Full guide to Meteora: understanding liquidity

Since the emergence of the first DeFi protocols, this sector has become one of the most developed and popular avenues for earning in the world of cryptocurrencies. A key aspect of building decentralized finance is the mechanisms for providing liquidity, as liquidity determines how easily one asset can be converted into another.

To ensure decentralized processes for exchanging and trading assets, special smart contracts are created — liquidity pools, which also allow users to earn from the fees generated by these exchanges by providing their assets to these pools.

In this article, we will discuss the Meteora project, which plays a key role in developing dynamic liquidity within the Solana ecosystem, allowing users not only to place assets in pools but also to optimize yield through automatic redistribution of funds among various trading pairs.

The Essence of Meteora and Why Everyone is Talking About It

Meteora is a DeFi platform in the Solana ecosystem that offers dynamic liquidity pools with automatic adaptation to market changes. The project gained popularity with the rise of meme coins, as it enabled liquidity provision for meme tokens launched on the Solana blockchain.

Interesting Features:

- The project's TVL exceeds $1 billion;

- The project is developed by the team behind DEX Jupiter and has connections with the wallet and marketplace in the Solana network - Backpack;

- All launchpads of Jupiter are closely linked with Meteora's pools. Meteora is the largest liquidity provider for Jupiter and other DEXs in the Solana network;

- Information about investments from funds is absent; however, the project's Twitter account is followed by the official Solana account and representatives from Coinbase Ventures, Jump Capital, Alameda Research, and many top influencers and developers;

- Meteora launched a platform for staking meme coins and issued a meme coin called M3M3, whose capitalization reached $200 million at its peak. M3M3 tokens were distributed to active users of the platform, with some drops reaching several thousand dollars;

- The launch of the MET token has been officially confirmed, and part of the rewards is allocated for the community. Additionally, 10% of the total token supply will be distributed among liquidity providers;

- According to unconfirmed reports, the token drop can be expected in spring 2025.

To track user activity, a program called "The Massive Meteora Stimulus Package" was launched in January 2024, where points are awarded for activity on the platform, which will be converted into project tokens.

The conditions for farming points are as follows:

- 1 xp for providing $1 TVL per day;

- 1000 xp for each dollar earned in fees;

- 1.25x multiplier for all users with gradual reduction.

❗️ IMPORTANT!

- XP is awarded only for activity in Dynamic Pools, DLMM, and Multi-token pools;

- The rewards proposal also mentions a tier system to ensure a fairer distribution of tokens;

- Based on this proposal, the most effective way to farm xp is through yield farming in pools, since for every dollar earned, we will receive 1000 xp;

- Using the Backpack wallet allows you to earn xp with a 25% boost.

Tools and Other Useful Links

- Commission calculator for earnings on the platform

- Meteora Leaderboard based on points

- Activity checker for your wallet on the platform

- Number of points in your wallet:

https://point-api.meteora.ag/points/ваш_адрес - Total immersion in Meteora

- Dashboards and statistics

Before diving deeper into Meteora, it's essential to understand how liquidity pools work and what risks are associated with their use.

Liquidity Pools

Liquidity pools connect users who wish to exchange one asset for another with liquidity providers looking to earn from the fees that users pay for exchanges.

Liquidity pools in the DeFi space can mainly be divided into two types:

AMM pools (Automated Liquidity Makers) are automated liquidity pools where liquidity is distributed evenly across the entire price range. This approach does not require active management of funds, but a significant portion of liquidity may remain unused.

