6 0

21Shares Launches SOL ETF Amid Solana Price Decline to $134

- Solana's price fell by 4% to $134, influenced by market turbulence despite the launch of 21Shares' SOL ETF (TSOL) on CBOE.

- 21Shares confirmed the TSOL listing, allowing investors access through banks and brokerages.

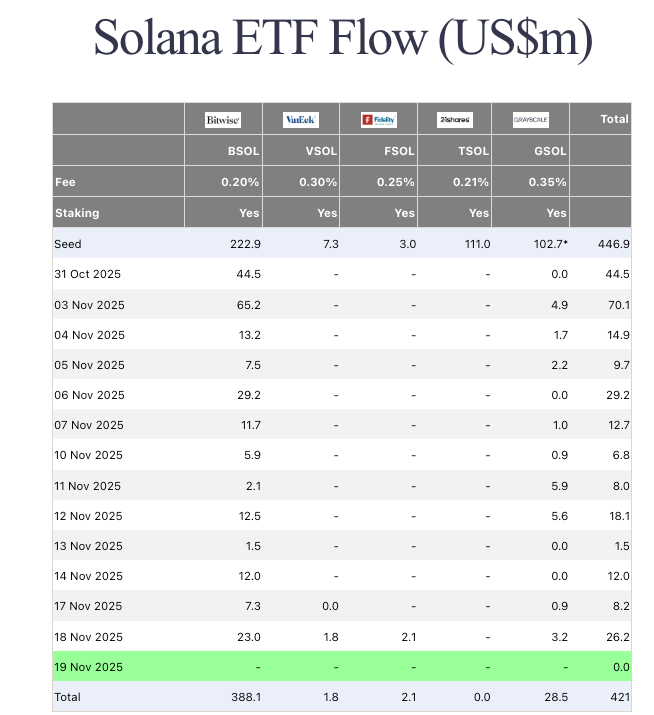

- Active Solana ETFs have shown positive performance since Oct. 28, collectively holding $421 million in SOL.

- Bitwise leads with $388.1 million in BSOL, followed by smaller holdings from VanEck, Fidelity, and Grayscale.

- 21Shares launched TSOL with a $111 million seed fund; all active Solana ETFs are staking-enabled, offering yield income to investors.

- Solana's staking offers up to 6.3% APY, with an increase in staking ratio to 67.3%.

- Solana's price forecast shows SOL at $133.88, within a downtrend and below Bollinger Bands mid-line, indicating bearish pressure.

- The lower Bollinger Band is at $123.99, serving as potential support if selling continues.

- RSI at 35.93 suggests weakening bearish momentum, but recovery signals need RSI above 40.

- A price drop toward $124 is possible if sentiment worsens, while a bounce could lead SOL to $145.

- SUBBD presale exceeded $1.4 million, nearing its $1.5 million target, amid interest due to Solana's resilience and new ETF demand.

- SUBBD integrates AI and creator monetization, offering tokens priced at $0.057 each.