Exploring NFTs: A Complete Guide to the Technology

Non-fungible tokens, or NFTs (Non-Fungible Token), are digital items that possess uniqueness; their management is carried out through the Blockchain network. For example, such items can include collectibles, in-game items, digital art, exhibition tickets, domains, and a list of physical world assets.

All NFT tokens are bought and sold on marketplaces. The most popular among them is the OpenSea platform. The purchasing algorithm is simple. You register a Metamask wallet, authorize yourself on OpenSea using it, fund your wallet with Ethereum cryptocurrency, and make purchases on the platform while connected through Metamask.

NFT provides the internet community with virtual collecting. Without blockchain, it is impossible to be a verified owner of any digital asset. For instance, when sending an image via a messenger, its copy multiplies: one remains on the sender's host, another in the messenger's database, and a third with the recipient. Blockchain technologies allow for reserving information about a specific author. Thus, an artist or other rights holder can be identified, which adds value to the asset they sell.

This article contains a detailed overview of NFTs: the technical part ERC721, the history of creation, myths about Non-Fungible Tokens, and their current state. This information will be useful for both beginners in this field and experts.

What does "non-fungible token" mean?

Many discussions about NFTs are based on the idea of fungibility. It is defined as "the ability to be replaced by another identical element." However, such framing strays too far from the essence. For simplified understanding, you can imagine an item that you own.

Fiat currency is a standard illustration of a fungible item. Ten US dollars are ten US dollars, regardless of the serial number of the banknote or whether that money is held in your bank account. The ability to approximate a dollar bill with another identical one makes this currency fungible.

Fungibility is quite relative; it applies only when comparing a series of items. For example, consider business class, economy class, and first-class tickets. Each ticket within its class is interchangeable, but exchanging a first-class ticket for a business class ticket without an additional payment is impossible. Similarly, a table you dine at roughly corresponds to another table of the same model, only if you haven’t assigned your table a unique number.

Fungibility can be subjective. Let's return to the ticket example: an airline customer fundamentally prefers a window seat, so in their view, those two tickets may be non-fungible. For a layperson, a rare penny might be worth 1 cent, while for a collector, that coin has entirely different value. These nuances become priorities when incorporating these elements into blockchains.

The NFT Market

Current Market Size

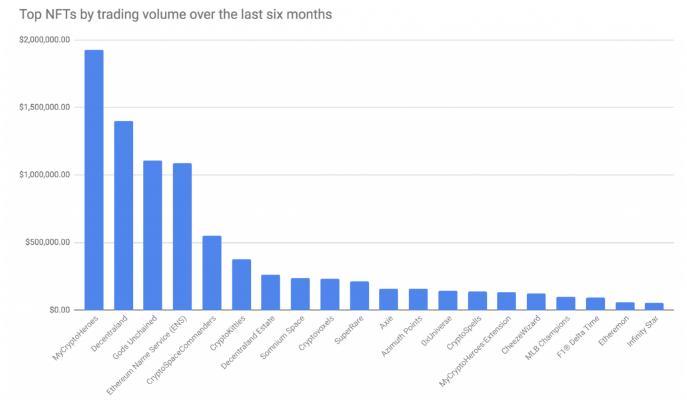

The NFT token market is still relatively small, and measuring it is more challenging than the crypto market due to the lack of spot prices for assets. This analysis focuses on secondary trading volume, i.e., on Peer-to-Peer sales of tokens used as a market indicator.

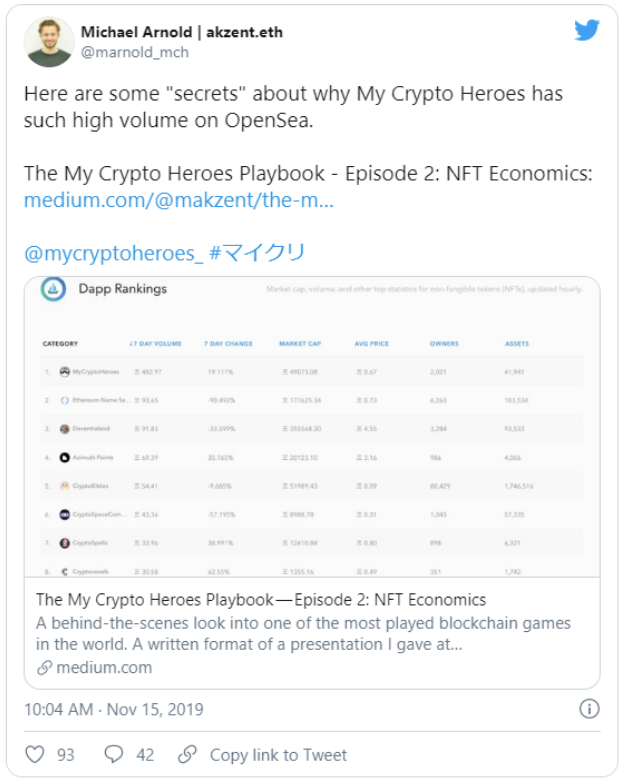

The metric estimates the secondary market volume at $2-3 million per month, with several specific projects becoming prominent over the past six months.

Growth of the NFT Market

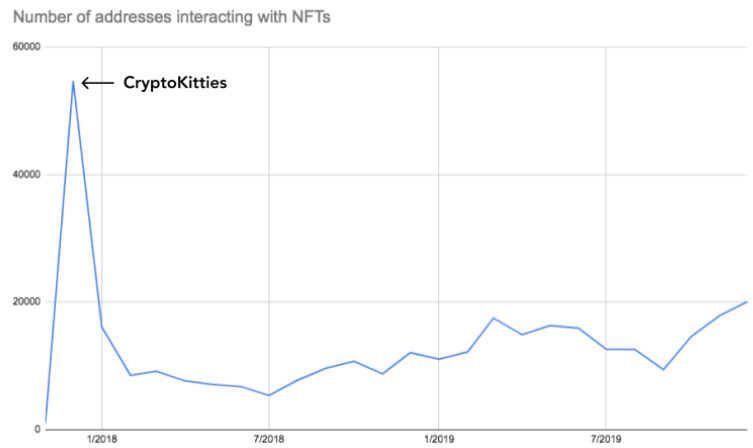

After the Crypto Kitties bubble in early 2019, the number of unique addresses interacting with the NFT system grew—from ~8500 accounts in February 2018 to >20,000 accounts in December 2019.

The market is driven by a core group of experienced users. On OpenSea, the average amount per seller is $72.06, while an individual seller can liquidate assets worth ~$1152, indicating a large number of active sellers.

It should be noted that large official accounts significantly inflate the average value. On OpenSea, each buyer averages purchases of $42.75, while an individual buyer can spend ~$944.86.