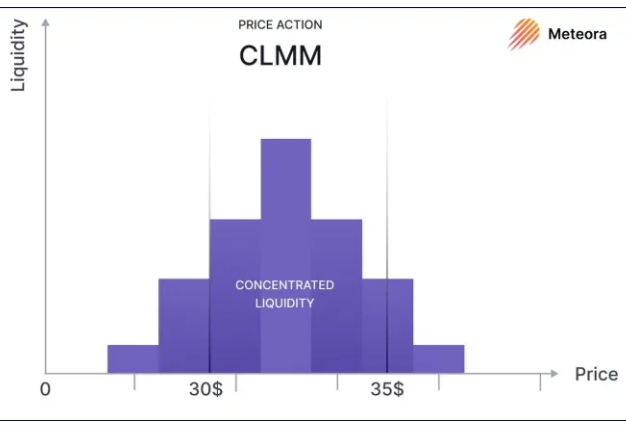

CLMM pools (Concentrated Liquidity Market Makers) are an advanced version of AMM, where users can specify a price range in which their liquidity will be utilized. Importantly, when the price moves outside the specified range, only one asset will remain depending on the price movement, and earning yield will cease until the price returns to the range. This approach increases yield but requires more active management.

For users making exchanges, there is no significant difference in which type of pool to use for trades, but for liquidity providers, this difference defines their approach to asset management and yield generation strategies.

LP Tokens

By sending funds to a pool, liquidity providers receive so-called LP tokens. These tokens confirm ownership of a share in the pool and guarantee that the liquidity provider can withdraw their assets from the pool.

For example, by adding assets to the SOL/USDC pool, the provider receives LP SOL-USDC tokens in return. If the volume of the pool increases (for instance, due to fees), the value of the LP tokens will also increase, and vice versa.

In addition to exchanging LP tokens for the original assets from the pool, liquidity providers can use them to earn additional yield, such as sending them to yield farms or employing them in various farming strategies. Some of these products are available on Meteora, which we will discuss next.

Impermanent Loss (IL)

When earning yield in liquidity pools, it's also important to consider impermanent losses (IL).

Impermanent losses occur when the price of an asset moves in one direction, resulting in a change in the ratio of assets that we deposited in the pool. The value of IL indicates the loss between holding a position in the pool compared to holding the same assets outside the pool.

Let's examine where impermanent losses come from and what happens to your assets in pools using the example of ETH/USDT:

Initial conditions:

- ETH price $3000

- Depositing assets into the pool in equal amounts - 1 ETH and 3000 USDT

IL in AMM Pools

- When the price of ETH rises, algorithms will sell it. As a result, the ratio of our assets in the pool will change, and USDT will become greater than ETH.

The price of ETH increased from $3000 to $4000. Consequently, the ETH balance in the pool decreases to 0.87 ETH or $3900. If we had simply held 1 ETH on balance, its value would have been $4000 instead of $3900.

IL in this case is 100 USDT - When the price of ETH falls, algorithms will buy ETH. As a result, the ratio of our assets in the pool will change, and ETH will become greater than USDT.

The price of ETH dropped from $3000 to $2000. Consequently, the ETH balance in the pool increases to 1.14 ETH or $1950. If we had simply held 1 ETH on balance, its value would have been $2000 instead of $1950.

IL in this case is 50 USDT

IL in CLMM Pools

In such pools, liquidity is provided within a specific price range rather than evenly. Suppose we limited the range of liquidity provision from 2500 to 3500 USDT per ETH.

- When the price of ETH rises (e.g., to 4000 USDT), all our ETH will convert to USDT since the price has exceeded our specified upper limit. Consequently, our asset balance in the pool will consist of 0 ETH and approximately 3500 USDT.

IL in this case will be 500 USDT, because if we had simply held 1 ETH, its value would have been 4000 USDT while we locked it at 3500 USDT.

- When the price of ETH falls (e.g., to 2000 USDT), all our USDT will convert to ETH since the price has fallen below our specified lower limit. Consequently, our asset balance in the pool will consist of 0 USDT and 1.7 ETH.

IL in this case will be 1600 USDT, because if we had simply held the assets, the total value would have been $5000, while in the pool we have 1.7 ETH valued at 3400 USDT.

If we provide our assets in pools with stable pairs, such as USDT/USDC, then in any outcome of price movement, we will end up with one of the stablecoins in hand.

CLMM pools allow for higher commission yields but carry the risk of moving out of range, unlike AMM, where we always retain part of our assets.

