Cryptocurrency Exchange Ratings — List of 15 Reliable Crypto Exchanges

A cryptocurrency exchange is a platform that allows you to buy, sell, and trade bitcoins along with other cryptocurrencies (altcoins) with each other and/or for fiat money. Under this general definition lies a multitude of different categories — cryptocurrency exchanges differ from each other in terms of centralization, client requirements, additional trading features, etc. We present to your attention a detailed overview of cryptocurrency exchanges and some new platforms.

Spot Exchanges

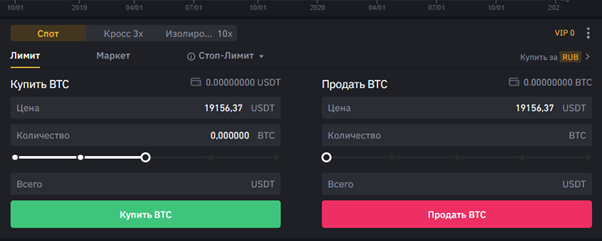

Spot cryptocurrency exchanges are more suitable for beginners and novice traders. The feature of spot trading is that settlements for each transaction occur at the same moment it was made.

Spot platforms support two main types of trading orders: market and limit. Market orders are suitable for immediate buying or selling at the current rate. Limit orders allow you to set your own price, resulting in the order being filled only when a matching order at the same price appears.

The market is formed by makers and takers. In short, a maker is someone who creates limit orders, while a taker is someone who fills them by creating a market order. Since the maker plays a key role in forming the market, trading fees for them are usually significantly lower or even zero.

Popular spot cryptocurrency exchanges:

Futures (Options) Trading Exchanges

A derivative is a contract under which one user agrees to transfer cryptocurrency to another within a specified time and at a specified price. By trading derivatives, traders do not own the underlying asset itself but earn from changes in its market price and provide risk hedging.

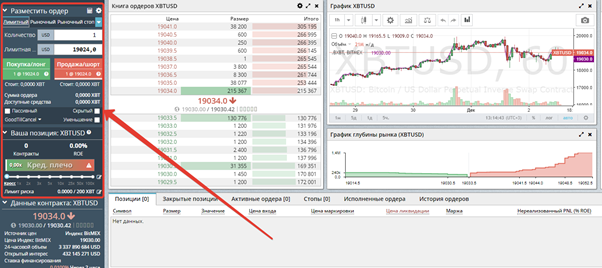

When trading contracts, leverage is often used, which can significantly increase potential earnings, but in the case of an unsuccessful deal, losses can also increase just as much.

Futures are contracts for the sale/purchase of an asset in the future at an agreed price. Futures can also be perpetual, meaning they can be sold at any time. Options differ from futures in that they do not obligate the trader to purchase the specified asset but give them the right to do so.

Examples of futures cryptocurrency exchanges:

Cryptocurrency Exchanges with Margin Trading

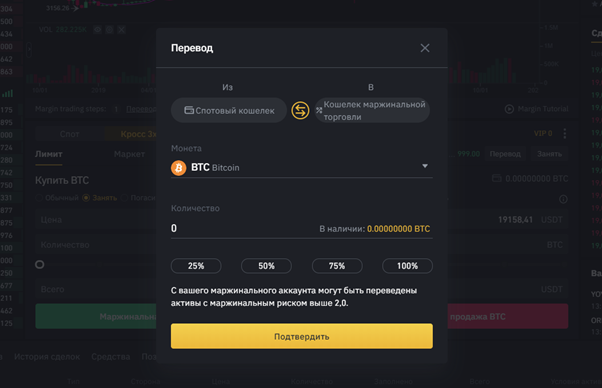

Margin trading involves providing the trader with a loan for a certain amount secured by the funds they have in their balance. This loan can only be used for trading operations on the same exchange. The credit leverage increases purchasing power and can multiply profits from successful trades. Due to the high-risk component, margin trading in cryptocurrencies is suitable for professionals and is not recommended for beginners.