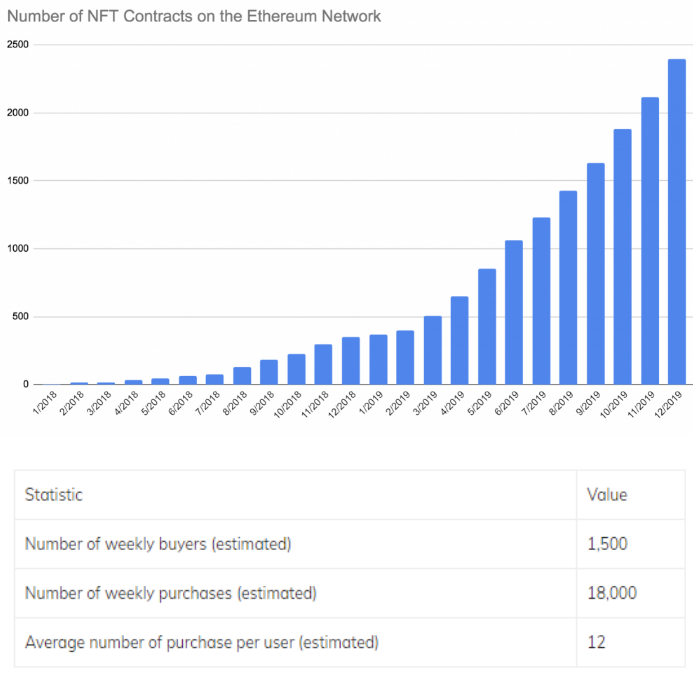

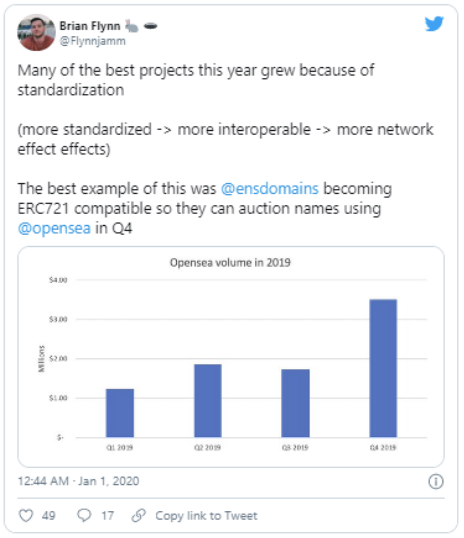

Given the growth rate of the NFT market, a good way to measure its expansion is to study developer interest. Over 2019, the number of ERC721 smart contracts created in the network increased exponentially—by June 2019, the number of new developers in the market reached several thousand.

Where to Buy NFT Tokens

NFTs are primarily traded for Ethereum cryptocurrency on specialized marketplaces. The most popular platforms for purchasing NFT tokens are OpenSea and Rarible. For less expensive assets, mechanisms like Dutch auctions and fixed-price sales are often used, while for more expensive assets, such as highly valued Gods Unchained cards or legendary gaming items, the English auction mechanism (like eBay) is employed. Bundles are also a very popular method of sale, and their sales percentage has steadily increased to 20% since December 2019.

How to Create an NFT and Sell it at Auction

One of the most high-profile deals using NFTs was the sale of Jack Dorsey's first tweet on Twitter. The sale was conducted on the online auction platform OpenSea. Let's look at how to sell NFT tokens on the resource. Since user verification occurs on the Ethereum blockchain, future NFT sellers need to authenticate themselves on the network.

This is done using the Metamask cryptocurrency wallet. The easiest way to install it is to add the extension to your browser. I use Metamask for Chrome.

Next, after completing the simple wallet registration, we go to OpenSea and register with the already installed wallet.

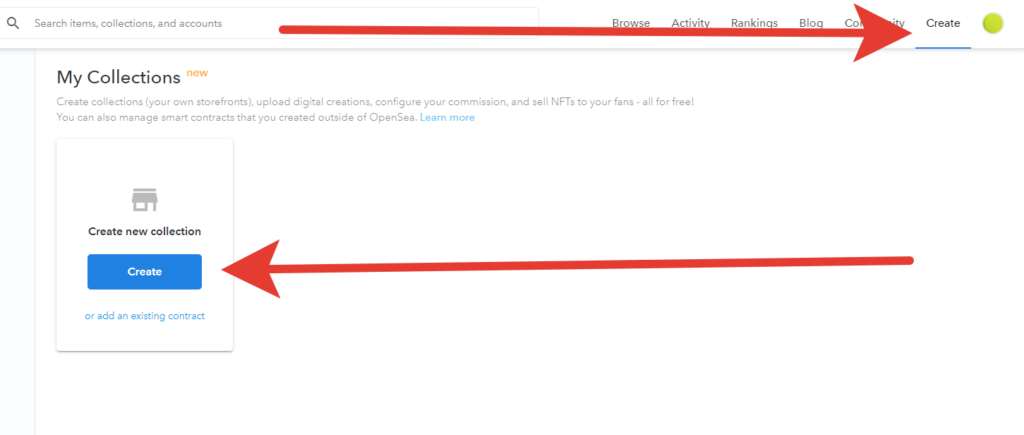

After registering with the wallet, we go to the Create section and try to create our first NFT collection by clicking the blue Create button. Collections on OpenSea are like categories. Within each collection, NFT tokens are sold separately.

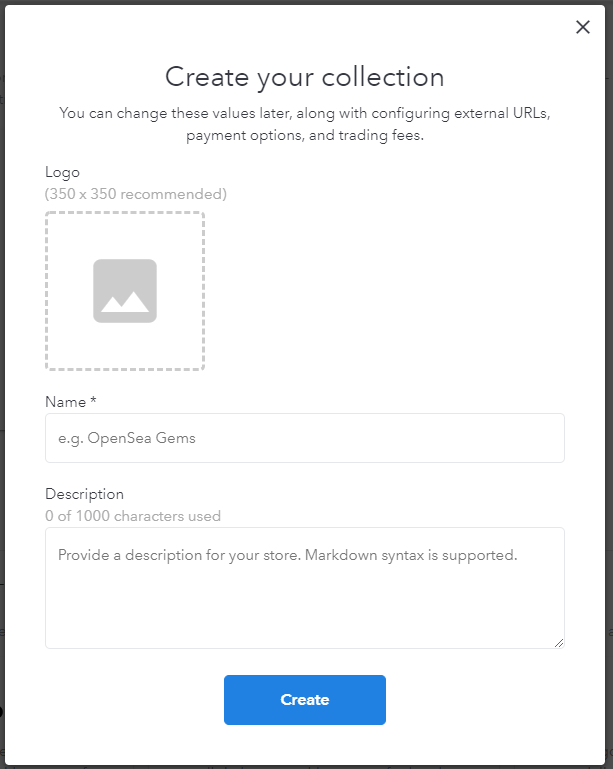

To create a collection, you will need to add a logo, write a name and description. It is recommended to use square images as logos.

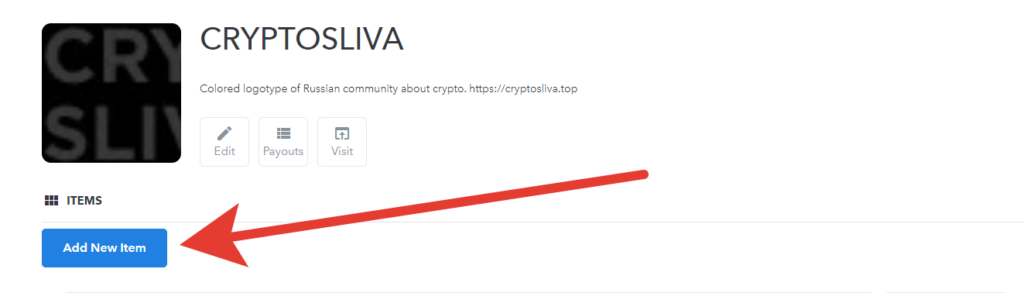

After creating the collection, we can proceed to listing our NFTs for sale. Within the collection, they are called items.

