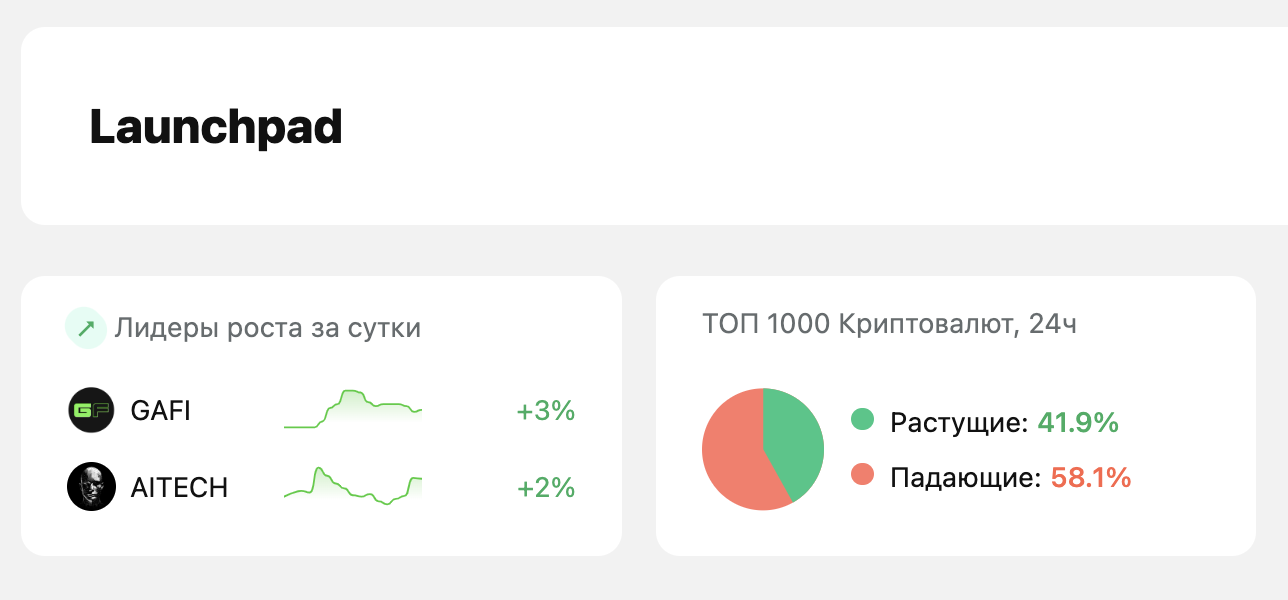

Best launchpads for token launches in 2025

Launchpads in the cryptocurrency ecosystem play a key role in attracting investments and launching new projects. They provide platforms for blockchain startups to raise funds through various forms of initial token offerings (ICO, IDO, and others).

Launchpads have become an integral part of the crypto ecosystem, giving investors the opportunity to access promising projects at early stages.

Advantages of Using Launchpads

Examples of successful launches and unique mechanics show that participating in launchpads can provide significant profits but also requires careful analysis and selection of the right platform.

- Early Access to Promising Projects

Launchpads allow investors to acquire tokens before they hit exchanges. An example is the Avalaunch project, where participants received tokens of the AVAX project at early stages, which subsequently led to their value increasing several times after going public. - Guaranteed Allocation for Large Investors

Some launchpads, such as Binance Launchpad, offer guaranteed allocations, especially for those who actively participate in staking the platform's tokens (BNB). In the case of the Axie Infinity project, users who invested through Binance saw significant profits after the game became one of the most popular blockchain games. - Risk Reduction through Verified Projects

Platforms like Polkastarter and DAO Maker carefully select projects by checking their team, business model, and technological base. This reduces the likelihood of fraud or project failure. DAO Maker successfully launched the Orion Protocol project, which has shown stable growth since its IDO, providing participants with confidence in their investments. - Community Engagement and Marketing Support

Launchpads not only attract investments but also help projects build a community. An example is Solanium, where the successful launch of the Star Atlas project not only brought profits to participants but also helped create a strong community, leading to long-term token growth. - Access to Innovative Tokenomics Mechanisms

Many launchpads offer unique conditions for participants. For instance, the TrustSwap platform uses a time-lock mechanism for tokens to prevent sharp price drops. Participants in the IDO of the ChainGames project were able to achieve stable profits due to well-structured tokenomics and project support during the post-trading phase. - Ease of Participation and User Convenience

Launchpads like Coinlist ensure simple registration and transparent participation conditions, attracting mass users. Participants in the IEO of the Flow project on Coinlist received a high percentage of profit as the participation process was convenient and accessible even for new investors.

TOP 15 Launchpads for Token Launches

This article provides an overview of 15 popular launchpads, their mechanics, and key facts, considering current trends in the cryptocurrency market.

1. Binance Launchpad

https://launchpad.binance.com/

Operates on the Binance platform. The mechanics are based on participation through purchasing BNB.

Binance Launchpad focuses on supporting promising projects through initial exchange offerings (IEO).

To participate, you need to hold a certain amount of BNB in your account.

Format: token purchases through a lottery system, where purchase tickets are distributed proportionally to the amount of BNB held.

2. CoinList

https://coinlist.co/

Provides users access to early token sales.

The key feature is thorough project verification before listing.

Users must go through the KYC verification process.

Format: participation in token sales at a fixed price.

3. Polkastarter

https://www.polkastarter.com/

Supports cross-chain IEOs, specializing in startups within the Polkadot ecosystem.

Projects undergo strict vetting, reducing risks for investors.

Participants need to hold POLS tokens to access private sales.

Format: fixed pools with varying minimum thresholds for investors.

