How Revenue Became the Main Indicator of a Crypto Project’s Success

Understanding how crypto protocols work with revenue and cash flow. How the team's revenue will become a defining factor for tokens in the future.

The article's author analyzed S&P 500 data to understand how stock buybacks and dividends affected companies in the past.

In today's issue, Kash Dhanda from Jupiter assisted.

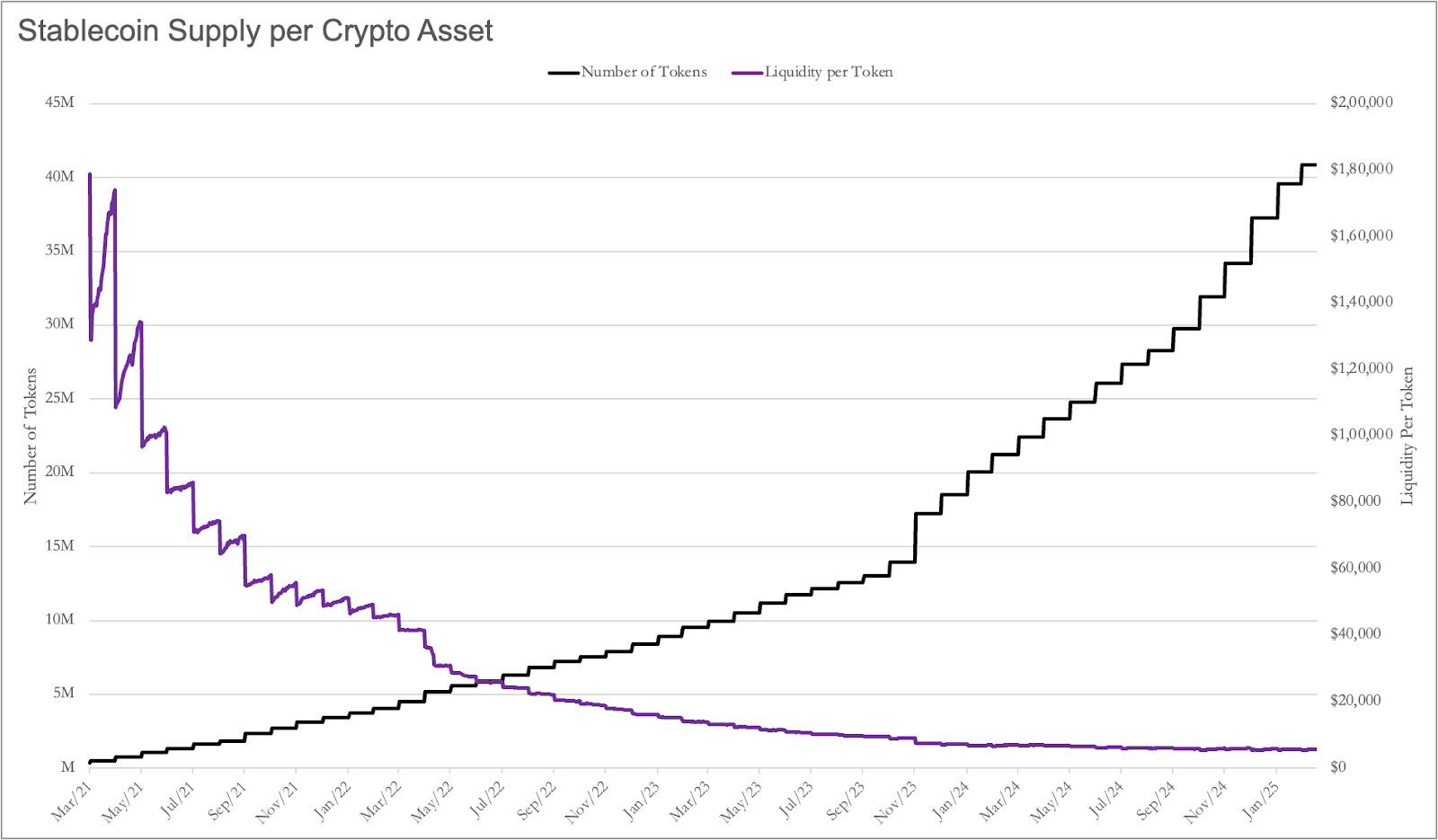

Recently, I used stablecoin supply as an indicator of liquidity. Then I considered the number of tokens in the market. The goal was to determine liquidity per asset. As expected, this number tends toward zero.

In March 2021, there was ~$1.8 million in liquidity per token in stablecoins. By March 2025, that figure is $5,500.

Projects have found it harder to attract attention: the number of tokens has increased from 5 to 40 million, and competition for capital has intensified. How can they maintain the interest of token holders?

One approach could be to create a community, ask them to write "GM" in Discord, and hint at airdrops.

But what happens next? Once they receive their tokens, they will simply move on to the next Discord to write "GM."

It is clear: the community does not stick around without a compelling reason. In my view, the reason is a good product with real cash flow. Or growth figures. But the latter cannot occur consistently without the former.

Russ Hanneman Syndrome

In the series Silicon Valley, Russ Hanneman boasted about becoming a billionaire by "launching radio on the internet." It seems everyone in crypto wants to be like Russ — chasing instant billions without worrying about boring things like business fundamentals, creating competitive advantages, and sustainable revenue.

Recent articles by Joel — "Death to Stagnation" and "Make Revenue Great Again" — emphasize the urgent need for crypto projects to focus on creating sustainable value. Similar to the memorable scene where Russ Hanneman humorously dismisses Richard Hendricks' concerns about building a sustainable revenue model, many crypto projects have also drifted along speculative narratives and investor enthusiasm — a strategy that is now clearly unsustainable.

However, unlike Russ, founders cannot just throw themselves "Three Commas" (Tres Comas).

Most will need sustainable revenue. But to get there, they first need to learn how those who already have it do it.

https://www.youtube-nocookie.com/embed/BzAdXyPYKQo

Zero-Sum Games for Attention

In stock markets, regulation plays a role in maintaining liquidity of traded stocks by setting high barriers for listing companies.

Of the 359 million companies worldwide, only about 55,000 are publicly traded — just ~0.01%.

The upside is that most available capital is concentrated in a limited pool rather than being dispersed. But it also means investors have fewer opportunities to chase outsized returns by betting on companies in the early stages of their life cycle.