Please note. For every action on the platform, you need to verify with your Metamask wallet. OpenSea will ask you to click the "Sign" button in the crypto wallet extension.

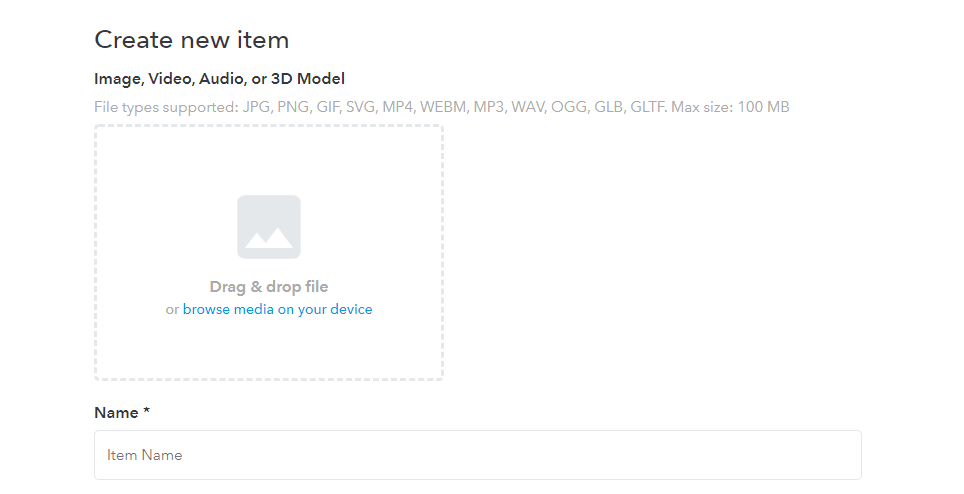

At this stage, only the NFT item is being created; its auction listing with a minimum price for the lot will occur in the next step. To create an item, you need to specify:

- Logo

- Name - Name (Required)

- External Link - Link with a description of the NFT object

- Description - Description

- Properties - Properties (Will be displayed on the NFT page framed with information blocks)

- Levels - Levels of development. Progress bar for informativeness

- Stats - Statistics. Also an informative block

- Unlockable Content - Unlockable content. Content visible to the creator after purchasing the NFT

- Supply - Number of copies for sale

After filling in all the necessary fields, your Item page will open. To list it for sale, you need to click the Sell button.

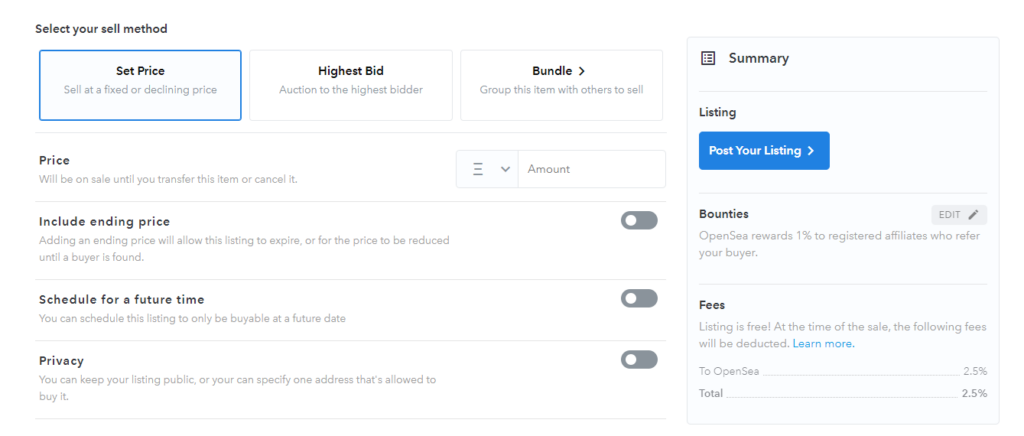

On the next page, editing data for sale becomes available. Let's go through it step by step.

Select the method of sale

Set Price - Fixed price sale

- Price - Enter price. Set in Ethereum (ETH)

- Include ending price - Change price by the end of the sale

- Schedule for a future time - Set the time for the sale to take effect

- Privacy - Restrict sale to a specific ETH address

Highest - Classic auction with sale at maximum bid

- Minimum Bid - Minimum bid (Starting price)

- Reserve price - Price limit for sale. The auction will not take place if this value is not reached.

- Expiration Date - Closing date of the auction.

Bundle - Selling an item in a group with others

In the right block, we see how much OpenSea's services cost. The service fee is 2.5% of the sale price. But you also need to consider the GAS costs that will have to be paid.

To start the sale, simply click the Post Your Listing button.

Non-fungible Assets on Blockchain

Before crypto, there were digital currencies, and non-fungible virtual assets have existed since the launch of the Internet. Domains, in-game items, even social media page addresses like Instagram or Facebook are considered non-fungible assets; their difference lies in functionality and high liquidity. Some of these items have unique value: Epic Games generated $2.5 billion in profit through paid skin transfers in the free-to-play shooter Fortnite in 2018, and the capitalization of the event ticket market could soon touch the mark of $69 billion, as the domain market continues to grow steadily.

Society possesses a vast number of such digital resources.

To what extent do these digital items belong to society? In cases where electronic ownership implies solely an item owned by one person, such ownership can be considered full-fledged. However, when electronic ownership resembles ownership in the world of physical things (freedom of property and transfer), the situation may be entirely different. Rather, it seems more like ownership with restrictive conditions.

This is where we can turn to the help of the blockchain network. The level of coordination of digital assets is ensured through blockchain, allowing for the provision of ownership rights and transfer to other users. How this works: blockchain uniquely identifies a non-fungible asset by adding special properties that influence the relationships between asset creators and their users.

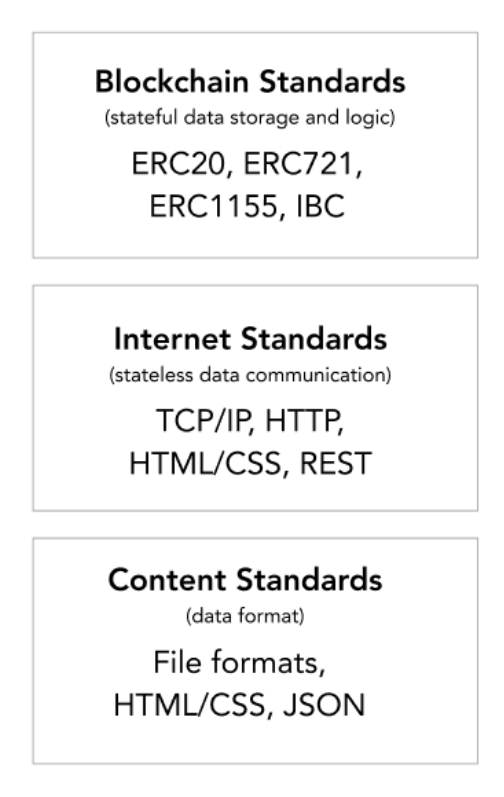

Standardization

The traditional financial system lacks a uniform representation in the virtual realm. Gaming presents in-game collectible items differently. By presenting NFTs in public blockchains, creators implement collective, reusable samples with inheritance capabilities that pertain to non-fungible tokens: ownership, transfer, and access control management. Additional samples (for example, specifications for displaying such tokens) overlay expanded display in applications.

They are analogous to similar elements of the virtual world: JPEG or PNG extensions, HTTP, and HTML/CSS. Blockchain overlays a top layer, opening up new possibilities for developers to track status for application creation.

