How to Trade Cryptocurrencies for Beginners: Strategies and Useful Links

Trading cryptocurrencies means making a profit from the process of speculating on cryptocurrencies. Usually, cryptocurrency exchanges are used for this purpose.

If you are a beginner, you probably have in mind the thought of incredible x's (multiplying money) and super profits. There is nothing wrong with that; the motivation for 80-90% of people joining the crypto community is precisely instant income. But these are the realities: 95% of those who come here lose their enthusiasm and a lot of money, leaving the market without ever having earned anything.

This article is part of an introductory series of materials on trading cryptocurrencies:

- How to quickly buy cryptocurrency: simple ways

- TOP-15 Mistakes of Beginner Traders

- Where to store cryptocurrency? Choosing a crypto wallet

- Where to trade cryptocurrency? Choosing a cryptocurrency exchange

- Simplifying the trading process. A list of verified services

It should be noted that trading on the cryptocurrency market, just like trading on the traditional stock market, is associated with tedious work, significant efforts, and high risks.

However, there is good news: despite the fact that many associate speculation in the market and forecasting prices with a lottery, there is a huge difference in the probability of suffering a loss and going into the red (losing money). Trading in the market has greater risk control; if in a lottery or sports betting you lose your deposit outright in case of failure, here you always keep your losses in focus with the help of stop-losses.

Simply put, you cannot buy bitcoin for $1000 and completely lose that amount. This will only happen in the case of complete devaluation of the cryptocurrency. The probability of such an outcome is incredibly low.

Let's start with the basics: in order to grasp the substance called the crypto market, understand its laws and how it works, we need to start from the ground up and define the main concepts.

Glossary of Terms in Cryptocurrency Trading

Below is a list of terms that you are likely to encounter on the educational path leading to understanding exchange trading of digital currencies.

Bitcoin - The main and first cryptocurrency. Detailed overview of Bitcoin.

Altcoins - From the word alternative coins, alternatives to Bitcoin. Any cryptocurrency that is not Bitcoin is an altcoin.

Cryptocurrency Exchange - A platform for executing trades, specifically buying/selling cryptocurrencies.

Terminal - A page on the exchange through which trades are directly executed.

Exchange Service - A platform that allows exchanging (converting) one type of currency for another. In our case, it will be useful for topping up the exchange balance.

Order - In direct translation, it means a request. Exchanges operate on the principle of placing orders from one trader to another for the purchase or sale of an asset. That is, when we buy, the actual purchase process occurs after our order is fulfilled when a buyer or seller is found for us.

Bulls - A type of trader who earns by the traditional scheme "buy low - sell high." Analogous to bulls pushing the price up with their "horns."

Bears - Opponents of bulls, their main activity on the exchange is short selling. Bears earn by selling an asset as collateral with the possibility of repurchase at a lower price.

Types of Cryptocurrency Trading

Any new player starting to work with cryptocurrencies needs to know about several types of trading in the crypto market. There are 3 main types, each implying work with exchanges of certain categories. So, the 3 types are:

- Margin trading of cryptocurrencies

- Standard trading of altcoins and Bitcoin

- Participation in IEO and ICO

Let's briefly touch on each of them.

Margin trading - Trading with leverage and borrowed funds from exchanges. Trading an amount exceeding $1000 can actually require only a tenth of that amount. The leading exchange with this functionality is Bitmex. More details about the exchange and margin trading principles we wrote here.

Standard trading of altcoins - Classic trading similar to regular speculation "buy low - sell high." The leading exchange is the aforementioned Binance.

Step-by-Step Trading Guide for Beginners

This section will be dedicated to a brief introductory course for beginners wishing to engage in trading on cryptocurrency exchanges. The instruction is step-by-step and will briefly outline the algorithm for trading cryptocurrencies on the exchange. It is worth noting that if you are simply a staunch supporter of any technical innovation, you do not necessarily have to resort to working with exchanges. In other words, if you are confident in the growth of a particular asset (cryptocurrency) in the future and plan to acquire it, it is easier to do so using regular cryptocurrency wallets. For example, MyEtherWallet (Wallets for ERC-20 tokens).