On some exchanges, it is required to first transfer funds to a separate margin account before using the lending option.

The loan can be issued either directly from the funds belonging to the exchange or (more often) from the funds of other users, who thereby earn by investing their money for interest.

Examples of cryptocurrency exchanges with margin trading:

Rating of Cryptocurrency Exchanges for Russia

1. Binance

- Official website of the Binance exchange: https://www.binance.com

- Year of establishment: 2017

- Fees: maker 0.075%, taker 0.1% (possible reduction using BNB token)

The leader in spot trading. Binance stands out for its low fee levels and high functionality — there are different types of trading (spot, margin, futures, OTC, p2p), as well as opportunities for passive income — deposits, pools, lending systems. Recently, the option to order a plastic card has become available.

2. Yobit

- Official website of the exchange: https://yobit.net/

- Year of establishment: 2014

- Fees: 0.2% from each trader's transaction

The Yobit cryptocurrency exchange is registered in Panama and, at the time of writing this review, has over 6000 trading pairs available for trading on the platform. The administration of the cryptocurrency exchange is anonymous.

3. Coinbase

- Exchange: https://www.coinbase.com/ru/

- Year of establishment: 2012

- Fees: 0.5% + fixed fees may apply depending on the currency

A regulated American cryptocurrency exchange + wallet. Initially, it was a specialized service aimed at working with Bitcoin, but now it offers full functionality with support for a number of popular digital and fiat currencies. Coinbase positions itself as a fully transparent platform for authorities, so anyone using it must undergo verification and be prepared for their transactions to be checked.

4. Binance Futures

- Exchange: https://www.binance.com/ru/futures

- Year of establishment: 2019

- Fees: maker 0.02%, taker 0.04%

A platform launched by the Binance cryptocurrency exchange quickly rose to the top spot in daily trading volume among futures exchanges. It supports several types of contracts. Any user of the main Binance platform can open an account on this site without needing to create a separate account. However, to trade, funds must be transferred from the main account to the futures account.

5. Kraken

- Exchange: https://www.kraken.com/

- Year of establishment: 2011

- Fees: maker 0.16%, taker 0.26%

One of the oldest cryptocurrency exchanges still successfully operating today. Founded in the USA, it mainly targets users from either the States or Europe, although Russian is also supported. The authority of the Kraken platform is confirmed by its trading volumes — the exchange confidently remains a leader in spot trading.

6. EXMO

- Official website of the EXMO exchange: https://www.exmo.me/

- Year of establishment: 2013

- Fees: Trading fee 0.2%

The EXMO cryptocurrency exchange is fully adapted to the Russian market. This is because the exchange was founded by Russian entrepreneurs Eduard Anufiev and Ivan Petukhovsky. Users are also attracted by the low level of commission fees.

7. ByBit

- Exchange: https://www.bybit.com/

- Year of establishment: 2018

- Fees: maker -0.025%, taker 0.075%

This relatively new derivatives exchange has quickly gained popularity. Much of this can be attributed to the $10 bonus it gives upon registration (though it can only be used for trading). In addition to this bonus, there are others (for the first deposit, for activity on social media, etc.). There is a demo account where you can try your hand at trading without risk.

8. PrimeXBT

- Exchange: https://primexbt.com/

- Year of establishment: 2018

- Fees: 0.05%

PrimeXBT is a multifunctional platform where trading is available for both cryptocurrencies and other trading instruments (forex, commodities, indices). You can work with the exchange without verification; leverage up to 100x (for crypto) is provided. Fiat can be deposited using a bank card.

9. Poloniex

- Exchange: https://poloniex.com/

- Year of establishment: 2014

- Fees: 0.125%

The Poloniex exchange provides opportunities for spot, derivative, and margin trading, as well as lending (depositing cryptocurrency for interest). Only verified users can work with the platform. A significant selection of trading pairs (over 250) and loyal fees have maintained substantial trading volumes on the exchange for several years, although they are far from top-tier.