Interoperability

The standards for non-fungible tokens allow them to move easily across various systems. Once an NFT creator launches a project, non-fungible tokens are instantly converted into public ones, opening access for viewing through other wallets, and they begin trading on trading platforms and becoming visible to other resources. This possibility arises from the transparency of standards, their consistency, and the reliability of APIs that allow reading and writing data.

Trading

Free trading on open platforms is enabled through interoperability. Users can manage their items outside their original environment, i.e., on a market where they gain the ability to utilize complex trading options. This includes auctions, for example, like on eBay, trading. Bundling and the right to trade in any monetary equivalent, such as stablecoins and various application currencies.

Thus, game developers have access to trading assets, marking a metamorphosis from a closed economy to an open market one. Game creators no longer need to manage the economy. Instead, there is now the opportunity to let free markets do this heavy lifting!

Liquidity

The right to instant trading of Non-Fungible Tokens leads to increased liquidity. NFT trading platforms provide their services to a wide and diverse audience—from professional traders to crypto newcomers, enabling the sale of assets to a large number of buyers. Similarly, the peak popularity of ICO projects in 2017 expanded the range of unique virtual items, creating a new class of ownership.

Scarcity and Proven Rarity

Smart Contracts enable developers to set limits on the supply of NFTs and ensure such immutable properties of NFTs after their release. Thus, a creator can ensure, through programming, the creation of a certain number of highly rare items, while the quantity for creating regular items is not limited. Developers add such properties that do not change over time, including due to the impossibility of altering coding in the chain. This is especially important for digital art, where proven rarity is a primary priority property of the original work.

Programmability

Non-Fungible Tokens are programmable. CryptoKitties (which will be discussed later) embedded a reproduction mechanism in the Smart Contract, represented as virtual wallets. Most NFTs in 2021 feature complex mechanics such as minting/crafting/redeeming/random generation, etc. The variety is extensive.

Standardization of NFT Tokens

Standards transform NFT tokens into truly revolutionary tools. They guarantee creators adherence of assets to specific logic and allow precise parameters for their operation with core functionality.

ERC721 Standard

The creators of Crypto Kitties first introduced the standard for non-fungible digital assets—ERC721. This is a standard for smart contracts based on Solidity, allowing contract design through simple imports from public OpenZeppelin libraries (here you can find educational material for your first contract).

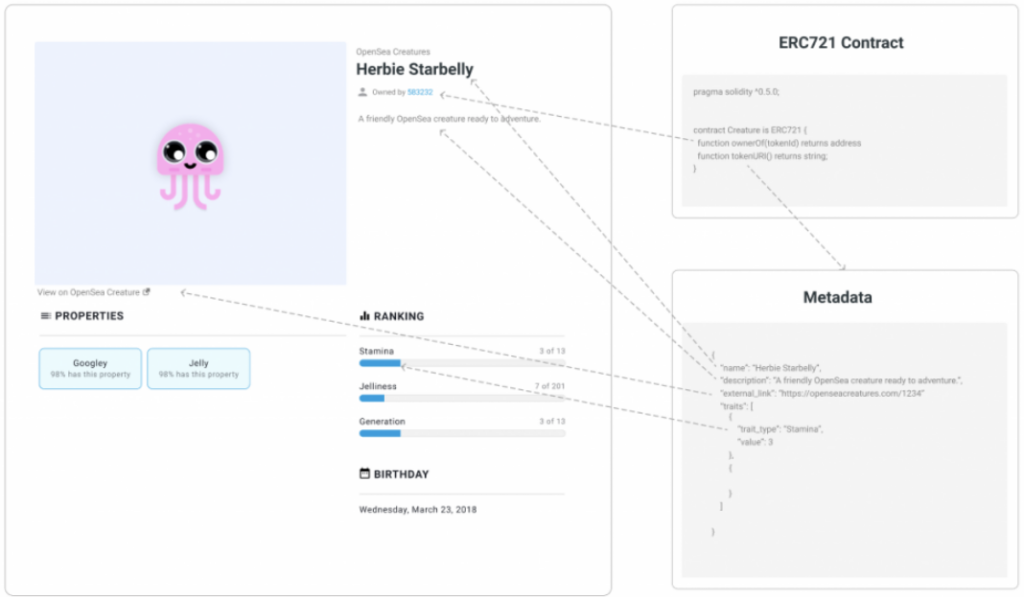

The ERC721 protocol is quite simple: it is responsible for matching unique id keys (each assigned to one asset) with the addresses of the owners of those keys. Additionally, ERC721 can transfer assets via the TransferFrom method.

To work with NFTs, you will need these two functions: ownership verification and asset transfer. The protocol also has additional functions, some of which are critically necessary for NFT marketplaces, but the concept of NFTs is quite simple.

ERC1155

This was implemented by a group of developers from Enjin, who added a semi-fungibility option for assets in the NFT space. In the ERC1155 protocol, keys are not tied to individual assets but to entire classes. For example, a key can be linked to a class "shield," and a wallet can contain 100 units of these shields. The balanceOf method will show how many shields belong to a specific wallet, and a user can send any number of shields using the TransferFrom method.

This combination offers enhanced efficiency: with the ERC721 protocol, if a user wants to send 300 skins for a game character, they must modify the state of each game's smart contract using the TransferFrom function. With the ERC1155 protocol, only one request for the TransferFrom method is needed for all skins at once. However, this efficiency comes with a drawback of losing some information: there is no way to track the movement log for each game skin or item separately from the others.

It is important to note that the ERC1155 standard is an extended version of the ERC721 protocol, meaning that it is possible to create an asset based on ERC721 while working with the functions of the ERC1155 standard. That is, each user will have a unique key indicating "1" for each asset. This advantage contributes to the rapid rise in popularity of the ERC1155 protocol.

The developers of OpenSea created a public repository on GitHub for a simple start with the ERC 1155 protocol.

ERC20 matches addresses and amounts, ERC721 checks only the similarity of unique identifier keys with their owners, while ERC1155 has "included comparison" for both identifiers and amounts.

Composed NFTs

Composed NFTs based on the ERC-998 protocol are a template that combines fungible and non-fungible digital items and assets within itself. Currently, only a few composed NFTs are available, but there is a wide selection of promising options for their use!

...In CryptoKitties, you can attach toys and a food bowl, for example. A toy can be purchased for regular fungible tokens. When selling kittens, all their associated belongings are sold along with them.

Standards Outside the Ethereum Network

Currently, NFTs are often used based on the Ethereum blockchain, but similar standards are beginning to appear on other blockchains. For example, the DGoods development, designed by the team from Mythical Games, aims to design a multifunctional protocol for various blockchains and is currently preparing a solution for EOS. Cosmos developers are also busy designing an NFT standard that will be included in the Cosmos SDK.