In CLMM pools, during strong price movements, our assets are fully converted into one of the assets. To effectively utilize CLMM pools, it is necessary to adjust the range or use automated rebalancing strategies.

The main task of a liquidity provider is to ensure that the yield from commissions in the pool exceeds the costs associated with impermanent losses.

Now that we understand how liquidity pools work, let's talk about Meteora and the tools available on the platform.

Meteora Products and Tools

Liquidity Pools

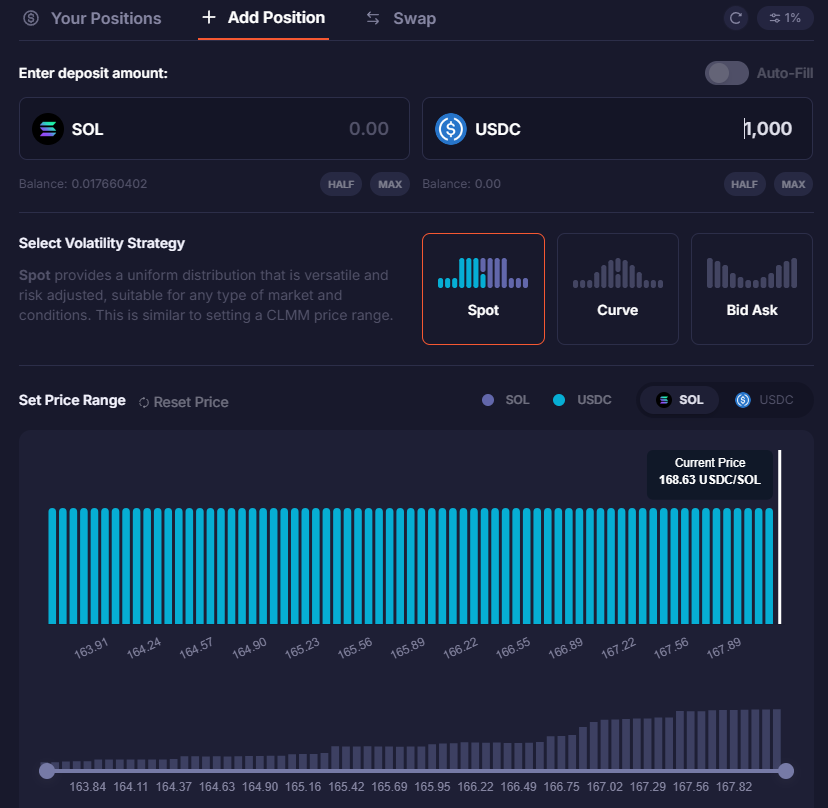

The most popular and widely used product on the platform is DLMM pools.

Firstly, because users have flexible settings for patterns to distribute liquidity, which combined with high trading volume metrics allows for earning commissions tens of times more efficiently than on other platforms.

Secondly, because farming in liquidity pools yields the most points, which is necessary to qualify for drops from the project.

Meteora offers several types of liquidity pools that allow users to earn yield by providing their assets.

DLMM Pools (Dynamic Liquidity Market Maker)

This is an advanced version of CLMM pools where the risks of impermanent losses are reduced, and liquidity is automatically rebalanced as market conditions change. While in CLMM pools, you need to choose the price range yourself, in DLMM pools this process is automated.

| Characteristic | AMM | CLMM | DLMM |

| Liquidity | Liquidity is distributed evenly across the entire price range from 0 to ∞ | Liquidity is distributed within a specified price range, e.g., from $1000 to $1500 | Liquidity dynamically shifts within the range |

| Pool Fee | Fixed fee | Different fee levels depending on the range | Different fee levels, can adapt based on market conditions |

| Yield | Providers earn fees from all transactions | Providers earn fees only within the specified range | Optimized fees due to dynamic liquidity management |

| Impermanent Loss | High, as liquidity is spread over the entire price range | Lower, if the range is not managed | Low, as liquidity moves automatically |

| Usage | Maximally simple liquidity addition | Requires understanding of the market and active management | Automatic liquidity management reduces the need for manual control |

| Examples | Uniswap V2, PancakeSwap | Uniswap V3, Meteora | Meteora DLMM |

One of the main features of DLMM pools is the ability to deposit assets unilaterally, i.e., to contribute only one token from the pair to the pool. This can be useful during token launches when a project deposits newly created tokens into the pool for users to purchase them with SOL.

