Choosing a Wallet for Cryptocurrency: Review of the TOP-15 Best Crypto Wallets

A cryptocurrency wallet is software that stores private and public keys in an encrypted format for access to the cryptocurrency virtual balance.

When working with cryptocurrencies, users utilize a range of tools, one of the most important being a crypto wallet. Previously, we dedicated a separate article to the topic of profitable trading in the crypto market.

Depending on the goals of using digital assets, the technical features of storage can vary significantly. Our review discusses how to properly choose a cryptocurrency wallet in Russian.

TOP 15 Cryptocurrency Wallets

🥦 In this section, we described cryptocurrency wallets for all platforms and devices. If you are interested in wallets for smartphones, you can find the best ones here - Cryptocurrency Wallets for Smartphones

Ledger Nano S

Type: hardware, multi-currency (over 30 cryptocurrencies).

One of the most budget-friendly yet reliable and well-established hardware wallets. It was introduced to the public in 2016. The Ledger Nano S does not support the Russian language; however, it can be used even with minimal knowledge of English (besides, there are many adapted instructions available online). As of the time of writing this review (June 12, 2019), the wallet costs 5,499 RUB (data from the official website).

Exodus

Type: desktop (thin), multi-currency (over 96 cryptocurrencies). There is a mobile version for Android and iOS.

Distinctive features of Exodus: Easy installation, intuitive interface, wide functionality. Access keys are stored on the user's computer. No Russian language support. Available for free download on the official website.

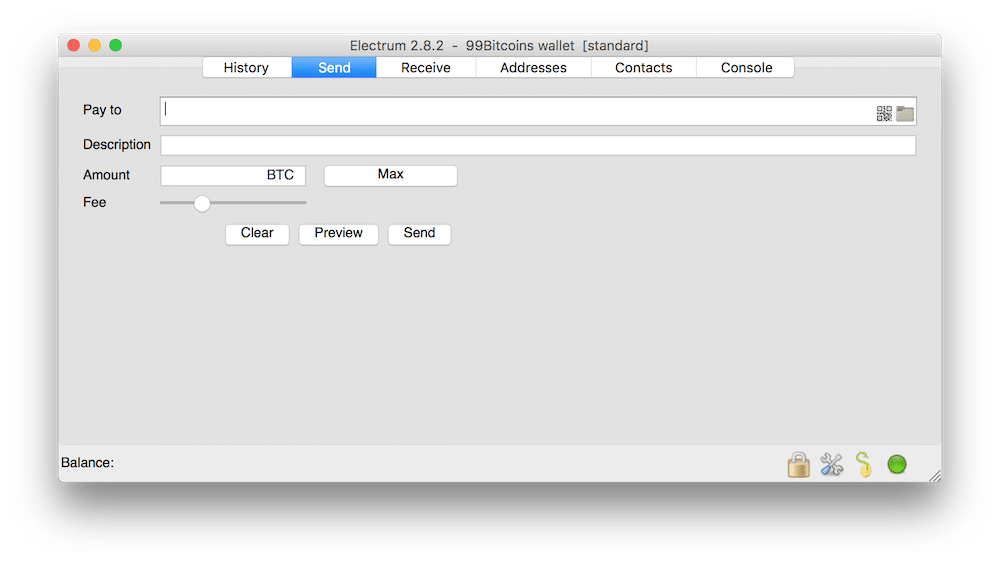

Electrum

Type: desktop (thin).

There are Bitcoin, Vertcoin, and Dash wallets.

One of the oldest wallets with open source. Its development has been ongoing since 2011. It can be integrated with most popular hardware wallets. The wallet can also be used via its portable version (through a flash drive).

Bitcoin Core

Type: desktop (thick), cold Bitcoin wallet.

The wallet was developed in 2009. Since then, it has undergone numerous improvements. Notably, it was one of the first to support SegWit technology. It is one of the most popular wallets for long-term cold storage of Bitcoin.

MyEtherWallet

Type: hot browser wallet for working with ETH and ERC-20 standard tokens.

The first version of the wallet was presented in 2015. Currently, it is available in more than 20 languages. Despite several incidents related to hacking, the wallet remains popular due to its simplicity and high level of functionality.