Divided attention and low liquidity are the price we pay for any token being easily tradable publicly. I'm not trying to prove one approach is better than another. I'm merely highlighting the contrast between two worlds.

The question is, how to stand out among millions of existing tokens?

One way is to show that there is demand for what you are creating, and you will allow token holders to participate in the growth. Make no mistake. Not every asset or project should equally obsess over revenue and profit maximization.

Revenue is not the goal but a means for perpetual existence.

For example, an L1 blockchain that hosts enough applications just needs to earn enough fees to offset token inflation. If Ethereum's validator yield is ~3.5%, that means it adds 3.5% to its supply each year. Any ETH holder who does not stake ETH for that yield gets diluted. But if Ethereum burns an equivalent supply through its fee-burning mechanism, then the average ETH holder is not diluted.

Ethereum as a project does not necessarily need to be profitable because it already has a thriving ecosystem. As long as validators receive sufficient yield to keep nodes running, it is fine for Ethereum not to have excess revenue. But this does not apply to projects with a circulating supply of tokens that is, say, 20%. They resemble traditional companies more closely and may require time to achieve the status of a fund where a sufficient number of volunteers can sustain the project.

Founders must confront the reality that Russ Hanneman humorously ignored. Real, regular revenue matters.

For clarity: everywhere in this text where you see “revenue,” I actually mean FCF (free cash flow). This is because for most crypto projects, data on anything beyond revenue is hard to obtain.

FCF = Net Income + (Depreciation + Amortization + Tokenized Compensation ± Investment Losses/Gains)

Understanding how to allocate this FCF — when to reinvest it for growth or when to share it with token holders, and optimal methods of distribution (such as buybacks or dividends) — will likely become a decisive factor for founders looking to create long-term value.

To make these decisions effectively, it is helpful to look at stock markets, where traditional companies regularly distribute FCF through dividends and stock buybacks. These decisions are influenced by factors such as company maturity, sector in which it operates, profitability, growth potential, market conditions, and shareholder expectations.

Different crypto projects inherently offer different opportunities and constraints for redistributing value depending on their life cycle stage. Below, I will break down several of them.

Life Cycles of Crypto Projects

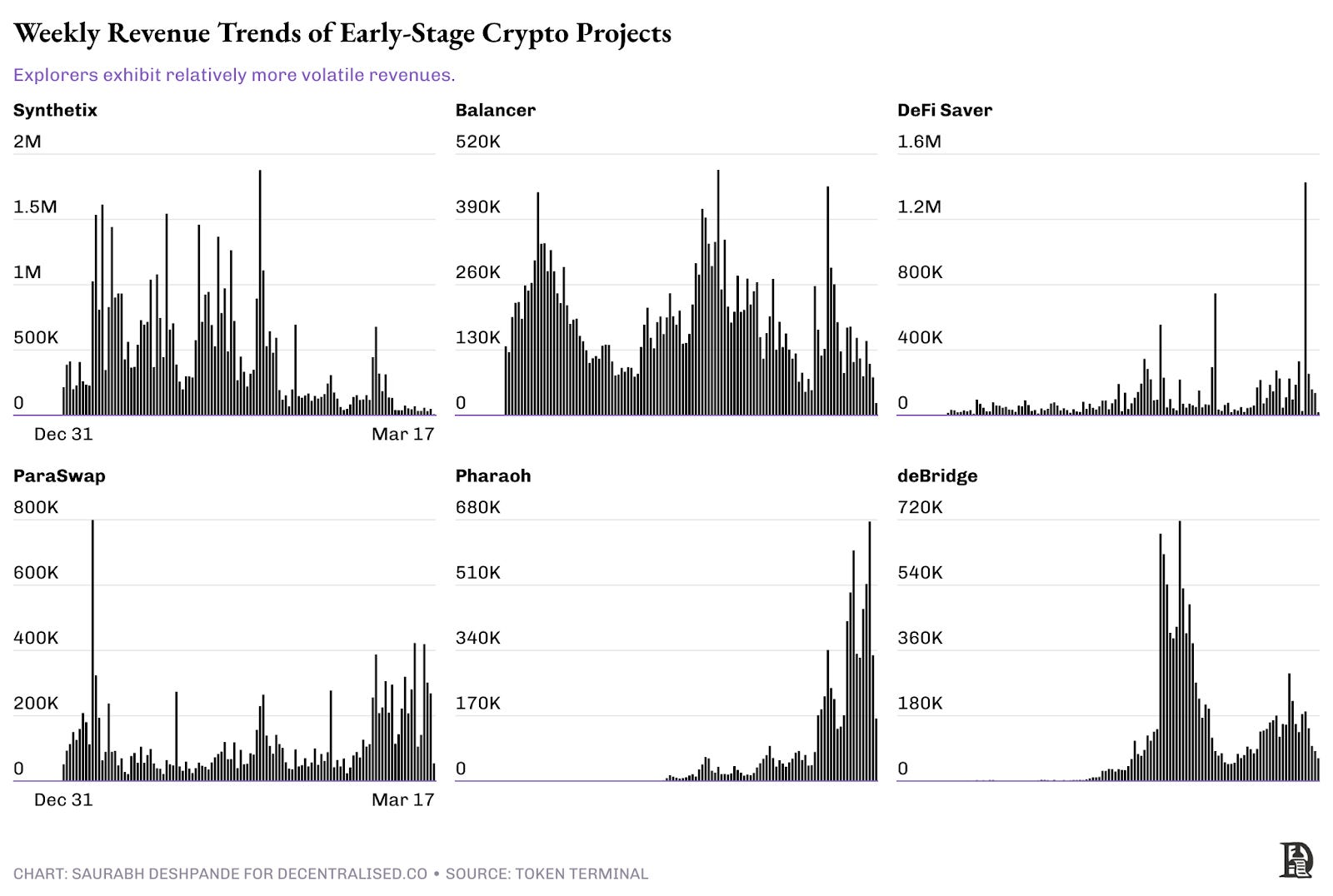

Explorers

Early-stage crypto projects often find themselves in an experimental phase. They focus on attracting users and refining their core offerings rather than aggressive monetization. Product-market fit remains uncertain, and these projects ideally prioritize reinvestment over revenue-sharing schemes to maximize long-term growth.