10. Binance DEX

- Exchange: https://www.binance.org/

- Year of establishment: 2019

- Fees: depend on the currencies and wallets used

Binance DEX is a decentralized cryptocurrency exchange launched by Binance as an option for those who prefer to manage their assets independently. To use it, you need to create a wallet, saving the private key and mnemonic phrase on your device. The platform supports assets operating on the Binance Chain and Binance Smart Chain blockchains.

11. Bitmex

- Exchange: https://www.bitmex.com/

- Year of establishment: 2014

- Fees: maker -0.025%, taker 0.075%

The BitMEX exchange ranks among the most sought-after platforms for trading cryptocurrency derivatives. It offers several different types of contracts; however, all calculations, deposits, and withdrawals are conducted in Bitcoin (here it is denoted not as BTC but XBT). The platform is quite functional but also complex for beginners, so it is recommended to carefully study the accompanying reference information first.

12. Uniswap DEX

- Exchange: https://app.uniswap.org/#/swap

- Year of establishment: 2020

- Fees: 0.3%

Uniswap is an automated market-making exchange operating on the Ethereum blockchain and supporting all assets listed on that blockchain. It rewards liquidity providers with a share of the fees from operations conducted in each pool. Currently, Uniswap is the most popular decentralized exchange with a trading volume of over $300 million daily.

13. DyDx

- Exchange: https://dydx.exchange/

- Year of establishment: 2019

- Fees: maker 0%, taker 0.15%

The decentralized dYdx exchange provides opportunities not only for trading but also for DeFi lending. That is, if a user does not want to sell their assets, they can simply leave them as collateral and receive others in return for some interest. Interest rates change automatically based on market conditions.

14. Yobit

- Exchange: https://yobit.net/ru/

- Year of establishment: 2014

- Fees: 0.2%

YoBit is currently one of the most controversial platforms in the industry. It has been operating for several years, has its audience, but at the same time is constantly criticized for launching dubious services or problems with fund withdrawals. It supports several hundred trading pairs and regularly adds new ones. There is an opportunity for passive income through VMining or InvestBox.

15. Livecoin

- Exchange: https://www.livecoin.net/ru

- Year of establishment: 2015

- Fees: 0.18%

Livecoin positions itself as the #1 cryptocurrency provider. It allows working without passing KYC/AML, including with fiat, withdrawing money to cards or e-wallets. It supports working with vouchers — special codes for instant transfers within the exchange without fees.

16. Currency

- Exchange: https://currency.com/ru

- Year of establishment: 2019

- Fees: maker -0.025%, taker 0.075%

Currency is a Belarusian cryptocurrency and tokenized asset exchange that operates entirely within the legal framework and requirements of the High-Tech Park of Belarus. It is user-friendly, allowing deposits and withdrawals via bank cards. Account verification is required.

17. CEX.IO

- Exchange: https://cex.io/

- Year of establishment: 2013

- Fees: maker 0.16%, taker 0.25%

Cex.io was originally founded as a cloud mining service but later requalified as a trading platform. It allows trading with leverage up to 100x and also offers staking for some popular tokens (XTZ, ATOM, MATIC, etc.).

Comparison of Cryptocurrency Exchange Fees

The priority indicator when choosing a cryptocurrency exchange is the fee charged during trading or when depositing/withdrawing funds from the account. We present a summary table of fees across cryptocurrency exchanges.

Trading fees (listed without considering possible discounts):

| Exchange | Maker Fee | Taker Fee |

| Binance | 0.075% | 0.1% |

| EXMO | 0.4% | 0.4% |

| Poloniex | 0.125% | 0.125% |

| Coinbase | 0.5% | 0.5% |

Withdrawal fees for cryptocurrencies:

| Exchange | Withdrawal Fee for Cryptocurrency (listed for Bitcoin) |

| Binance | from 0.0000016 to 0.0005 BTC, depending on the type of address |

| EXMO | 0.0004 BTC |

| Poloniex | depends on network congestion |

| Coinbase | depends on network congestion |