The unilateral deposit function can be used to form various earning strategies.

For example, suppose we want to acquire a newly launched token in anticipation of its medium-term growth. Instead of simply buying it on a DEX, we can take advantage of the unilateral deposit of our USDT into the DLMM pool of the chosen token.

We know that when the token price falls, our stablecoins will convert into that token to balance the asset ratio in the pool. By specifying a certain range from the upper to the lower limit, we can thus not only convert USDT into the chosen token via DCA (Dollar Cost Averaging) but also earn yield for providing liquidity.

Another feature of DLMM pools is the absence of LP tokens when adding liquidity. For this reason, projects cannot permanently lock liquidity in pools.

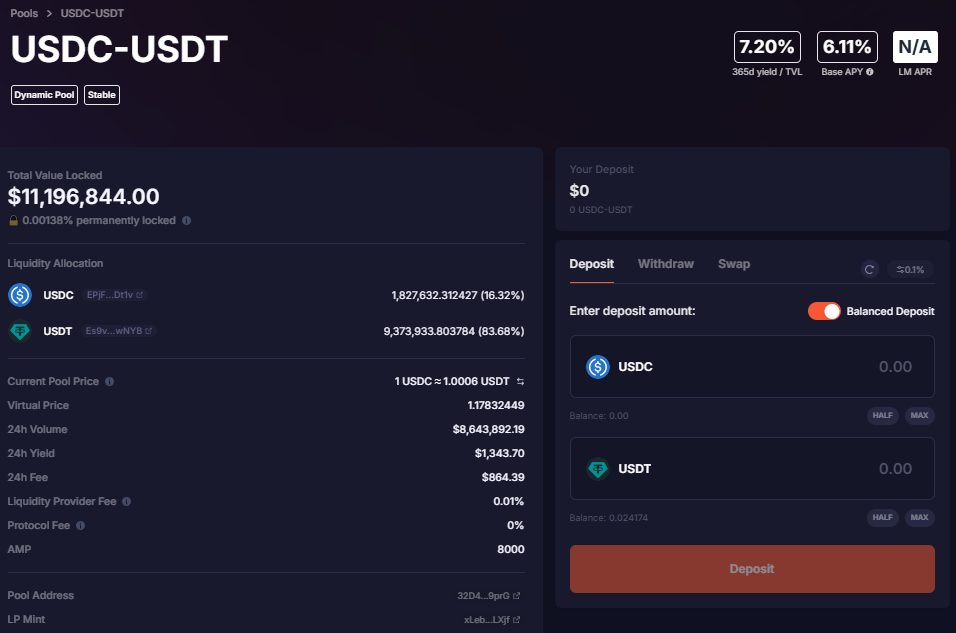

Dynamic Pools

These are pools using the classic AMM model. Unlike DLMM pools, Dynamic Pools offer a fixed percentage of fees and distribute liquidity across the entire range. They do not require active management and rebalancing of assets.

Assets in these pools are placed in vaults and distributed across lending protocols, generating additional yield and rewards, such as exchange fees, interest on loans, liquidity mining rewards, and more.