Governance in such projects is usually centralized, with founding teams controlling updates and strategic decisions. Ecosystems are in their infancy, network effects are weak, making user retention a significant challenge. Many of these projects rely on incentives in the form of tokens, venture funding, or grants rather than organic demand to sustain initial activity.

While some may achieve early success in niche markets, they still need to prove whether their model can scale sustainably. Most crypto startups fall into this category, and only a small fraction will advance further.

These projects are still searching for product-market fit, and their revenue dynamics highlight their struggle to maintain stable growth. Some, like Synthetix and Balancer, exhibit sharp spikes in revenue followed by significant declines, indicating periods of speculative activity rather than sustainable adoption.

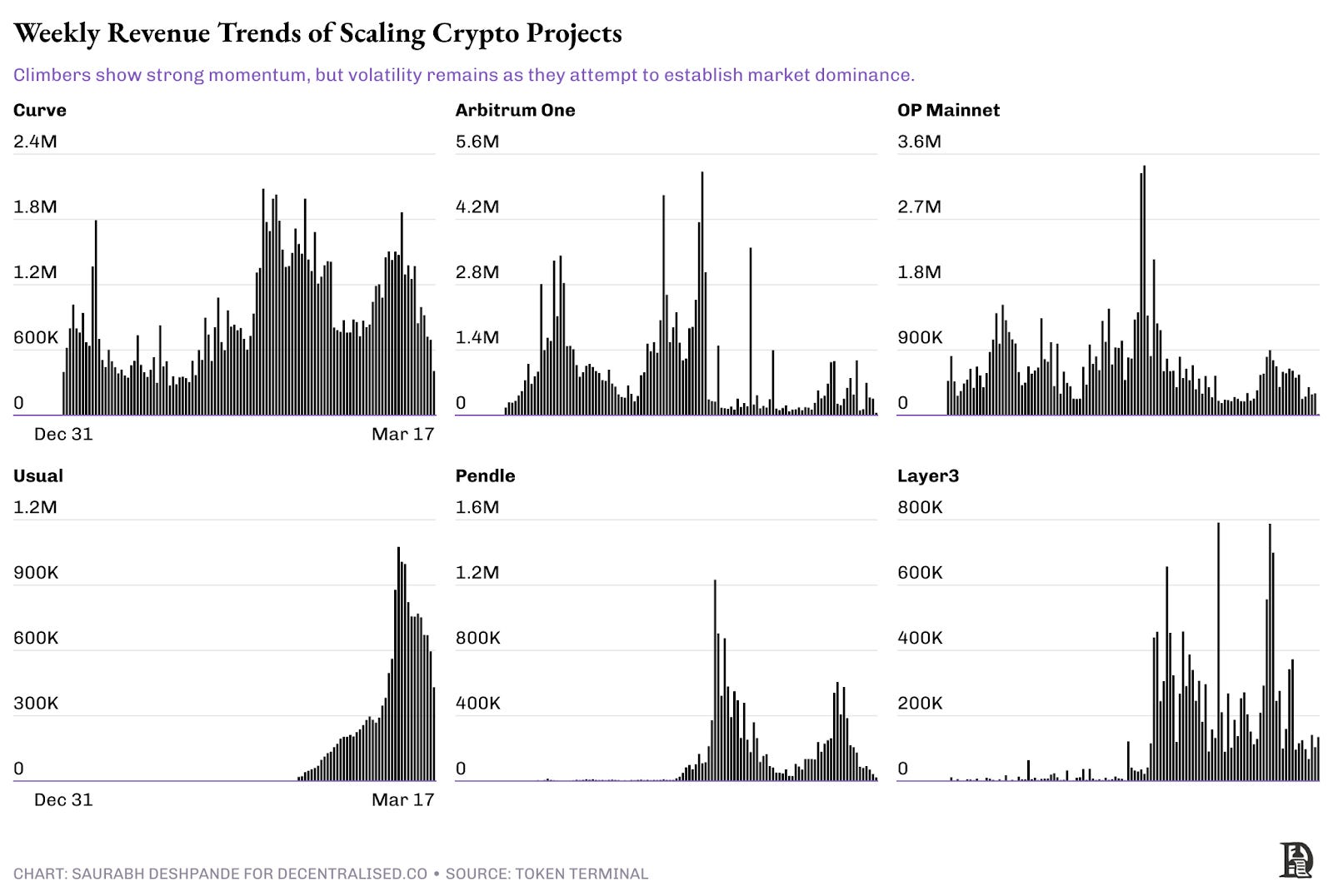

Climbers

Projects that have outgrown the early stage but have not yet become leaders fall into the scaling category ("climbers"). These protocols generate significant revenue — from $10 million to $50 million annually. However, they are still in a growth phase where governance structures are evolving, and reinvestment remains a priority. While some consider revenue distribution mechanisms, they must balance between distribution and continued expansion.

Weekly revenue of scaling crypto projects (Climbers)

Examples: Curve, Arbitrum One, OP Mainnet, Usual, Pendle, Layer3.

The chart above shows the weekly revenue of crypto projects in the "Climbers" category — protocols that have gained traction but are still in the process of solidifying their long-term positions. Unlike early-stage "Explorers," these projects generate significant revenue, but their trajectories remain unstable.

Some, like Curve and Arbitrum One, demonstrate stable revenue streams with noticeable peaks and troughs, indicating fluctuations driven by market cycles and incentives. OP Mainnet follows a similar trend, showing spikes that indicate periods of high demand followed by inevitable slowdowns.

Meanwhile, Usual has shown exponential revenue growth, signaling rapid adoption but lacks historical data to confirm sustained growth. Pendle and Layer3 show sharp spikes in activity, indicating moments of strong user engagement but also revealing the challenge of maintaining momentum over time.

Many Layer-2 rollups (Optimism, Arbitrum), DeFi platforms (GMX, Lido), and new Layer-1s (Avalanche, Sui) fall into this category. According to Token Terminal, only 29 projects currently generate more than $10 million in revenue, although the actual number may be slightly higher. These projects are at a tipping point — those that strengthen their network effects and user retention will move to the next stage, while others may plateau or decline.