Non-fungible Tokens and Metadata

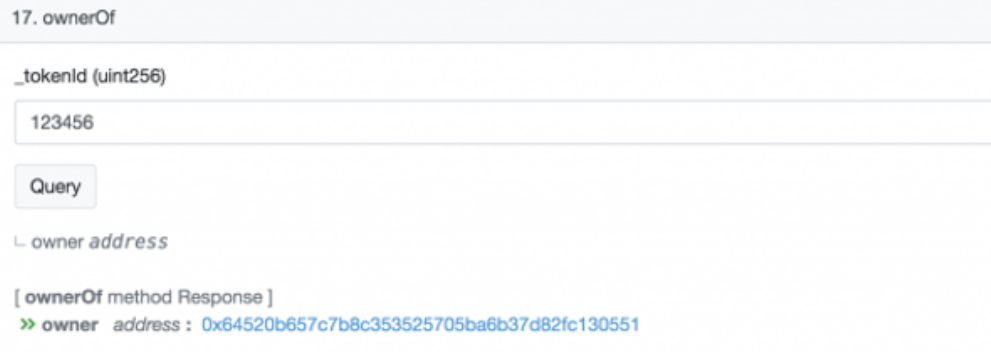

The ownerOf function gives us functionality to determine the owner of an NFT. Using official sites like CryptoKitties.co, OpenSea, we can see the owner's address of a specific cat. The same result can be obtained using the ownerOf query in the CryptoKitties smart contract.

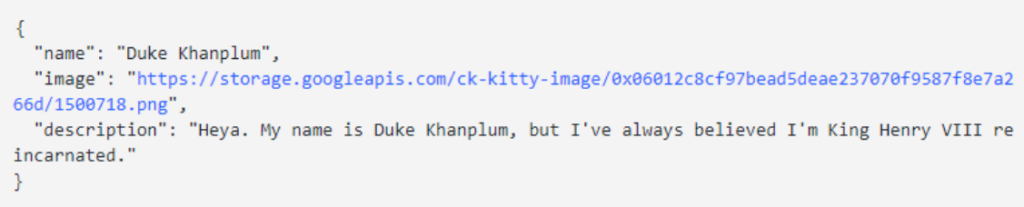

How can we see the appearance of CryptoKitty #1103414? And what about its name and other unique properties?

This is where metadata comes in handy, containing details about the properties of each individual cat. In the case of CryptoKitty, this includes the animal's name, appearance, unique description, and other secondary features known as cattributes.

When creating a ticket for an event or occasion, metadata can consist of date, time, ticket type, additional options, and the owner's name.

Meta characteristics for the previously discussed cat could include:

However, a logical question arises: how and where to store such data with the possibility of retrieval by applications working with NFTs?

On-chain or Off-chain

Initially, creators aimed to place meta characteristics both on-chain and off-chain. The main task was to figure out where such data would be stored: in the smart contract or separately?

On-chain Meta Characteristics

The benefit of storing meta characteristics on the Blockchain network:

- Metadata constantly interacts with the token, allowing them to exist outside the application. Any changes made to them are in accordance with existing blockchain logic;

- This condition is necessary to maintain long-term value, which may subsequently exceed the initial cost. Thus, digital art pieces can be stored indefinitely regardless of additional factors (e.g., preservation and use of the original site). For this reason, metadata should always be stored together with the token.

As mentioned earlier, blockchain logic is necessary for interaction with metadata. For example, CryptoKitty owners can influence the breeding speed of cats. It should be noted that this process gradually slows down. Therefore, the logic associated with the smart contract must have the capability to read metadata.

Off-chain Meta Characteristics

Regardless of such characteristics, many projects prefer storing metadata off-chain due to numerous existing limitations in Ethereum. For instance, the ERC721 protocol additionally includes the tokenURI method, which token creators can use to convey searchable metadata information for a selected item.

This method, tokenURI, returns a public URL back, which also returns a JSON dictionary of data used for CryptoKitty. Such meta characteristics must comply with the exemplary ERC721 protocol.

Solutions for Off-chain Storage

There are several ways to store meta characteristics off-chain.

Centralized Servers

The easiest way to save metadata is through a centralized server-node or cloud service like AWS.

However, this method has its drawbacks:

- The possibility for developers to change metadata;

- Inaccessibility of metadata if hosting goes offline.

Services that cache metadata on their servers act as helpers, ensuring access to information at all times.

IPFS

In 2021, many developers in the digital art field began using a global file system (IPFS) to store metadata off-chain. IPFS is a peer-to-peer file storage system that allows content to be hosted by replicating it across different PCs.

IPFS guarantees:

- Immutability of metadata due to the unique hash address of the file;

- Accessibility of information as long as nodes exist for hosting such data.

The existence of services like Pinata greatly simplifies everything for creators, as infrastructure is managed for scalability and the possibility of managing IPFS nodes, while the Filecoin network can overlay IPFS to incentivize nodes to host files.

The History of Non-Fungible Tokens

Now that we understand what "non-fungible tokens" are, we can trace their history.

The Period Before CryptoKitties Emergence

Attempts to create Non-Fungible Tokens were made long before colored coins appeared within the BTC blockchain. For example, the Pepe the Frog meme emerged—Rare Pepe, which was designed using Counterparty on Bitcoin Blockchain. These tokens are indeed sold on virtual marketplaces and participate in auctions.

The CryptoPunks project is one of the first developments based on the Ethereum blockchain. It consists of ten thousand collectible punks with unique characteristics.

The CryptoPunks project was developed by a small team from Larva Labs. It served as a marketplace trading platform that could be accessed using wallets like MetaMask. This simplifies the initial requirements for working with NFTs.

Considering the exclusivity and popularity of the brand, whose community were pioneers of this technology, the CryptoPunks project is rightly regarded as the most recognized and respected among crypto enthusiasts.

It should also be noted that punks were created within the ETH network, allowing them to be compatible with most trading platforms and wallets. However, they still lag behind newer assets as they predate the ERC721 protocol.

The Birth of CryptoKitties Game

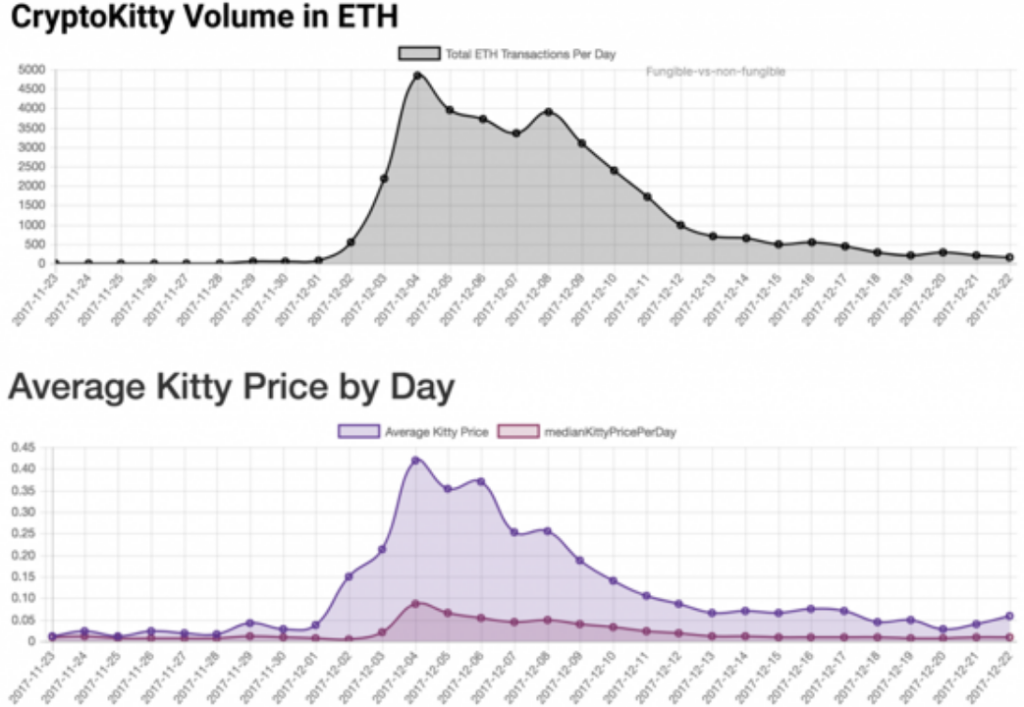

CryptoKitties is a pioneer in the NFT space that popularized this technology. The developers of CryptoKitties showcased a relatively simple online game at the ETH Waterloo hackathon in 2017. In it, users could breed digital cats together to produce offspring in the form of new unique cats with varying qualities: rarity. The first cats were sold in a Dutch auction format, where the price decreased over time, and their offspring could be sold on the secondary market at any price.

