6 0

BULLISH 📈 : 21Shares predicts XRP growth with ETF-driven demand by 2026

21Shares projects a shift in XRP's valuation dynamics by 2026, moving away from litigation impacts towards ETF-driven demand and on-ledger adoption.

- XRP's valuation is expected to be anchored in institutional fundamentals post-SEC settlement in August 2025.

- The removal of legal constraints allowed the market to reprice XRP to a new high of $3.66, with $2.00 as support.

XRP Price Predictions for 2026

- XRP faces a challenging environment without reliance on regulatory uncertainty, introducing risks if adoption does not scale.

- Clarity expands potential buyers including US-based institutions, funds, banks, and payment companies.

- US spot XRP ETFs significantly increased demand, reaching over $1.3 billion in assets and a 55-day inflow streak.

- Institutional demand meets low exchange reserves, driving potential repricing but also posing reflexivity risks if inflows slow.

21Shares notes XRP's smaller market cap at ETF launch could amplify price impacts compared to Bitcoin's ETF debut.

- XRPL is positioned as a financial infrastructure for tokenization and stablecoin settlement.

- RLUSD's growth showed over 1,800% increase in market cap; XRPL DeFi TVL expanded nearly 100x over two years.

- Execution risks exist due to slower progress and competition from ecosystems like Canton and Solana.

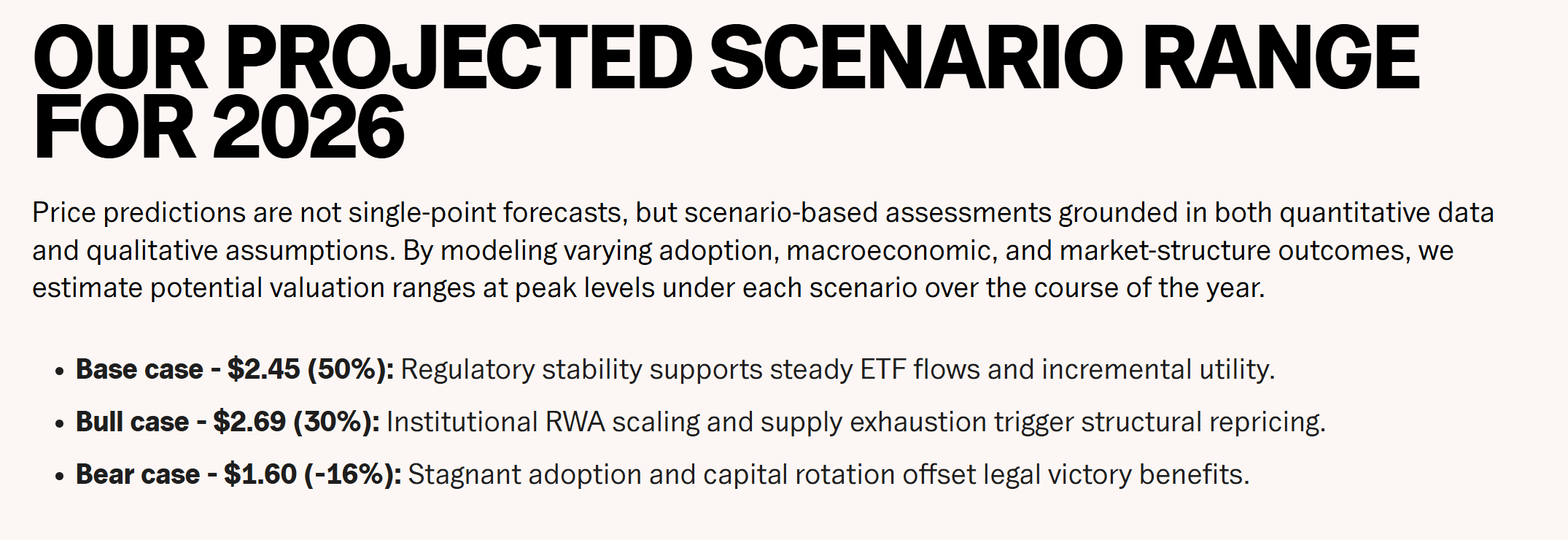

Price scenarios for 2026 are: base case $2.45 (50% probability), bull case $2.69 (30%), bear case $1.60 (-16%). Key factors include ETF inflows, tokenization volumes, and RLUSD traction.

Currently, XRP trades at $1.8792.