If your goal is to earn from speculative actions, then welcome to the exchange; first, we need to decide on the choice of platform, and we have a comparative review of exchanges for this.

Next, the general principle of working with an exchange, regardless of which one you choose, boils down to a few steps:

- Registration on a cryptocurrency exchange. A suitable option for beginners would be - Binance (link to the review)

The best exchange can be chosen from our analysis of popular exchanges - link - Setting up authentication (linking email, adding 2FA, filling out personal information, and sometimes sending photos)

- Activating the account

- Topping up the exchange balance

- Going to the trading terminal (analysis below)

If the first 4 points are clear, what about topping up the account on the exchange, considering that exchanges, except for a few, do not work with rubles?

How to Top Up Your Balance on the Exchange

The whole problem is that, as we mentioned, the most popular exchanges like Binance, Bitfinex, Bittrex, and many others simply do not accept Qiwi, Yandex Money, or even card payments, which means we will face difficulties from the first contact with the exchange. Exchange services come to the rescue.

An exchange service allows you to exchange your rubles for any popular cryptocurrency. That is, we send them rubles, and they send us digital money to our account on the exchange.

We won't go far; let's analyze it using the first available exchange service as an example.

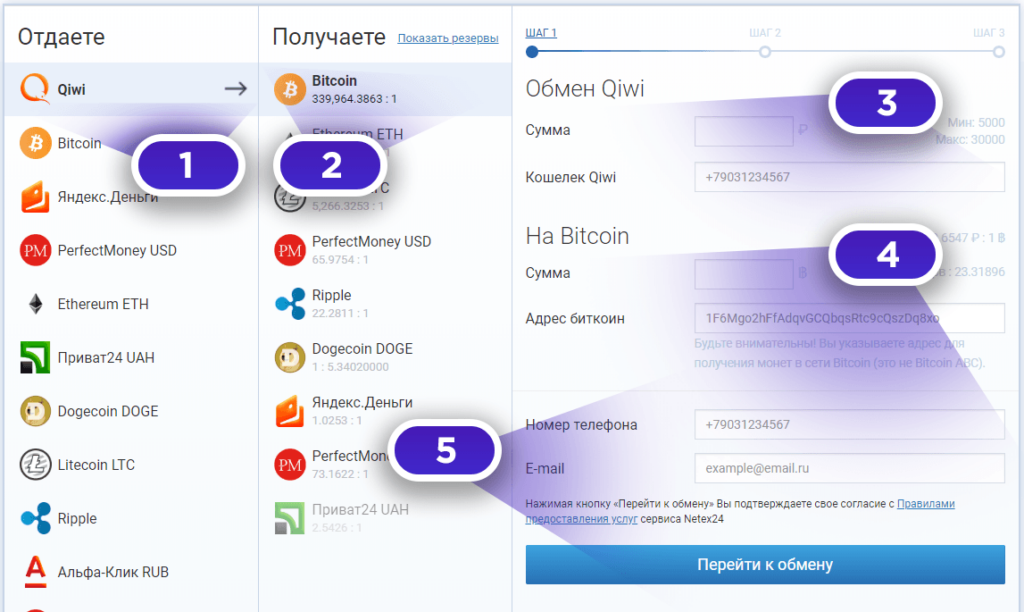

As you can see, we chose the payment system Qiwi (1) as the exchange currency and are trying to exchange it for Bitcoin (2), which will be credited to the exchange account whose address we will specify in point (4). In point 3, we indicate how much and from which Qiwi number the funds will be transferred for exchange. The last thing to fill out is your contact details, where information about the status of your procedure will be sent.

Which Exchange Service to Choose

To choose a quality exchange service and be sure that your funds will reach their destination, we will use a popular rating of exchange services - https://www.bestchange.com

Recently, its Russian version was blocked during one of Roskomnadzor's raids, so we have to settle for the English version. But everything is clear without that.