Although there were critics who labeled CryptoKitties as "not a game," the developers truly made a breakthrough in gaming mechanics based on blockchain considering the strict limitations of the protocol. For instance, they developed a breeding algorithm embedded in the encrypted code of the smart contract that determined a cat's "DNA," introducing genetic diversity—the parameters of the cat.

Additionally, the CryptoKitties developers thought out a breeding system that introduced an element of randomness into the process. They reserved a portion of cats with the first IDs for use in promoting their project.

The Dutch auction mechanism on the blockchain was also developed by this team. Subsequently, it became a fundamental method for determining the value of NFT assets in the market.

The CryptoKitties team influenced the rapid development of NFT technology at its inception.

The rapid success of CryptoKitties can be attributed to several factors.

Speculation Mechanic

The breeding and selling algorithm in CryptoKitties for profit was quite simple: buy two cats, produce offspring, repeat until obtaining a rarer specimen, resell the cat and repeat again. Or just buy a rare cat and wait for a buyer willing to pay a higher price. Prices rise as long as there is an influx of money from new users.

At its peak popularity—capitalization of assets in CryptoKitties equated to ~5500 ETH, and the owner of Cat #18 managed to sell it for 253 ETH (about $110,000 at the time of sale). Later, this price record was surpassed by the sale of a cat named Dragon for 600 ETH ($140,000 in September 2018). Although there are skeptics who consider this deal fraudulent. Regardless, this did not affect the hype surrounding the project, comparable to a "gold rush."

Virality

The second crucial aspect of the success of CryptoKitties is their story. Digital cats were delightful, accessible, and entertaining, and the very idea of owning a digital cat for $10,000 was so absurd and nonsensical that it immediately became a hot topic for discussions and debates.

CryptoKitties: a spectacular tale of feline hype

Moreover, a historic event occurred when cat owners "broke the Ethereum network." Since the Ethereum blockchain is designed to handle only a limited number of transactions (~15 transactions per second), loading the network's capacity led to an increase in the mempool and rising gas prices required for transactions. The average daily number of unconfirmed transactions in the mempool surged from 1500 transactions to 11,000. New participants in the cat craze spent unimaginable sums on transaction fees and waited hours for confirmations.

It is natural that these factors inflated the "CryptoKitties bubble": as demand grew, prices also rose, leading to even greater demand. But of course, all bubbles must eventually burst. In December, prices for cats began to decline, and volume dropped significantly.

Users understood that retaining a large audience with primitive gameplay wouldn't last long. After all, there were "real games" with well-developed, interesting, and advanced gameplay. Once the hype passed—the market fell, and today, CryptoKitties earns only about 50 ETH per week.

2018: Hype, Hot Potato Game, and Layer Two Solutions

No matter that the situation is a bit different now — at first, CryptoKitties seemed magical to the community. It was the first time that a team managed to create a non-commercial application on Blockchain that became a technical mainstream for several weeks. Then, after CryptoKitties, in late 2017, NFTs were poised for a second wave of popularity, during which investors and entrepreneurs saw new potential in owning such assets.

Additional Add-ons and Level 2 Games

Applications like CryptoKitties DLCs began to emerge quite rapidly; however, the development team of the popular game had no involvement in this anymore. The magic of CryptoKitties lay in the ability to develop add-ons without any extensions: developers provided access to their applications on top of the public smart contract of CryptoKitty.

CryptoKitties can indeed operate outside their own environment. For instance, in the game Kitty Race, cat breeders compete against each other for rewards in ETH, while KittyHats allows users to decorate their pets with hats and other elements.

Later, Wrapped Kitties linked CryptoKitties with DeFi technology, allowing cats to be turned into functional ERC20 tokens that could be used on decentralized exchanges. Of course, this meant the emergence of the most interesting and unexpected opportunities for the cryptocurrency market thanks to CryptoKitties.

Dapper Labs also enhanced capabilities with KittyVerse.

Hot Potato

This era was dubbed "hot potato" because many games similar to "hot potato" were created during this time. In January 2018, the launch of the game CryptoCelebrity was announced, whose mechanics were quite ordinary. First, it was necessary to buy collectible NFTs of celebrities. Then the celebrity immediately becomes available for purchase at an increased price. You earn on the margin, meaning when someone buys your celebrity, you receive income from the difference in acquisition (minus fees).

Thus, when a buyer appears for your celebrity — the profit goes to you. However, if no one wants to buy your celebrity, you will be at a loss.

CryptoCelebrity became incredibly hyped due to this speculative mechanic, and some celebrities, like Donald Trump, sold for incredibly inflated prices — $123 ETH or $137,000 at that rate. And even though the game CryptoCelebrity hit the NFT sphere hard, experiments with pricing and auctions are an integral part of the history of this industry.

Venture Capital Participation

Venture capital and cryptocurrency funds began to penetrate the NFT sector as early as late 2017. CryptoKitties raised $13 million from top investors by the end of the year and $14 million in November of the following year.

The Rare Bits project, founded by the co-founders of Farmville, and Lucid Sight additionally raised $7 million in early the next year. Then the Forte project secured $101 million through Ripple's gaming fund. Immutable, a company related to Gods Unchained, managed to raise $14 million from Naspers Ventures and Galaxy Digital, while Mythical Games, along with Javelin Venture Partners, raised around $18 million for the flagship EOS game Blankos Block Party.

The OpenSea project also gathered initial and strategic investments to promote its vision of creating a public open market.

2018-2019: Further Development

The hype of late 2017 and early 2018 gave way to the development of real NFT projects. Thus, Axie Infinity and Neon District, which emerged after CryptoKitties, managed to double their communities. NonFungible.com opened a platform for tracking existing NFT markets and established the term "non-fungible" as a description of a new class of digital assets.

Digital Art

People from the art world also became interested in NFTs.

The value of a physical piece of art grants ownership rights as well as the right to display it, leading to a series of experiments from interested artists.

Platforms for publishing digital art were launched: SuperRare, Known Origin, MakersPlace, and Rare Art Labs, and artists like JOY and Josie used smart contracts to create their own brand.

The social network Cent with its unique micropayment system became popular, where the community can share digital art and discuss it.

Platforms for Creating NFTs

Such platforms allow anyone to mint NFTs without special skills. Projects Mintbase and Mintable created tools that enable even newcomers to the industry to create their own NFTs.

The Kred platform allowed ordinary people to create business cards, collectible items, and coupons. CoinDesk Consensus invited Kred to its conference as its main partner, where the company created an NFT “Swag Bag” for visitors.

It is also worth mentioning the project Marble Cards, which added the ability for users to create unique digital cards based on any URL using the “marbling” process. This technology allowed for the auto-generation of images and unique designs.