Jaxx

Type: mobile, desktop, browser, multi-currency (over 80 cryptocurrencies).

The wallet's development began in 2014. It features extended functionality and the ability to organize cross-platform work. Integration with the Shapeshift platform allows for quick cryptocurrency exchanges.

Mycelium

Type: mobile (Android and iOS), multi-currency.

Ease of use combines with a wide range of functionalities. The wallet supports transactions with 164 fiat currencies (the balance can be displayed in rubles). It offers convenient interaction with social networks.

KryptoKit

Type: browser-based (for working with Bitcoin).

The wallet features an intuitive interface and extremely simple installation. It offers users the option to utilize an integrated system of internal (encrypted) messages.

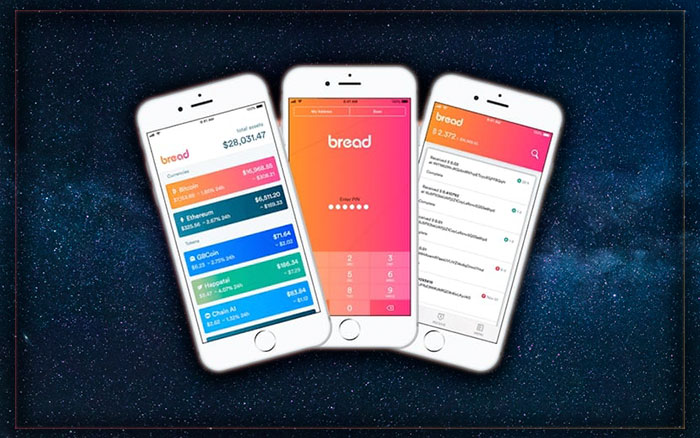

Bread

Type: mobile (Android and iOS), multi-currency (works with the most liquid cryptocurrencies).

It is one of the simplest wallets for working with cryptocurrency. The decentralized application connects directly to the blockchain using generated keys. The wallet does not have traditional passwords to remember, nor does it have servers that can be hacked.

Armory

Type: cold desktop (thick) wallet for working with Bitcoin.

Despite its large size and lack of extensive functionality, the wallet is popular due to its high level of security for storing cryptocurrencies. It is only available in English.

Trezor one.

Type: hardware, multi-currency (over 600 cryptocurrencies).

A simple wallet for cryptocurrencies that achieves maximum security for storing cryptocurrencies. It was first introduced in 2014. At the time of writing this review, the model costs 69 EUR (according to the official website).

Carbon

Type: mobile, multi-currency.

The cryptocurrency wallet was first introduced in 2016. Since then, it has undergone significant improvements that ultimately opened up a wide range of functionalities and ease of interaction with several popular cryptocurrencies.

Samourai

Type: mobile wallet for Bitcoins.

In the West, it is considered one of the most popular wallets for Android devices. It has been around since 2015, and the team continues to update and periodically improve their product. The source code is open.

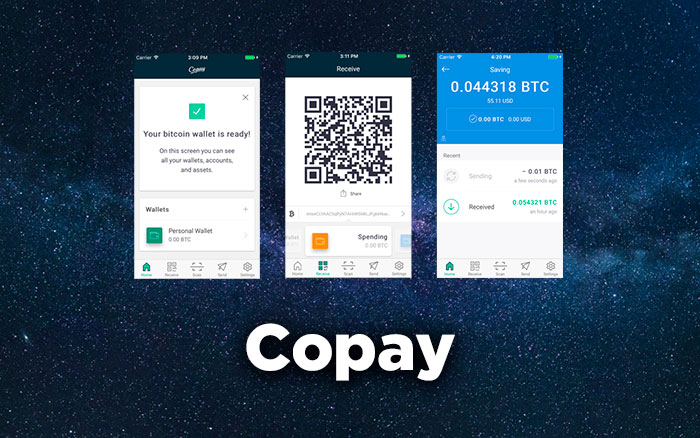

Copay

Type: mobile, browser-based (supports working with Bitcoins).

Copay is considered a cryptocurrency wallet in Russian. It combines simplicity with a high level of functionality and accessibility of various technical solutions that enhance its security.