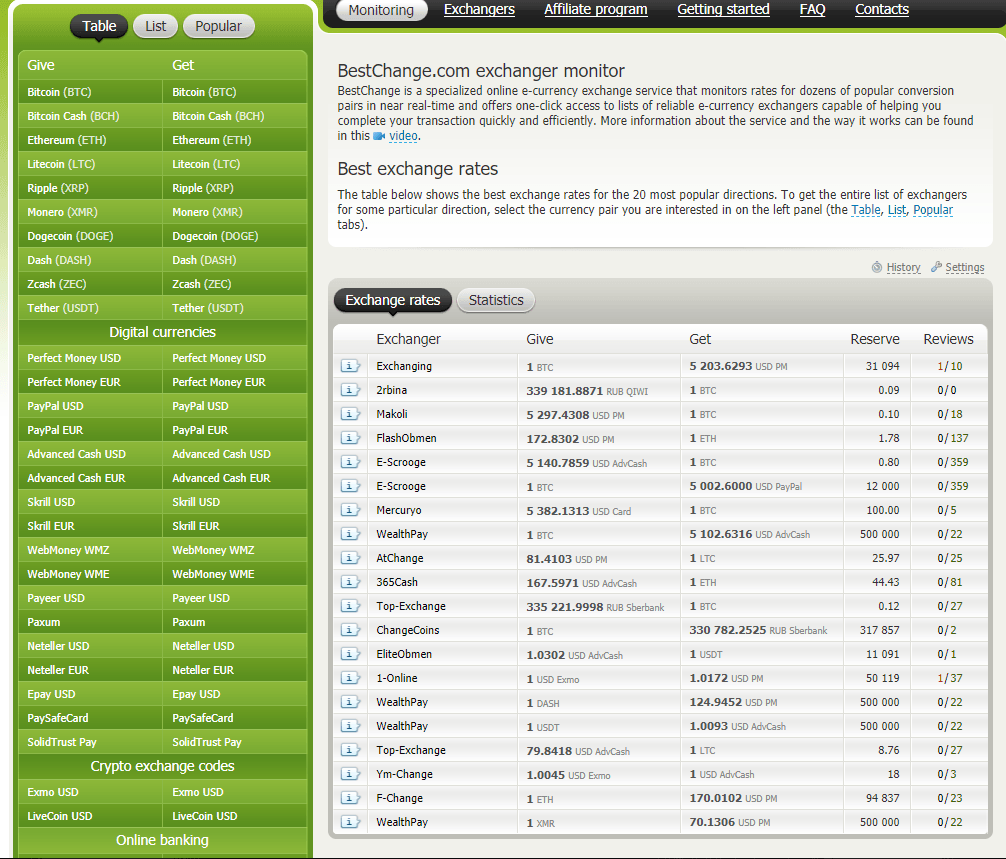

In the green window, we select what we want to exchange and what we want to receive. On the right, a list of all available exchange services appears. There is also information about their limits, exchange rates (exchange services earn on commissions), reserves, and the number of positive/negative reviews.

When choosing the right exchange service, focus on those that are at the top of the list. By default, the rating is sorted by commission size, so it's enough to choose a crypto exchange service with a large number of positive reviews at the very beginning of the list.

How to Trade Cryptocurrencies on the Exchange

We will elaborate a bit more on the fifth point and explain the basics that will be useful for making your first trade and finally transitioning from simple trading to profitable cryptocurrency trading.