For "Climbers," the path forward includes reducing dependence on incentives, strengthening network effects, and proving that revenue growth can be sustainable without sharp pullbacks.

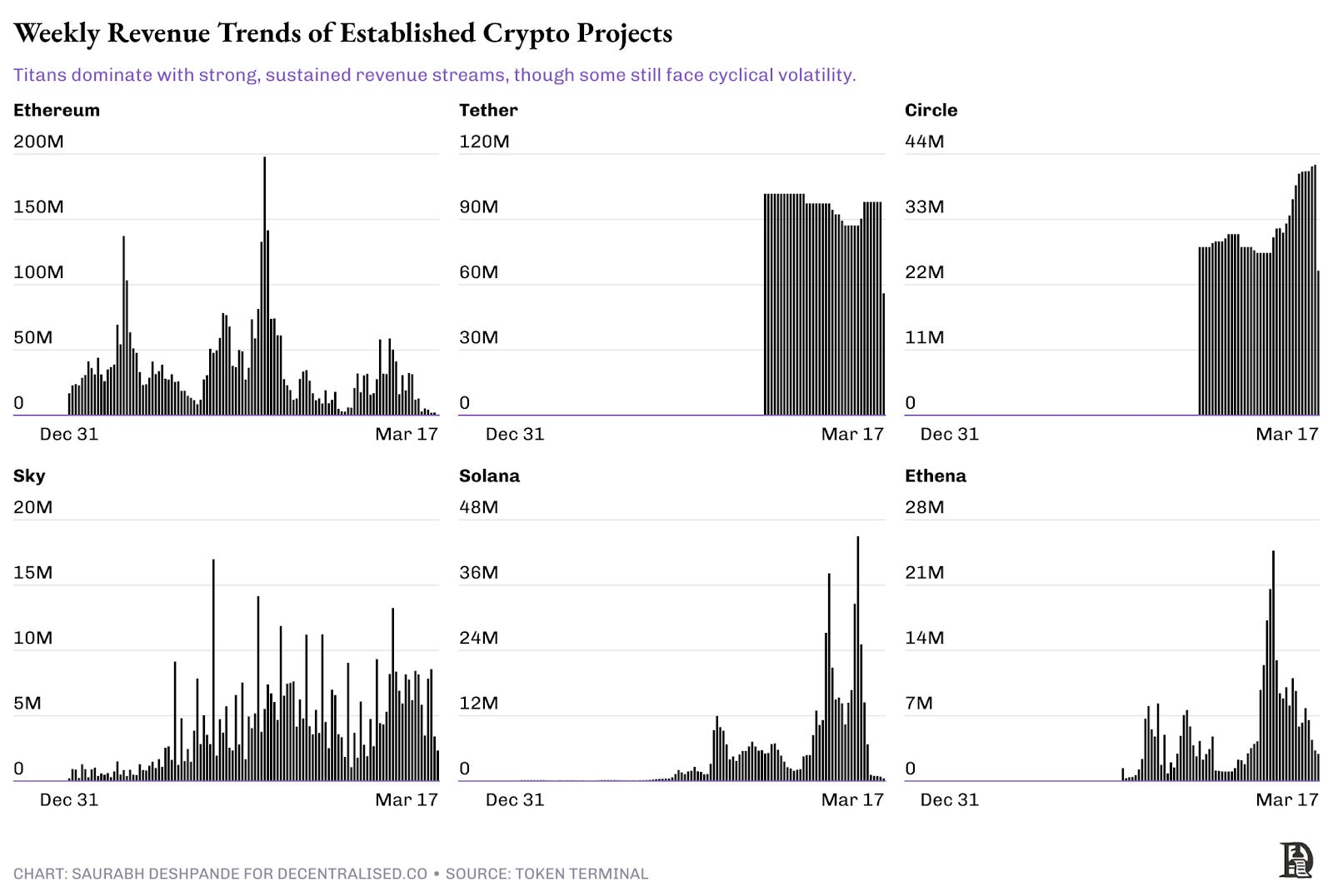

Titans

Established protocols like Uniswap, Aave, and Hyperliquid belong to the growth and maturity category ("titans"). They have achieved product-market fit and generate substantial cash flow. These projects are ready to implement structured buybacks or dividends, reinforcing trust among token holders and ensuring long-term sustainability. Governance is decentralized, with active community involvement in updates and treasury decisions.

Examples: Ethereum, Tether, Circle, Solana, Ethena, Sky.

Network effects provide a competitive advantage, making them difficult to displace. Currently, only a handful of projects generate revenue at this level, meaning very few protocols have reached true maturity.

Unlike early-stage or scaling projects, these protocols do not rely on inflationary incentives in the form of tokens; instead, they derive sustainable income from trading fees, lending interest, or staking fees. Their ability to withstand market cycles further distinguishes them from speculative enterprises.

Unlike early-stage projects and "Climbers," these protocols demonstrate strong network effects, established user bases, and deeper market penetration.

Ethereum continues to lead in generating decentralized revenue, demonstrating cyclical peaks that coincide with periods of high network activity. Tether and Circle, both stablecoin giants, represent a different revenue profile, with more stable and structured income streams rather than volatile spikes. Solana and Ethena, while generating substantial revenue, still exhibit distinct cycles of growth and retraction, reflecting their evolving adoption models.

Meanwhile, Sky (formerly MakerDAO) exhibits more chaotic revenue dynamics, suggesting fluctuating demand rather than consistent dominance.

While "Titans" stand out in scale, they are not immune to volatility. The difference lies in their ability to weather downturns and maintain revenue over time, solidifying their positions as market leaders in the crypto ecosystem.

Seasonal

Some projects experience rapid, unsustainable growth due to hype, incentives, or social trends ("seasonal"). These projects, such as FriendTech and meme assets, can generate substantial revenue during peak cycles but struggle with long-term retention.

Premature revenue distribution schemes can exacerbate volatility, as speculative capital quickly exits once incentives dry up. Governance is often weak or centralized, and ecosystems tend to be shallow, with limited dApp adoption or long-term utility.

While these projects may temporarily reach sky-high valuations, they often crash when market sentiments shift, leaving investors disappointed. Many speculative platforms rely on unsustainable token emissions, wash trading, or inflated yields to create artificial demand. While some evolve beyond this phase, most fail to establish a robust business model, making them inherently risky investments.