How to Top Up a Cryptocurrency Wallet?

Among the ways to top up crypto wallets, attention should be paid to the possibility of depositing fiat and the necessary procedures that open access to such operations (for example, whether KYC procedures need to be completed).

KYC (Know Your Client) – the principle of "Know Your Customer." A concept that originated from the banking sector and stock trading, in the world of finance. It means that any company dealing with the funds of individuals must identify the counterparty and establish their identity before conducting a financial transaction.

If the cryptocurrency wallet you chose can only be topped up with cryptocurrency, prior conversion of fiat may be required. For this, you need to register another wallet that allows you to perform the corresponding operation, followed by transferring digital coins to the original address. An alternative could be working with exchangers, where you can exchange fiat for cryptocurrency by providing your account number.

An example of working through an exchanger: user A wants to sell 1 Bitcoin. User B decided to buy 1 BTC for rubles. Both individuals leave their requests on the platform, allowing them to find each other. By specifying the transfer details, the parties complete the transaction.

The Process of Creating Transactions

In most cryptocurrency wallets, regardless of their type, operations involving the transfer of funds to another account occur through the formation of a corresponding request indicating the recipient's address. Accordingly, before creating a transaction, it is necessary to know the wallet number of the person to whom the cryptocurrency is to be transferred.

Types of Cryptocurrency Wallets

The variety of wallets for working with cryptocurrencies allows users to utilize the necessary functionality while avoiding technical difficulties. It is likely that in the future, the crypto community will be offered a universal solution, but for now, we suggest you explore the available options.

Browser-Based Crypto Wallets

They are convenient because there is no need to download anything to your phone or PC. The storage of crypto is handled by an extension installed in browsers like Google Chrome or Opera. To access cryptocurrencies, a secret phrase is needed. Losing it means losing access to the wallet.

Examples of wallets: Metamask, Phantom

Pros:

- Does not take up space on the computer or smartphone

- Quick access from the browser

- Quick access via secret phrase

- Access in the browser on another PC using the secret phrase

Cons:

- The secret phrase cannot be changed

- No support for most browsers, such as Safari

- Cannot be opened on a smartphone if the extension does not have an app for iOS or Android

Hardware Wallets

This type of wallet was created to provide maximum protection for cryptocurrencies. They are devices similar to flash drives that can store digital assets.

Features:

- Ability to store cryptocurrency offline. Lack of internet connection prevents attempts at remote data extraction.

- Presence of technical barriers to ensure a high level of security. Depending on the models, hardware wallets may offer a range of options: from setting a password to systems that counteract intruders. The latter may include the ability to force the display of fake account balance information when entering a previously programmed code.

Hardware wallets differ in appearance and functionality; some models even come with a display. Working with cryptocurrency can be done by connecting the device to a computer (by entering passwords). In case of loss or damage to the hardware wallet, the information stored on it can be restored (by entering pre-programmed access codes).

The ability to set up multi-layered security systems eliminates the risk of theft of cryptocurrency if an intruder gains access to the device.

Pros:

- High level of security

- Convenience of storing cryptocurrencies

- Ability to restore access in case of loss of the device.

Cons:

- High cost

- Insufficient level of mobility (due to the need to install software for interaction on the computer to which it is connected)

- Complex setup.

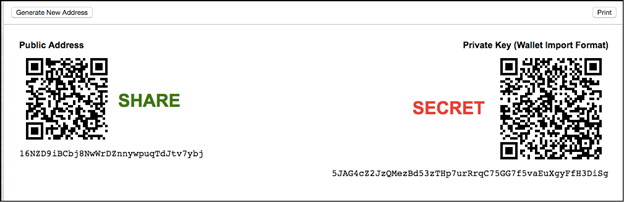

Paper Cryptocurrency Wallet

The essence of this type of wallet can be understood by its name – access to cryptocurrency is "sealed" by creating a QR code. Its storage occurs on a paper medium. Essentially, this type of wallet represents a printout of the private key. Gaining access to it opens the way for interaction with the cryptocurrencies associated with the linked account.

The generation of keys, which will later be stored on paper in printed form, is carried out using specific software. To obtain the code, it is essential to ensure safety: at a minimum, do not conduct the operation over public Wi-Fi and check the antivirus functionality.