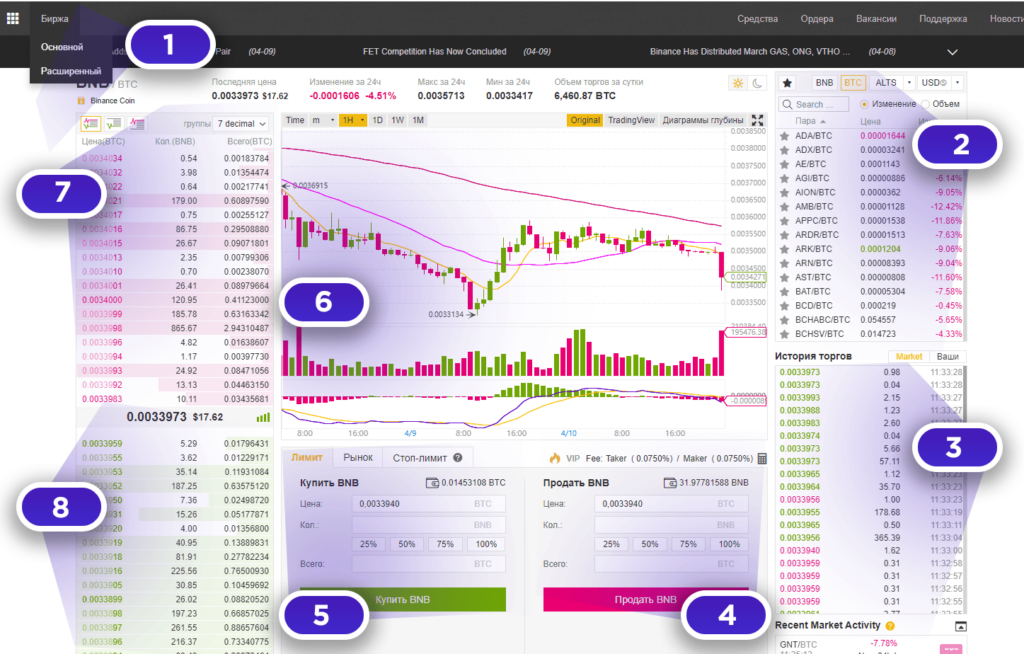

Looking at the screenshot below, we see the Binance exchange terminal. It's from Binance because other cryptocurrency exchanges operate on the same principle; they differ in window sizes, colors, layout - but the logic is the same. The exchange has two terminals: Basic (with minimal functionality) and Advanced (for more experienced users, with a brutally dark interface. If friends come over to your house, you can turn it on to look like a more serious trader).

We won't dwell on every point in detail; we'll cover what is necessary for your first acquaintance.

- A link to access the terminal

- A window necessary for selecting a specific cryptocurrency

- A list of already completed trades by all traders currently trading on the exchange

- A window for selling the cryptocurrency you have selected (if you bought it earlier).

- Price - Selling price

- Qty - Quantity (you can specify a fractional value. You can use percentage buttons that will automatically select the required portion of funds from your account)

- Total - In this field, we see how much money will be spent on purchasing cryptocurrency overall. (In our case, how many bitcoins will be spent on buying the specified amount of BNB at the indicated price)

- Sell button - Direct placement of the order

- A window for buying the selected asset. (I will describe what limit, market, stop-limit mean later)

- Price - Purchase price per unit

- Qty - Quantity of the asset being purchased at the specified price

- Percentage as in the sales window

- Total - How much will be paid in total (in our case, bitcoins) for the specified amount at the desired price

- The main chart displaying price movement, red and green bars - candles indicating price changes over a certain period (at the top corner 1h means 1 candle = 1 hour)

- Order queue for selling

- Order queue for buying

When trading, you always use a trading pair of cryptocurrencies for the exchange. That is, besides the fact that you have already exchanged your real rubles for Bitcoin through an exchange service and sent them directly to the exchange, on the platform itself you buy cryptocurrencies with Bitcoin. In the screenshot, it is visible that all assets are available for trading in pairs with BTC. If it's Ethereum, then ETH/BTC; if it's, for example, Via Coin, then VIA/BTC.

