по величине в истории

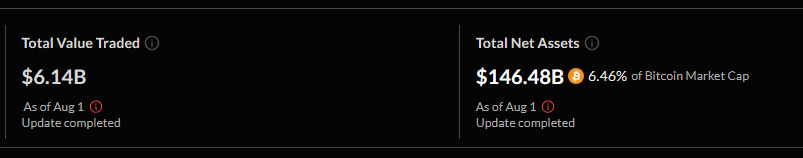

Спотовые Bitcoin ETF столкнулись с крупными институциональными выводами, составившими более $812 миллионов в прошлую пятницу. Это второй по величине однодневный отток в истории, что снизило совокупные чистые притоки до $54.18 миллиардов.

Ключевые моменты

- Общие активы под управлением спотовых Bitcoin ETF составляют $146.48 миллиардов, что соответствует 6.46% рыночной капитализации Bitcoin.

- Лидером по выкупам стал Fidelity’s FBTC с $331 миллионом, за ним следует ARK Invest’s ARKB с $327.93 миллиона.

- Grayscale’s GBTC показал отток в $67 миллионов, а BlackRock’s IBIT — незначительный отток в $2.58 миллиона.

- Ежедневный объем торгов всех Bitcoin ETF достиг $6.13 миллиардов, при этом BlackRock’s IBIT составил $4.50 миллиарда.

- Несмотря на выводы, активная торговля свидетельствует о корректировке позиций инвесторов, а не об их полном выходе.

Конец серии притоков Ether ETF

Спотовые Ether ETF зафиксировали чистые оттоки в $152 миллиона в прошлую пятницу, завершив 20-дневную серию притоков. Grayscale’s ETHE стал крупнейшим источником этих оттоков, потеряв $47.68 миллиона.

- Bitwise’s ETHW и Fidelity’s FETH потеряли $40.30 миллиона и $6.17 миллиона соответственно.

- BlackRock’s ETHA сохранил стабильность с активами под управлением в $10.71 миллиарда.

- Общий объем торгов для Ether ETF составил $2.26 миллиарда, при этом продукт Grayscale составил почти $290 миллионов.

- Совокупные активы под управлением Ether ETF составляют $20 миллиардов, или 4.70% рыночной капитализации Ethereum.