Important! For greater security, after downloading specific software, most resources recommend disconnecting from the network to initiate the code generation process. This step helps reduce the threat of information interception by hackers.

Subsequently, the printed code can be stored on a single sheet of paper or on separate fragments in different locations. Experienced crypto users advise laminating the paper to protect it from physical damage.

Pros: availability, high level of security, simplicity of creation, ability to issue multiple wallets without damaging the budget.

Cons: the possibility of losing access due to paper damage, inability to recover assets in case of loss of the code.

Cryptocurrency Wallets for Computers. PC Versions

Interaction with assets like Bitcoin, Ripple, and other tokens can be realized using special cryptocurrency wallets for computers. This type of storage can be conditionally divided into two categories:

- thick (implying the need to download the blockchain to the computer);

- thin (operation is conducted without downloading the blockchain).

This version implies downloading software for subsequent interaction with cryptocurrencies: for making payments (via internet connection) and storage (offline). A feature of desktop wallets is the ability to organize parallel storage of assets using computer resources.

Pros: ability to organize a combined type of use (as both cold and hot storage).

Cons: low level of mobility (to gain access from a new device, software must be downloaded and installed), often high weight of wallet software, maximum security can only be achieved if cryptocurrencies are stored without internet connection.

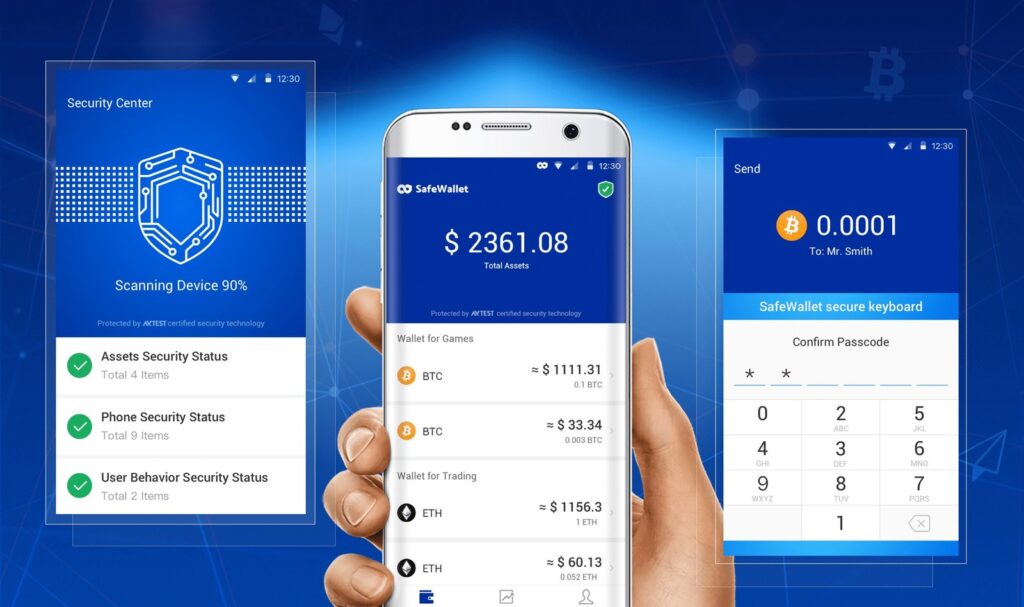

Cryptocurrency Wallet for Android and iOS

Cryptocurrencies claim to take on the role of fiat in the future. At the same time, it is difficult to imagine the life of a modern user without Android and iOS devices for communication, which many use to carry out various money operations (payments, transfers, etc.). As a result, the direction of developing mobile wallets for cryptocurrencies has become one of the most popular, as constant access to a computer (due to its large size) becomes an unaffordable luxury.

The essence of a mobile cryptocurrency wallet lies in providing all the necessary functionality for storing and practically applying assets for iPhone and Android users. However, due to the differences in technical capabilities between computers and phones, this direction currently cannot boast a sufficient level of security. The high functionality compensates for this shortcoming.

Pros: variety of application choices, high functionality, ability to always control savings and perform operations anywhere convenient (within internet access).

