What is DeFi – Understanding through examples of decentralized cryptocurrencies

Decentralized finance (DeFi) is an alternative to the traditional financial system. The successes and challenges of this direction are almost impossible to separate from the crypto and blockchain sectors, which also provide new solutions for a fiat-oriented world. The combination of DeFi developments can be represented in the format of crypto-economics. We invite you to explore four key questions that can reveal the features of the decentralized finance concept.

What is DeFi?

DeFi — is a type of financial systems based on blockchain and smart contracts. Its feature is the presence of tools that completely eliminate intermediaries. The system implies operation based on the concept of open finance. The latter is based on the principles of decentralization. As a result, the optimal tool for forming DeFi systems has become blockchain. The technology can guarantee data immutability, bypassing the need to ensure trust between parties.

Thus, DeFi systems can be called a financial product built on blockchain. The concept can guarantee the protection of user interests and access to bypass potential blockages from regulatory authorities. Working with DeFi can be implemented in an international format.

The concept opens access to full control over one's accounts. The likelihood of pressure from third parties, including intermediaries, is absent. The communication tool between participants in the decentralized finance system is smart contracts. The latter expand the scope of possible applications of blockchain due to a high level of automation. Operating within the framework of this class of systems makes the financial network more independent, reducing the need to involve users in transactions.

The combination of DeFi capabilities has allowed the concept to begin the process of establishing itself in various sectors of the financial market. In particular, developments have found application in the field of lending.

What is DeFi for?

Cryptocurrencies are just one component of the DeFi direction, thanks to which it is possible to create truly transparent and profitable financial products within the framework of the concept. Digital assets simplify the process of conducting transactions. Despite the decentralized nature of cryptocurrencies, many centralized projects operate in the blockchain space. The latter are also related to controlling the inflow and outflow of digital assets.

An example of centralized companies in the crypto space includes many popular digital asset exchanges, including Binance. Trading platforms effectively act as gateways to the market. Against the backdrop of the decentralized foundation of cryptocurrencies, centralized platforms do not allow for the full potential of digital asset systems to be realized.

DeFi sector solutions can eliminate the problems of increased centralization faced by crypto projects. For mass adoption, the concept must be deployed within an organized crypto economy.

DeFi cryptocurrencies

Today, decentralized cryptocurrencies based on DeFi are particularly popular. However, just like during the hype era of initial coin offerings (ICO), projects that offer a specific product are especially promising. Let's talk about such:

Uniswap Exchange and UNI Token

First of all, Uniswap is a protocol that allows exchanging ERC-20 tokens. Any user of the blockchain network has the opportunity to exchange cryptocurrency without undergoing verifications. Also, other users acting as liquidity providers can earn a percentage from facilitating financial transactions. Uniswap has high growth rates, as the system includes some oracle that provides a weighted average price for assets without fluctuations. The UNI cryptocurrency grants voting rights to its holders within the blockchain network. A key role in the operation of the Uniswap exchange is given to decentralization.

Trust Wallet and TWT Token

Back in 2018, the cryptocurrency exchange Binance set a course for decentralization. Its first steps in this area were associated with Binance Chain - an internal blockchain. Its goal was to bring new tokens to the market and facilitate trading between them. Later, Binance Chain was used for the release of a decentralized exchange, now known as Binance DEX. According to the creators, the decentralized version of the exchange was supposed to inherit the best features of its centralized counterpart. The next product in the DeFi space was the Trust Wallet cryptocurrency wallet, used for storing ERC-20 tokens and also considered decentralized. In March 2020, information emerged that the wallet would have its own token - Trust Wallet Token. According to the developers, the cryptocurrency will be used to reward active users. Additionally, it will grant its holders preferential voting rights. Thus, investors in the TWT token will be able to influence the future of the project.

We wrote a detailed review of the TWT cryptocurrency.

Differences Between Centralized and Decentralized Finance

Unlike the centralized financial system, the high level of automation of DeFi solutions allows for the elimination of a large number of errors related to the human factor. Work in this format can be built on open-source applications. Ethereum can be considered as a base for programs.

The system is flexible. Users of decentralized finance networks have access to a wide range of settings. The system remains autonomous. If necessary, components of DeFi networks can be combined to form new projects.

Existing DeFi Projects

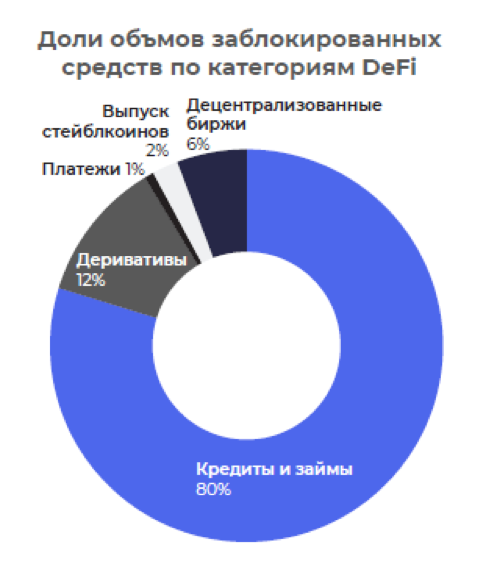

There are many viable DeFi projects. The decentralized finance sector includes the following areas:

- Lending platforms. Example: MakerDAO project — the platform issues loans in cryptocurrency Ethereum secured by the stablecoin DAi

- Stablecoins. An example can be the stablecoin of the mentioned MakerDAO project - DAi

- Decentralized exchanges. Example: IDEX exchange — a decentralized exchange on DeFi using smart contracts based on Ethereum.

- Asset management

- Prediction markets

- Identification and verification

- Marketplaces

- Derivatives

- Insurance

- Lending

- Tokenization of assets

- Decentralized exchanges

- Infrastructure

Stablecoins built on DeFi demonstrate a high level of resilience against various restrictions.

Additionally, DeFi solutions can serve as the basis for building decentralized exchanges for digital assets. The latter already exist. However, unlike their centralized counterparts, platforms of this type remain extremely "clunky" and under-functional. The flexibility of DeFi solutions can eliminate this problem.

The high level of automation of developments in the decentralized finance sector can be used to build a wide variety of platforms: from logistics platforms where data needs to be matched, to investment projects.

Conclusion

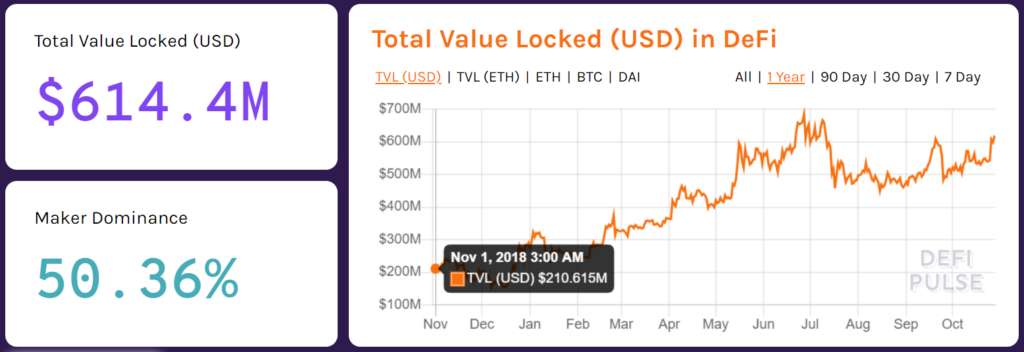

The unique opportunities of DeFi have made the concept an important component of the crypto economy. The great interest in the technologies of this sector confirms that new solutions will sooner or later displace traditional financial systems from the market.