Profit Distribution Models of Public Companies

Much can be learned by observing how public companies manage their excess profits.

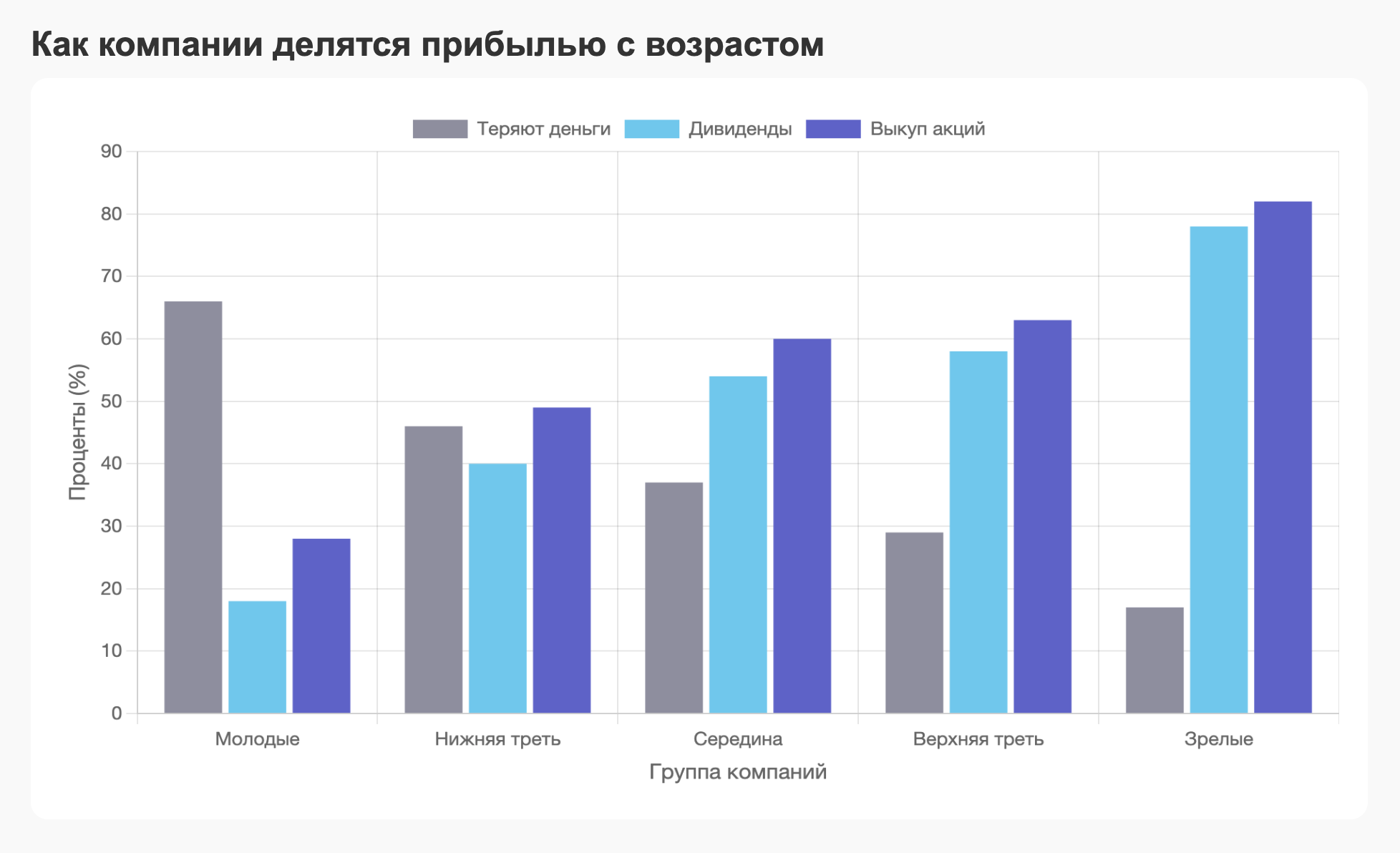

The chart illustrates how traditional companies' behavior regarding profit distribution changes as they mature.

Younger firms (the bottom decile) experience high levels of financial losses (66%), prompting them to retain profits for reinvestment rather than distribute dividends (18%) or conduct stock buybacks (28%).

As firms mature, profitability typically stabilizes, reflected in increased dividend payments and buybacks. Mature companies (the top decile) often distribute profits, with dividends (78%) and buybacks (82%) becoming commonplace.

These trends parallel the life cycle of crypto projects. Similar to young traditional companies, early-stage crypto "Explorers" typically focus on reinvestment to find product-market fit.

In contrast, mature crypto "Titans," akin to old, stable traditional firms, are well-suited for sustainable income distribution through token buybacks or dividends, enhancing investor confidence and long-term viability.