Cons: insufficiently high level of security, which is why most users prefer to use mobile wallets solely for organizing everyday expenses. Full storage of savings can be organized using other, more reliable methods (for example, using a hardware wallet).

Hot and Cold Cryptocurrency Wallets

In the crypto community, it is customary to divide wallets for working with assets into "hot" and "cold." The former, characterized by "increased temperature," are designed for quick access to funds. These include storage "built" for interacting with cryptocurrencies in everyday life (for example, mobile wallets).

Pros of hot wallets: operational access to cryptocurrencies.

Cons of hot wallets: insufficiently high level of security (partly due to the fact that passwords are stored directly in the program).

"Cold" versions are created to form maximum security for asset storage (example – hardware wallets). Working with them as a basis for creating transactions in everyday life is extremely inconvenient due to the need to overcome several barriers to access funds.

Pros of cold wallets: ability to organize a high level of protection for cryptocurrencies since access keys are kept offline.

Cons of cold wallets: difficulty in practical application for ensuring everyday expenses.

Multi-Currency Wallets for Cryptocurrencies

Multi-currency wallets are those that allow users to work with a wide range of cryptocurrencies. Usually, this status is assigned if access to at least four assets is available. In today's market, most projects fall into this category. Multi-currency wallets can be any type: both hardware and mobile wallets.

Pros: ability to interact with a large number of cryptocurrencies simultaneously, access to increased earnings on digital assets (by expanding the working coins).

Cons: none.

Internal Wallets of Cryptocurrency Exchanges

Wallets registered through opening an account on cryptocurrency exchanges can also be used for storing cryptocurrencies. Most popular trading platforms, including Binance or Bitmex, are centralized, which negatively affects the level of security. However, recently many exchanges have taken steps to address this issue.

One example of a solution for users who entrusted their funds to a centralized platform was demonstrated by Binance specialists (our review of the platform). After the hack of the exchange's hot wallet in May 2019, its team decided to compensate for losses using funds from a user security asset fund they had previously established SAFU.

The fund has been filled since June 14, 2018. 10% of the exchange's fees were directed to SAFU.

As a result, the incident with the hack of the platform, followed by prompt compensation for damages, demonstrated Binance's viability despite its centralized nature.

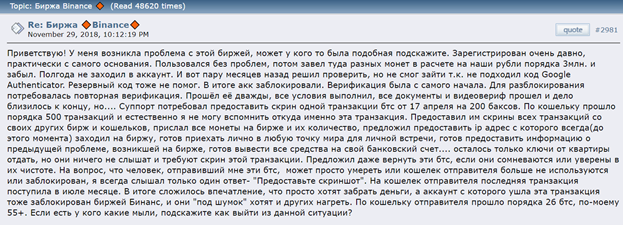

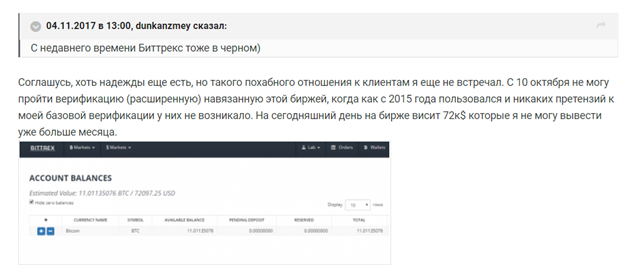

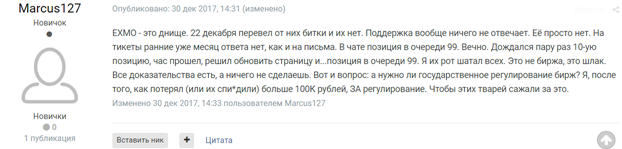

When choosing to store cryptocurrency on exchanges, it is crucial to familiarize yourself with the platform's internal rules and user reviews on independent forums beforehand. There are often reports of account blocks, leading to difficulties in attempting to recover access to funds.