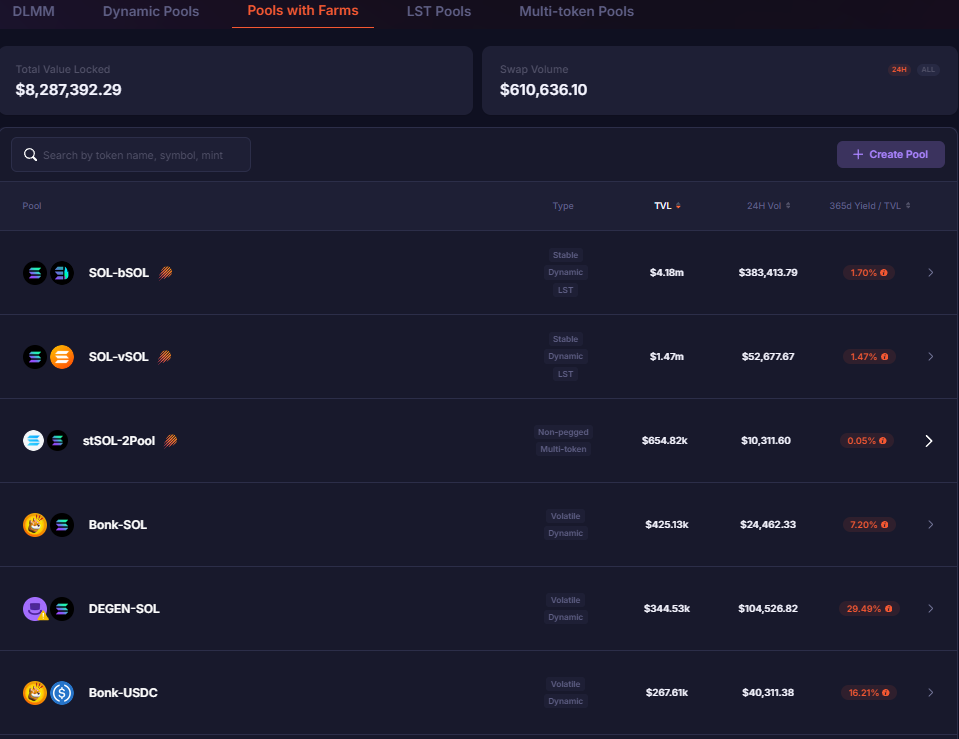

Pools with Farms

These are liquidity pools that allow liquidity providers to increase their yield through additional farming rewards, thereby combining multiple sources of income. By sending assets to such pools, we receive LP tokens in return, confirming ownership of a share of the pool.

We can then use our LP tokens in various farming strategies both on Meteora and beyond. For example, Meteora offers special Pools Farms, which we will discuss below.

LST Pools

These are pools that allow using tokens from liquid protocols to provide liquidity in pools and earn additional profits. Thus, we can earn yield for providing liquidity in pools without losing rewards from staking.

Multi-token Pools

These are pools that simultaneously support several tokens, for example, the PAI-3Pool consisting of PAI/USDT/USDC.

Dynamic Liquidity Vaults (Meteora Dynamic Vaults)

These are vaults where assets are automatically redistributed among 10+ lending and DeFi protocols, optimizing fund placement and providing the best yield.

Instead of manually placing your assets across DeFi protocols, Dynamic Vaults algorithms find the most profitable options by constantly redistributing liquidity.

Auto-Compounding Vaults

These are vaults that automatically reinvest earned yield to increase profits through compound interest. Instead of manually reinvesting earned rewards from farming and paying fees for deposits and withdrawals, the system does this for you without charging fees.

For example, if you are yield farming in Meteora pools and receiving rewards in various LP tokens, you would need to manually sell the earned tokens and redeposit them into the pool to increase yield. With Auto-Compounding, the system automatically reinvests rewards back into the pool without additional actions required on your part.

Auto-Compounding is available in Dynamic Pools and Dynamic Vaults.

Summary

Meteora is one of the key players in the meme coin market within the Solana network. Over the past few months, the platform has facilitated the launch of several high-profile meme coins such as HAWK - for blogger Hayley Welch, TRUMP - for U.S. President Donald Trump, MELANIA - for First Lady Melania Trump, and most recently — the LIBRA token, which sparked outrage around the platform and led to the resignation of a co-founder of Meteora.

Despite the FUD surrounding Meteora, its popularity and trading volume remain high, and the meme coin trend on Solana continues to capture the attention of the entire crypto market. If you haven't started using Meteora yet and engaging with the project to qualify for drops, you still have plenty of time to rectify that.