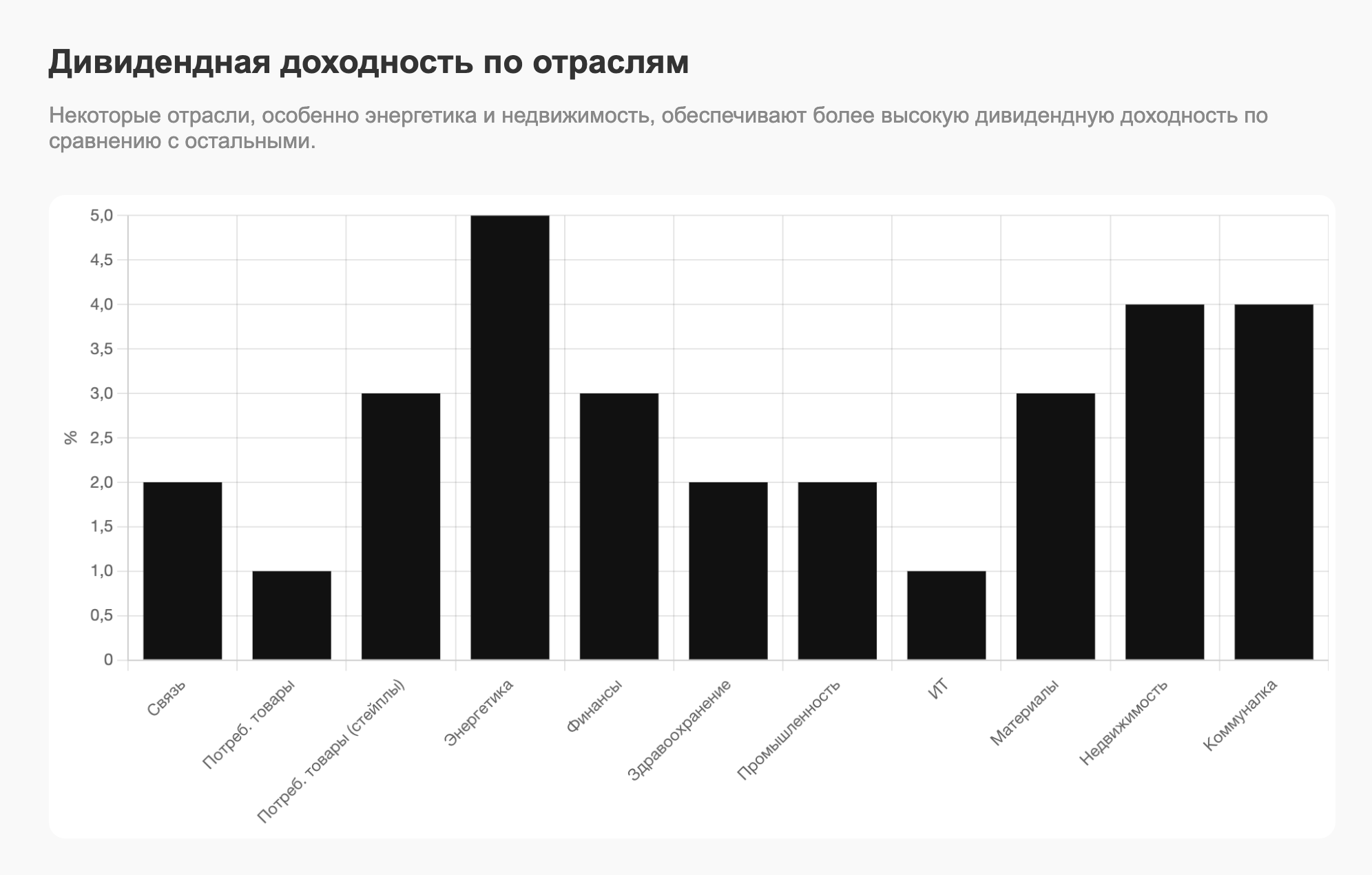

The connection between a company's age and its profit distribution strategy naturally extends to industry practices. While young firms typically prioritize reinvestment, mature firms adjust their strategies according to their industry's characteristics.

Stable sectors with rich cash flows tend to favor predictable dividends, while sectors marked by innovation and volatility prefer the flexibility offered by stock buybacks.

Understanding these nuances helps crypto founders effectively adapt their revenue distribution strategies, aligning their projects' life cycle stages and industry characteristics with investor expectations.

The chart below highlights various profit distribution strategies across industries. Traditional, stable sectors like utilities (80% dividend payers, 21% buybacks) and consumer goods (72% dividend payers, 22% buybacks) clearly prefer dividends due to predictable revenue streams. In contrast, technology sectors like information technology (27% buybacks, highest proportion of cash returned via buybacks at 58%) lean towards buybacks, providing flexibility amid revenue volatility.

These findings have direct relevance to crypto projects. Protocols with stable, predictable revenues — such as stablecoin providers or mature DeFi platforms — may best align with consistent payouts resembling dividends.

Conversely, crypto projects focused on high growth and innovation, especially in DeFi and infrastructure layers, might benefit from flexible token buybacks, reflecting the strategies of traditional tech sectors to adapt to volatility and rapidly changing market conditions.

On Dividends and Buybacks

Both methods have their merits, but recently buybacks have been favored over dividends. Buybacks are more flexible, while dividends are "sticky." Once you announce a dividend of X%, investors expect payment every quarter.

This means buybacks give companies room for strategic maneuvering — not only in how much profit they return but also when they do so, allowing them to adapt to market cycles instead of being locked into rigid payout schedules. Buybacks do not create the same expectations as dividends. They are seen as one-off experiments.

However, buybacks are a way of transferring wealth. It's a zero-sum game. Dividends create value for every shareholder. So there is room for both.