For example, discussions about the previously mentioned Binance exchange in a positive light (No. 1 in the Coinmarketcap resource ranking based on adjusted trading volume data as of June 12, 2019):

Another example is a complaint about another well-known platform – Bittrex (No. 72 in the Coinmarketcap resource ranking based on adjusted volume data as of June 12, 2019):

There are also negative reviews about Russian-language platforms online. One of the most popular exchanges in this segment is EXMO (No. 57 in the Coinmarketcap resource ranking based on adjusted volume data as of June 12, 2019):

We have already mentioned the exchange in our honest review of the Exmo cryptocurrency exchange.

To be fair, it should be noted that it is unlikely that there is at least one popular exchange without any negative mentions online.

Trusting your funds to decentralized platforms allows for a higher level of security. However, this segment of exchanges currently does not provide an equivalent range of opportunities compared to centralized platforms. As a result, choosing security may negatively impact functionality.

How to Choose the Best Crypto Wallet?

Based on the ratings, we can compare the results obtained to choose the best cryptocurrency wallet and identify the drawbacks of other devices:

- Cryptocurrency wallet in Russian – Copay

- The most reliable and secure cryptocurrency wallet (according to reviews) - Bitcoin Core.

- The most popular cryptocurrency wallet – Metamask.

- The best cryptocurrency wallet for ICO – MyEtherWallet.

- Choice for users with a large number of cryptocurrencies – Trezor one, Jaxx.

- The most reliable cryptocurrency wallet - Ledger Nano S.

- Leader in reputation rating - Trezor one.

- The best choice for online work – Bread.

- For work on mobile phones – Jaxx.

- Choice for work on computers – Armory.

- The most cost-effective cryptocurrency wallet - Bitcoin Core.

- The best cryptocurrency wallet for smartphones - Samourai

The final choice of a wallet for working with cryptocurrencies should depend on the individual needs and preferences of each specific user.

How Cryptocurrency Wallets Work

Newcomers to the crypto sphere mistakenly believe that since cryptocurrency exchanges in the TOP 10 such as Binance have storage that can be used as a place to store cryptocurrencies, they can be fully relied upon. However, exchanges are hacked much more frequently than crypto wallets.

Cryptocurrencies, unlike fiat, do not have a physical equivalent; a wallet is also necessary for working with them. Just like with paper money, digital assets require a reliable storage solution that allows for necessary manipulations.

The difference in interaction with cryptocurrencies has led to the emergence of various types of cryptocurrency wallets in the market: some were created for convenient everyday use (including for paying for goods and services), while others were designed to provide maximum protection against theft (for those wishing to put away assets for the long term).

Users who prefer to use digital assets for trading also received an effective solution in the form of storage on exchanges. At the same time, cryptocurrency owners can combine different types of wallets in their work.

Risks of Working with Cryptocurrency Wallets

Since cryptocurrencies are digital assets, their wallets, in "bare" form, represent code. You don't need to be a programmer to understand that the basic level of security is laid down when writing the technical component of the future storage. However, even if the code initially seems reliable, crypto users may encounter dangers, including:

- phishing;

- theft of access keys;

- technical problems related to software components;

- loss of access keys

- loss of the storage medium

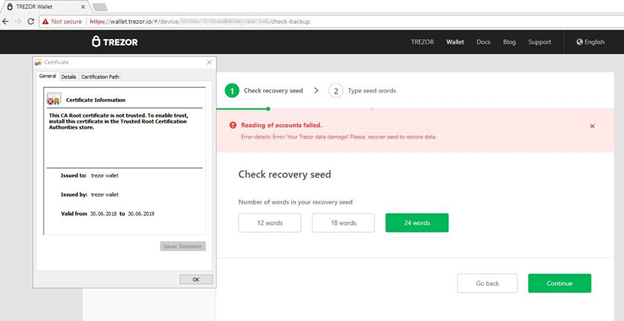

The above is an example of a phishing site for the Trezor cryptocurrency wallet, reported by the project team in the summer of 2018.

Moreover, there is currently a real war going on in cyberspace: programmers are trying to close all gaps in security systems, while hackers are looking for new vulnerabilities that can bring them profit.

Conclusion

Thus, there are currently enough options for cryptocurrency wallets that allow for effective interaction with cryptocurrencies, regardless of the complexity of the tasks at hand. The main thing is to determine the objectives that the chosen "crypto wallet" should accomplish.