In 2019, tools matured significantly but still faced challenges in the adaptation process. Mintbase and Mintable created websites aimed at making it easier for ordinary people to create their own NFTs. The Kred platform simplified the creation of business cards, collectibles, and coupons for influencers. Kred also partnered with the CoinDesk conference Consensus to create digital NFT “Swag Bag” packages for attendees. OpenSea created a simple storefront manager for deploying smart contracts and creating NFTs within them.

UPD: In 2020, evolutions of these platforms appeared, alongside Rarible and Cargo, with additional features for mass creation, unlockable content, and multimedia. This allowed artists, digital content creators, and even musicians to create NFTs without needing to program a smart contract. By the end of the year, OpenSea eliminated the need to pay gas fees associated with minting, making creating NFTs free.

Traditional Intellectual Property

Owners of traditional IP items followed the example of CryptoKitties and created several interesting projects.

- MLB (Major League Baseball), which signed a partnership agreement with game developer Lucid Sight to launch a new game MLB Crypto Baseball, trades collectible items based on Blockchain.

- “Formula 1” also signed a similar partnership deal with Animoca Brands to launch a blockchain game called F1DeltaTime, with the car “1-1-1” selling for $100,000 on OpenSea.

- Star Trek, along with Lucid Sight, created several military ships in the game Crypto Space Commanders. Following this, they were joined by a number of licensed football card companies, including Stryking and SoRare.

- Additionally, Panini America, one of the largest players in the collectibles market, developed a collectible card based on Blockchain.

Similarly, MotoGP collaborates with Animoca Brands.

Japan Holds Leadership Positions

Games from the Land of the Rising Sun pointed to a completely different path of development for the gaming industry, surprising foreign developers. My Crypto Heroes, a role-playing game with a developed internal economy, still leads the rankings on DappRadar.

My Crypto Heroes became the first game to implement the concept of ownership on Blockchain and Off-chain gameplay. Users choose in-game heroes and then transfer them to Ethereum for sale on the secondary market.

Scaling Virtuality

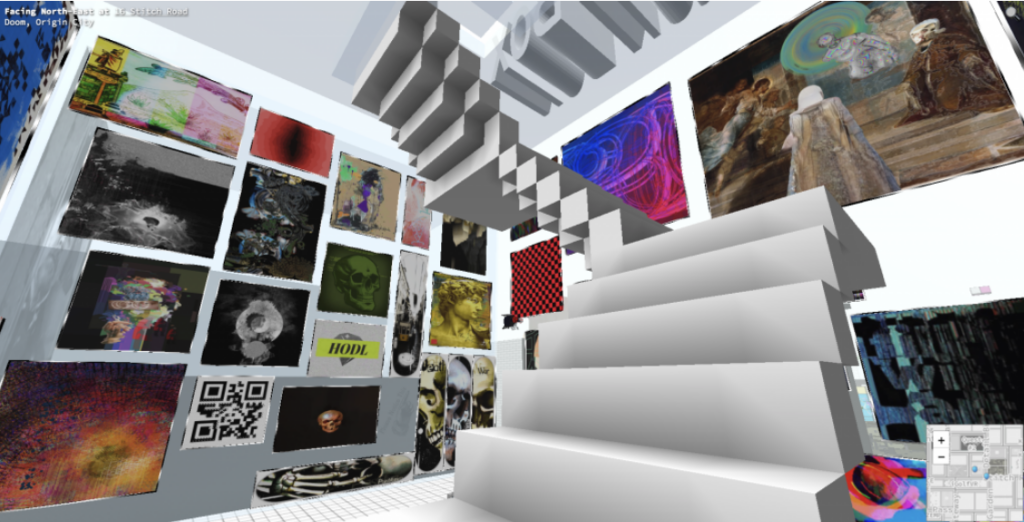

Digital worlds based on Blockchain also utilize NFTs to confirm ownership rights to internal assets. The project Decentraland, which raised $24.5 million for its MANA coin during its ICO, realized in-game land totaling $11 million. NFT assets in Decentraland traded at much higher volumes than those of other NFT projects in 2018.

Currently, Decentraland has its own beta version with developments like racing Battle Racers, accessible from anywhere in the world.

Cryptovoxels found a different approach. CryptoVoxels provides simple services based on webVR technology, and the project was founded back in 2018 by a single developer. The project tried to realize the amount of land that was in demand. The total trading volume amounted to >1700 ETH.

The most important nuance in the collaboration between CryptoVoxels and Decentraland is the ability to showcase one's Non-Fungible Tokens. Some collectors created CryptoKitty museums, cyberpunk-style art galleries, calendars of global events in the NFT space, and shops selling usable items for game characters.

CryptoVoxels is gaining popularity among digital art artists, including among the crypto audience of the Cent platform.

Some artists create “social money” in the Roll program, allowing them to deploy their ERC20 token and list it for sale.

There were also other projects like Somnium Space and High Fidelity – a project from the developers of the incredibly popular Second Life. Sandbox, which utilized Roblox – a platform for creators designed to empower content makers, also recently started selling land in its universe.

Enjin, which raised 75,031 ETH during its ICO in early 2018, expanded its multiverse platform into a whole system of games based on the ERC1155 protocol. One of Enjin's key points is the ability to transfer items from one game to another. Thus, the Enjin team released a “universal” axe Oindrasdain, which was added to the game Forgotten Artifacts as equippable weaponry, allowing players who previously owned it to try it out in that game.

Collectible Board Games

Collectible card games initially seemed the most natural realization for NFTs. The physical card game, Magic the Gathering – is not just a game. It’s a whole economy with hundreds of accompanying websites and trading platforms for buying, selling, and exchanging operations.

And while such digital equivalents of Magic the Gathering, like Hearthstone, could create a gaming market for their cards, such efforts might not align with the business model of releasing new decks. Blockchain allows for the instant creation of secondary marketplaces operating Off-chain.

After its presale of $4.9 million – the company Immutable launched the game Gods Unchained, likely the most promoted blockchain game of 2021.

The first fame came after an incident with the card game Hearthstone, which banned one of its players from participating in tournaments due to support for political protests in Hong Kong:

The Gods Unchained team banned cards for an extended period before launching the game. At that time, third-party marketplaces allowed cards to be listed for sale, but they couldn’t be purchased since transfers were impossible. Therefore, when the cards were unlocked in November – the Gods Unchained market exploded, and secondary trading volume exceeded $1.3 million.

Alongside these events, several other card games also quietly gathered fans. The game Skyweaver from Horizon Games raised $3.75 million in its seed round and released a public beta version.

The game Epics was the first to enter esports among collectible card games based on Blockchain networks, while CryptoSpells – a card trading game from Japan, took leading positions in the Japanese market.

DeFi Domain Services

The third largest class of assets in NFTs consists of domain name services, analogous to ".com" domains but based on decentralized technology. The Ethereum Name Service, launched in April 2017 and funded by the Ethereum Foundation, banned 170,000 Ethereum names during the period from 2017 to 2018 – successful purchase requests are included in a smart contract during the period of ownership by the domain trader.

In April 2019, the team upgraded the ENS smart contract to make it compatible with ERC721, allowing names to be traded on public NFT marketplaces.

In September 2019, the OpenSea platform partnered with ENS to conduct auctions for 5 domain names using an English auction mechanism. The total value of winning bids was 5,687 ETH. More information about the auction can be found here.