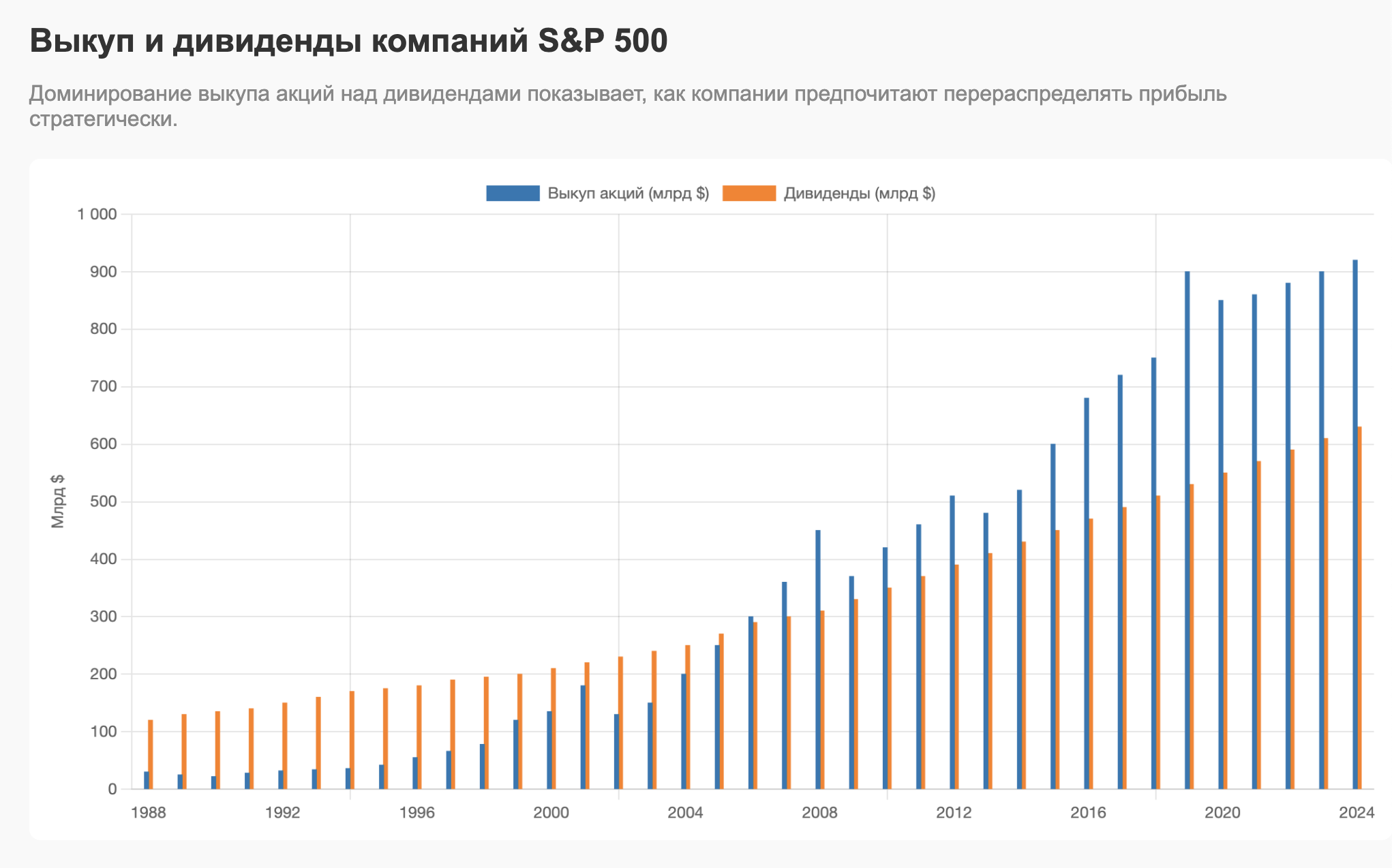

Recent trends show that for the reasons explained above, buybacks are becoming increasingly popular.

In the early 1990s, only ~20% of profits were distributed through buybacks.

By 2024, ~60% of profit distribution occurred through buybacks.

In dollar terms, buybacks surpassed dividends in 1999 and have not relinquished their position since.

From a governance perspective, buybacks require careful valuation assessments to avoid unintended wealth transfer from long-term shareholders to those selling their shares at inflated prices. When a company buys back its shares, it (ideally) assumes they are undervalued. And investors deciding to sell their shares think the shares are overvalued. Both cannot be right simultaneously.

You might think that a company always has more information about its plans than shareholders do. Therefore, those selling shares during a buyback may miss out on the opportunity for greater profits.

According to a Harvard Law School article, current disclosure practices are often untimely, complicating shareholders' ability to assess buyback progress and maintain their proportional ownership stake.

Moreover, buybacks can impact executive compensation when tied to metrics like earnings per share, potentially incentivizing executives to prioritize short-term stock performance over sustainable, long-term growth.

Despite these governance issues, buybacks remain attractive for many firms, particularly American tech companies. This is due to their operational flexibility, autonomy in investment decision-making, and minimal future expectations compared to dividends.

Generating and Distributing Revenue in Crypto

Token Terminal claims that 27 projects in crypto generate $1 million in monthly revenue.