Automated Cryptocurrency Trading via Bots

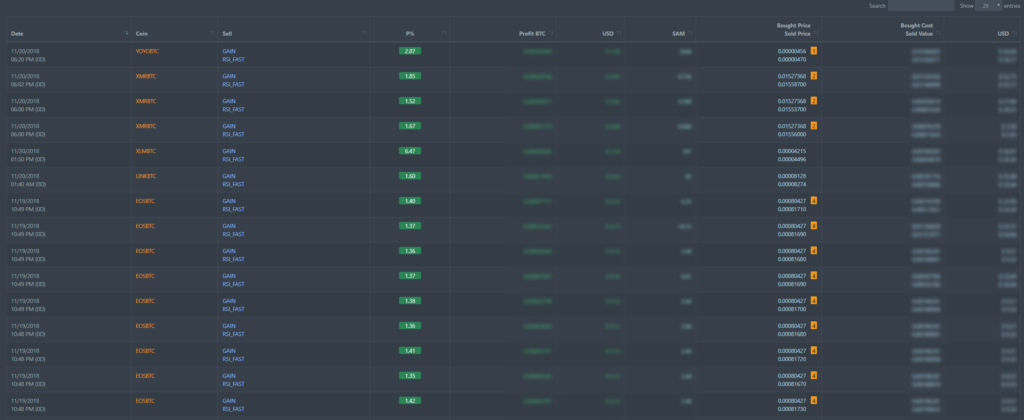

Often, Telegram bots are used for automated trading, detailed review available at the link. Since the time when trading on the stock market involved working with paper charts, an entire era has passed, and now not only are there many services and tools that facilitate the work of an ordinary trader, but there is also the possibility of employing trading bots in Telegram that will open and close trades automatically.

The principle is simple: a specially designed bot is programmed with a certain algorithm that performs specific actions upon reaching certain events. Often, these are specific patterns reflected through indicator values, among which may be RSI, MACD, Ichimoku, and many others.

Trading bots are mainly divided into two types:

- Regular trading bots - With pre-installed information on closing and opening trades based on indicators

- Arbitrage trading bots - Bots that open trades upon detecting a profitable price difference for an asset between exchanges.

Note: In most cases, working with bots requires trading skills at the level of an average trader and often programming skills.

The most common developer of trading bots is 3commas; below is a video tutorial that allows you to quickly set up your own trading bot:

Differences Between Cryptocurrency and Stock Markets

Remember one thing: the market is incredibly dependent on external events. When we talk about the crypto market, every project that has survived its ICO and reached the point where its cryptocurrency is now traded on exchanges always has its own news and announcements that lead to price spikes for their assets.

Moreover, a trend has been noticed that from time to time the market reacts differently to certain types of announcements. For example, about a year ago, almost any exchange announcing the listing of a new cryptocurrency would "pump" its price by at least 20%.

On the chart with a 1-day timeframe, you can see how the price of OmiseGO cryptocurrency changed in the trading pair with Bitcoin after the announcement from Bithumb. By the way, two green candles (the first of which has a long shadow) can be seen at the foot of the announcement; they indicate suspicious volume increases before such an event. There is a possibility that there were people who had information about the listing days before the event.

What Else Influences Cryptocurrency Prices

After analyzing hundreds of news articles and impulses on charts, several types of announcements from projects have been identified that lead to increased volatility of an asset. It should be noted that this list is characteristic solely for the crypto market; no other exists.

| Event | Impact |

| Conducting an ICO on Binance Launchpad | ⭐️⭐️⭐️⭐️⭐️ |

| Competition from Binance | ⭐️⭐️⭐️⭐️⭐️ |

| Listing on a major exchange | ⭐️⭐️⭐️⭐️ |

| Mainnet release | ⭐️⭐️⭐️ |

| Wallet release and similar announcements | ⭐️⭐️ |

| Partnership announcement | ⭐️⭐️ |

| Airdrop | ⭐️⭐️ |

Let’s clarify each point:

- IEO on Launchpad - A launchpad is a brand new project from the well-known exchange serving as a platform for conducting ICOs - simply put, the initial release of tokens on exchanges. Earning from this event is challenging, but the result will be worth it. In 2019, three major ICOs took place: Fetch, Bittorrent, and recently launched CELR. We will discuss the workings of launchpads later.

- Binance Competition - Traditional competitions held by Binance since its inception. Usually, these are competitions based on trading volumes over a certain period. An announcement appears in official sources about the start of competitions for maximum traded volumes on a specific cryptocurrency; the winner at the end of the competition shares a pre-allocated monetary pool equivalent to the cryptocurrency being traded. You can follow such events in Binance chats or on Twitter.