Additionally, unstoppable domains emerged – domains with a more speculative approach to decentralized domain name services, which led to Draper Associates and Boost VC raising $4 million in their first funding round. Subsequently, initially based on Blockchain Zilliqa, unstoppable domains acquired the domain “.crypto” as an ERC721 asset.

The Kred team is working on NFTs compatible with ENS and DNS. Storing the Kred token in a wallet provides access to manage this name both in DNS (link to website) and in ENS (link to wallet/contract).

Other Experiments

Most experiments in NFTs have been conducted in the fields of gaming and collecting – gradually, other ways to utilize the technology emerged. For instance, tickets for NFT.NYC and Token Summit were sold as NFTs, and the Coin.Kred team created a virtual “bag” for storing NFT items.

Binance also released festive NFT collectibles, while Microsoft created Azure Heroes – badges for participants in the Azure system.

The first major event in the NFT space in North America – NFT.NYC 2019 brought together over 500 participants and more than 80 speakers at the iconic Times Square in New York to discuss the development of the NFT ecosystem.

Crypto Stamp – a project by the Austrian postal service discussed with buyers of official physical stamps an entry point into the world of NFTs. Each physical stamp has a section with an opaque protective coating under which the buyer will find a private key with a small amount of ETH and a digital copy of the stamp itself, which can then be listed for sale on OpenSea. The project was quite unusual as it connected scarce and digital assets with a useful physical asset, thus attracting interest from collectors of digital art.

Dapper Labs, the creators of CryptoKitties, launched the tournament CheezeWizards. However, the game experienced a hard fork, resulting in both unpasteurized and pasteurized wizards, all due to an initial error in the smart contract. With complex gameplay on the blockchain, the project encompassed the need for standardization of NFT metadata placement, the possibility of updating smart contracts, and ensuring that auction mechanisms would change according to the primary attributes of items.

Recovery and Losses

Almost all games with the "hot potato" concept that appeared in 2018 are already dead.

Surprisingly, some of these projects were revived by their community members. Both CryptoAssault and Etheremon (now Ethermon) were restored. There was also an unsuccessful attempt to revive CryptoCelebrities by creating a game that allowed breeding celebrities.

Myths about NFTs

From an overview of the non-fungible token sphere, we will move on to the associated perceptions and myths.

Scarcity from Demand

Initially, right after the emergence of NFT tokens, it was believed that users were only concerned with the provable scarcity of NFTs and would rush to buy NFTs simply because they were placed on Blockchain.

However, it should be considered that demand is primarily driven by more traditional factors: utility and provenance.

The mechanism is clear: I am willing to buy an NFT ticket because it allows me to participate in a conference, I am willing to buy a piece of art if I can showcase it in a virtual world, I am ready to buy an item if it gives me special abilities in a game.

Additionally, the concept of provenance is important, i.e., the history of the NFT asset. Where did it come from? Who owned it before? As the NFT sphere develops, the stories behind intriguing NFT assets become increasingly complex and begin to influence the token's value.

The Impact of Smart Contract Technology

There is a belief that only through smart contracts will NFT assets exist forever. This overlooks the fact that there are other objects involved. For example, websites and applications that serve as portals for interaction with regular users. If the portal fails, the assets lose all value.

Perhaps in the future, Dapps can be deployed in a fully decentralized, indestructible manner, but for now, we still live in a hybrid world.

Separation of Blockchain

In 2018-2019, some projects applied an abstraction approach to Blockchain, where all internal mechanics of NFTs were hidden from users who were provided with a wallet hosted on a remote server with access via login and password.

This approach implied the same principles of simplified adaptation as centralized applications. But the problem lay in losing full compatibility with the rest of the NFT system: virtual worlds, wallets, marketplaces, etc.

Projects connecting directly to the NFT ecosystem, sacrificing some usability in the short term, are more appealing to today's user community.

Intersection in the NFT Sphere

Are different communities relatively isolated from each other (players in Gods Unchained play only Gods Unchained) or is there still communication between them? Can a crypto enthusiast of CryptoKitties own ENS and additionally participate in some digital art project?

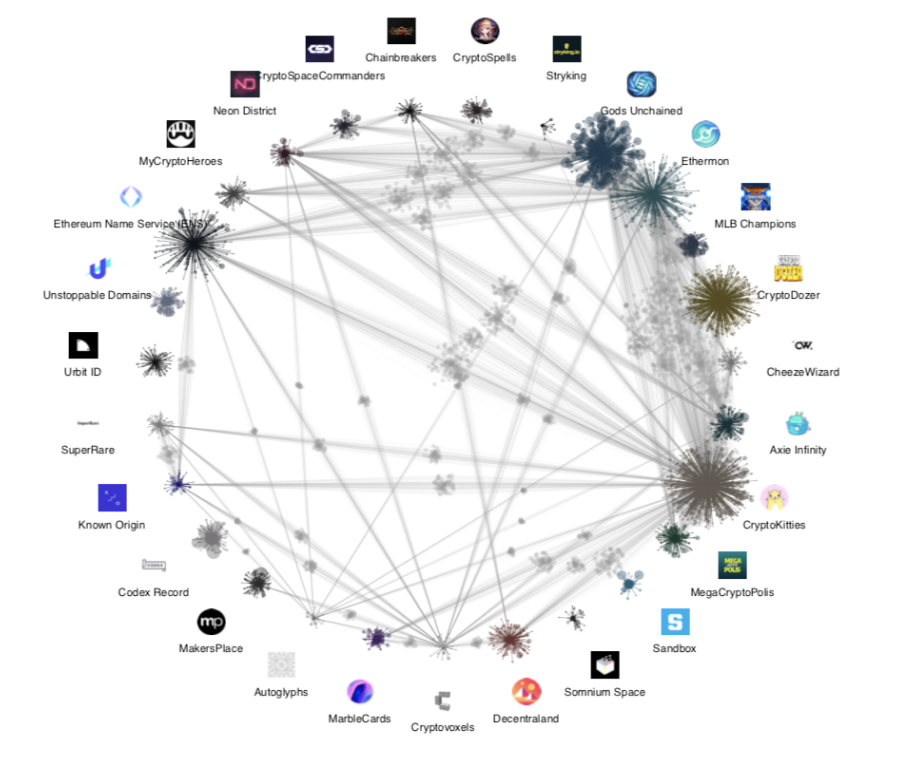

Takens Theorem, an anonymous yet very friendly Twitter account with incredible Blockchain analysis, conducted an analysis of the intersections of interests between various NFT communities.

The above diagram represents an overall network based on raw data from 400 thousand addresses in OpenSea. On the outer ring, each local network consists of addresses owning at least one type of NFT. The number of displayed nodes in a local network corresponds to actual data; for example, thousands of addresses have only CryptoKitties. The size of each node depends on its balance.

In Gods Unchained, it can be seen that many addresses have many cards (deck!). Light gray nodes connecting NFT projects represent known patterns of shared ownership. Additionally, there are thousands of addresses that own two different gaming NFTs – they are particularly noticeable on the right. Furthermore, there are other smaller patterns of shared ownership. Connections between projects indicate relationships between Cryptovoxels and Decentraland, as well as between ENS and many other projects.

What Awaits the NFT Sphere in 2021?

If you've read this article to the end – congratulations! Hopefully, you have learned a lot of new and exciting things about this unconventional and strange world of NFTs and will be inspired enough to explore at least a few of the mentioned projects. Perhaps even create your own.