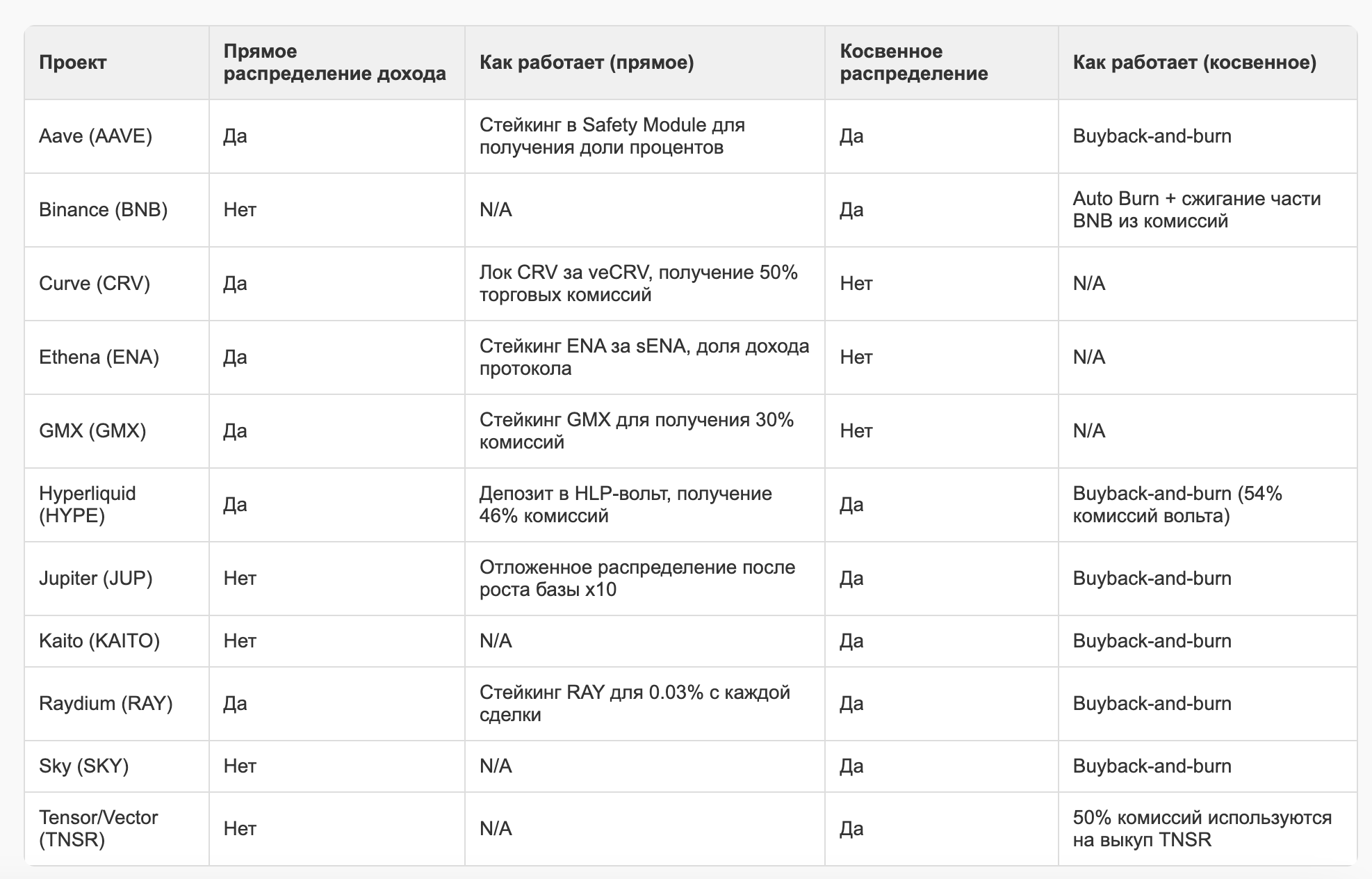

This data is incomplete as it misses projects like PumpFun, BullX, and others. But I don't think they are significantly off. I examined 10 of these projects to understand what they do with their revenue. The crux is that most crypto projects shouldn't even think about distributing revenue or profits to token holders. I appreciate the clear communication from Jupiter in this regard.

At the time of the token announcement, they made it clear that they did not plan to share direct revenue (like dividends) at that stage. Only after increasing the user base more than tenfold, Jupiter initiates a mechanism similar to a buyback to distribute value to token holders.

Crypto projects need to rethink how they share value with token holders, drawing inspiration from traditional corporate practices but uniquely adapting their approaches to avoid regulatory scrutiny.

Unlike stocks, tokens provide innovative opportunities for integration directly into the product ecosystem. Instead of merely distributing revenue for holding tokens, projects actively incentivize key actions within the ecosystem.

For instance, long before initiating buybacks, Aave rewarded stakers of tokens providing necessary backstop liquidity.

Similarly, Hyperliquid strategically allocates 46% of its revenue among liquidity providers — mirroring traditional consumer loyalty models in established businesses.

Apart from these token-integrated strategies, some projects employ more direct revenue distribution methods reminiscent of traditional public company practices. However, even direct revenue distribution models must act cautiously to avoid classification as securities, maintaining a delicate balance between rewarding token holders and complying with regulations. Projects based outside the U.S., like Hyperliquid, often have more freedom to adopt clearer revenue distribution practices.

Jupiter is a good example of more creative value distribution. They do not conduct traditional buybacks. Instead, they utilize Litterbox Trust, a third-party organization that programmatically receives JUP tokens along with half of Jupiter's protocol revenues.

It has accumulated ~18 million JUP, valued at approximately $9.7 million as of March 26. This mechanism directly links token holders with the project's success while notably avoiding regulatory consequences associated with traditional buybacks.

Remember that Jupiter took the path of returning value to token holders only after establishing a very reliable stablecoin treasury capable of sustaining the project for several years.

The rationale for allocating 50% of revenue to this accumulation plan is simple. Jupiter follows a guiding principle that equally distributes ownership between the team and the community, fostering clear alignment and shared incentives. This approach also encourages token holders to actively promote the protocol, directly linking their financial interests with the growth and success of the product.

Aave has also recently initiated token buybacks following a structured governance process. The protocol, supported by a healthy treasury of over $95 million (excluding its own tokens), began its buyback program after a detailed governance proposal in early 2025. This initiative, called "Buy and Distribute," allocates $1 million weekly for buybacks initiated after extensive community discussions regarding tokenomics, treasury governance, and token price stabilization. The growth of Aave's treasury and financial stability made this initiative possible without compromising operational capabilities.

Hyperliquid uses 54% of its revenue for HYPE token buybacks and utilizes the remaining 46% to incentivize liquidity on the exchange. The buyback is conducted through the Hyperliquid Assistance Fund. Since the start of the program, the assistance fund has bought back over 18 million HYPE. The value exceeds $250 million as of March 26.

Hyperliquid stands out as a unique case — its team has operated without venture funding, likely bootstrapped the project and now directs 100% of revenue either towards rewarding liquidity providers or buying back tokens. Replicating this may not be easy for every team. But both Jupiter and Aave demonstrate a key aspect: they are financially resilient enough to conduct token buybacks without jeopardizing their core operations, reflecting disciplined financial management and strategic understanding. This is something every project can emulate. First — runway, then — buybacks or dividends.

Tokens as a Product

Kyle makes a great point about the need for investor relations (IR) roles in crypto projects. For an industry built on transparency, crypto projects ironically do not provide clear visibility into their operations.

Much of the communication occurs through sporadic announcements in Discord or threads on Twitter, with financial metrics selectively published and expenses largely opaque.

When a token's price continuously drops, users quickly lose interest in the underlying product unless it has created significant competitive advantages. This creates a vicious cycle: falling prices lead to reduced interest, which further pressures prices. Projects need to give token holders compelling reasons to hold onto their positions and those without them reasons to buy. Clear, consistent communication about development progress and fund usage can itself become a competitive advantage in today's market.

In traditional markets, IR functions as a bridge between companies and investors through regular earnings reports, conference calls with analysts, and future forecasts. Crypto can adapt this model using its unique technological advantages. Regular quarterly reporting on revenue, operating expenses, and development milestones combined with on-chain verification of treasury movements and buybacks would significantly enhance stakeholder trust.

The biggest gap in transparency is expenses. Disclosure of team compensation, expense breakdowns, and grant allocations will prevent questions that arise only when a project collapses: "Where did the ICO money go?" and "How much are the founders paying themselves?"

Strong IR practices offer strategic advantages beyond mere transparency. They reduce volatility by decreasing information asymmetry, expand the investor base by making institutional capital accessible, cultivate long-term holders who understand operations well enough to maintain positions during market cycles, and build community trust that supports projects during tough times.

Progressive projects like Kaito, Uniswap Labs, and Sky (fka MakerDAO) are already moving in this direction with regular transparent reporting. As Joel notes in his articles, crypto must evolve beyond its speculative cycles. By adopting professional IR practices, projects can shed their reputation as "casinos" and become "compounders," as Kyle sees them — assets delivering sustainable value over the long term.

In a market where capital becomes increasingly discerning, transparent communication will become essential for survival.