4. TrustSwap Launchpad

https://trustswap.org/launchpad

The mechanics include token issuance via smart contracts and investor protection through escrow.

The main feature is transaction security and protection against early token sell-offs.

Participants need to hold SWAP tokens to gain access to projects.

Format: open token sales with investment protection.

5. DAO Maker

Focused on launching tokens through a "social mining" system, where users participate in project development.

Supports various capital raising models, including Strong Holder Offering (SHO).

Users must complete KYC and stake DAO tokens to participate.

Format: participation through completing tasks related to the project.

6. DuckStarter

A platform for IDOs, specializing in DeFi segment startups.

Projects undergo selection, minimizing the risk of failure.

To participate, you need to buy DUCK tokens and go through the verification process.

Format: fixed pools with opportunities to participate in private rounds.

7. BSCPad

Launching projects on Binance Smart Chain.

The main mechanics involve a multi-layered system where participants receive allocations based on their level.

To participate, you need to hold BSCPAD tokens.

Format: token distribution through lotteries and guaranteed allocations.

8. Ignition (PAID Network)

https://paidnetwork.com/

Launching IDOs based on the PAID Network ecosystem.

The mechanics are based on distributing allocations among PAID token holders.

To participate, you need to hold tokens and complete KYC.

Format: lottery or guaranteed allocations depending on the number of tokens held.

9. Avalaunch

A platform for launching projects on Avalanche.

The mechanics require participants to hold XAVA tokens to access sales.

Projects undergo thorough selection to minimize risks for investors.

Format: guaranteed allocations or distribution through a lottery.

10. Solstarter

A platform for launching IDOs on Solana.

Projects undergo security checks to eliminate risks for investors.

It is required to hold SOS tokens and pass verification to participate.

Format: token sales through lottery or fixed pools.

11. DAO Pad

Supports project launches through DAOs focused on decentralization.

The main mechanic involves participation through staking DAOPAD tokens for access to IDOs.

Conditions: a minimum amount of tokens is required, and KYC must be completed.

Format: guaranteed allocations based on staking.

12. ZeeDO (ZeroSwap)

A platform for launching IDOs that supports cross-chain compatibility.

The mechanics are based on a gasless transaction structure.

To participate, you need to stake ZEE tokens and complete KYC.

Format: token sales through a lottery system.

13. GameFi

Specializes in launching projects from the GameFi segment.

The mechanics include access through purchasing or staking GAFI tokens.

KYC and a certain amount of GAFI tokens are required to participate.

Format: lottery or guaranteed allocations depending on the staking level.

14. OccamRazer

Focused on the Cardano ecosystem and launching DeFi projects.

Projects undergo thorough vetting.

Participants need to hold OCC tokens for access to sales.

Format: fixed pools with guaranteed allocations.

15. Seedify

https://launchpad.seedify.fund/

The mechanics are based on an ecosystem to support gaming startups.

Projects go through a DAO system, allowing investors to participate in decision-making.

It is required to hold SFUND tokens and pass verification.

Format: lottery or guaranteed allocations depending on the level of participation.

How to choose the best launchpad platform

Errors in choosing a platform can lead to low demand for the token, weak community support, and consequently, project failure. Here we will discuss the main criteria that should be considered when selecting a platform for launching IEO (Initial Exchange Offering), IDO (Initial DEX Offering), or other types of token sales.

Liquidity and audience scale

One of the first factors is the availability of liquidity and an active user base on the platform. Platforms like Binance Launchpad or Bybit provide access to a vast number of potential investors, significantly increasing the chances of a successful launch. For example, Binance Launchpad allowed projects like Axie Infinity to raise millions of dollars in just minutes, thanks to millions of users on the platform.

Reputation and project verification

Launchpads with strict verification mechanisms usually have a higher reputation in the market. For example, Polkastarter is known for its thorough selection processes, which help minimize risks for investors and ensure a high level of trust. It is important to pay attention to platforms that require KYC completion and provide smart contract audits before listing.

Emission and vesting conditions

To successfully attract investors, it is necessary to consider the terms of token emission and vesting. Platforms like DAO Maker offer flexible vesting models that allow projects to gradually release tokens, reducing price pressure at the listing stage. For example, the project Orion Protocol, launched through DAO Maker, used a long-term vesting strategy that helped stabilize the token price after launch.

Allocation opportunities and protection mechanisms

Most launchpads use lottery or holding mechanisms to obtain allocations. For example, TrustSwap allows investors to stake SWAP tokens to gain the opportunity to participate in token sales. The more tokens held, the higher the chances of receiving an allocation. This creates additional motivation for long-term holding of the platform's tokens and keeps liquidity at a high level.

Listing conditions and post-token sale support

Some platforms, such as KuCoin Spotlight, not only provide access to the audience during the IEO stage but also support the listing of tokens on their exchange immediately after the token sale concludes. This creates an instant market for tokens and helps maintain investor interest. Without such a listing, tokens may quickly lose liquidity and demand, negatively impacting their price.

Risk minimization

To minimize risks, it is important to choose platforms that implement protective mechanisms for investors. For example, Balancer and Uniswap offer Initial Liquidity Offering (ILO) models, where the majority of funds are directed into a liquidity pool. This provides an instant market for tokens and reduces volatility in the first hours after listing.

Conclusion

Launchpads continue to evolve and occupy an important place in the cryptocurrency ecosystem, providing new opportunities for both startups and investors. Choosing the right launchpad depends on the specific needs of the project and the available resources for participation.

A successful token launch depends on several factors, such as liquidity, platform reputation, vesting conditions, and support at the listing stage. Platforms like Binance Launchpad and DAO Maker provide access to a large number of investors and offer well-thought-out protection mechanisms.