- About Listings - We discussed this earlier; it is worth adding that lately, adding coins to platforms brings less and less benefit, although if you monitor a project, predicting the addition of a coin to one exchange or another is quite feasible. For example, ICOs of major projects inherently imply listings on other exchanges; it is hard to imagine a new project's ICO being ignored by exchanges like Bithumb.

Where to Find News for Cryptocurrency Trading

In general terms, a trader in the eyes of an ordinary person is someone sitting at a computer looking at several monitors simultaneously, filled with numerous charts and media feeds, which is important. In reality, the picture looks almost like that; the only thing is that if you rely solely on media, nothing fruitful will come of it. Practice shows that news feeds absorbing news from primary sources serve purely informational purposes and are useful for understanding the general background and mood of the market.

So where to get news from primary sources? Simply from the primary sources themselves. Overall, there are few analysts in the crypto industry who trade considering both technical and fundamental aspects, but those who look at an asset from "both sides of the coin" gather news about it from official sources. Often, Twitter, Medium, official Telegram chats (links to them are published on the main site where rumors and emerging news are discussed), and announcements from the main site are sufficient.

Rarely, but sometimes leaks occur that can be utilized. It is clear that there will be no information regarding this in official representative sources, which is why the price remains stable for some time.

To keep your finger on the pulse of passing rumors and announcements, it is enough to have a good set of sources that inform about everything happening in the crypto environment.

Twitter Accounts and Blogs About Cryptocurrency

There is no sense in relying on Russian-language sources since "the main action happens abroad," and all Russian accounts, including crypto media, simply translate information into our language. Below is a set of Twitter accounts that can be used for obtaining timely insights.

- https://twitter.com/CarpeNoctom (Facts, news, analytics)

- https://twitter.com/crypto_rand (Technical analysis, patterns, signals)

- https://twitter.com/CryptoBoomNews (Interesting facts from the industry, coverage of important news events)

- https://twitter.com/SalsaTekila (Twitter account with ideas for technical market analysis for margin trading XBT)

Foreign Telegram Channels About Cryptocurrencies

Among Telegram channels, aside from the noise that blindly duplicates media, there are good foreign groups that search for and publish insights from primary sources. These include:

- https://t.me/altzsignalz (Specific signals for the crypto market, alerts about their activation)

- https://t.me/tradingcryptoex (Coverage of only vital news from media)

- https://t.me/cointrad (Technical market analysis, publication of specific entry signals)

- https://t.me/cryptonekoz411 (Complete overview of cryptocurrency prices supported by videos)

- https://t.me/coin_listing (Informing about fresh listings on crypto exchanges)

Services and Auxiliary Resources for Data Collection

The internet is also full of various services that not only help promptly obtain information from primary sources but also provide other technical data about cryptocurrencies.

- https://blocktivity.info (Data on the activity of different blockchains, number of transactions per day, network load)

- https://cryptopanic.com (Aggregator of news from media with data on audience reactions to news. It helps distinguish hype news from fundamentally useful ones)

- https://www.coingecko.com/en (Popular cryptocurrency ranking containing historical data on prices in any quote)

Once we have learned how to work with an exchange, we can move on to trading and specific strategies. The first problem faced by a novice who has just opened an exchange is whether there are strategies for trading cryptocurrencies.

The most optimal and easiest to understand is trend trading.

Above in the chart, you can observe an upward trend for one of the assets we have been examining, for which we recently published a ready trading signal in our Telegram channel.

Here you can see a clear pattern in the form of price reaching certain values through which we can draw a trend line (blue). At moments of touching the lines, you can notice two additional patterns:

- According to MACD (the moving averages chart below the main chart), two moving averages form bullish crosses (highlighted with green rectangles)

- The RSI values (oscillator under the MACD chart) show minimum values precisely at the moments of "touching" the trend line.

From this, we can conclude that upon reaching our blue line again, the chart is more likely to go higher. This means that at this point, it will be the best entry point for a trade.