8 1

$355M Liquidated as Bitcoin Surges to $115K Amid Fed Rate Cuts

Bitcoin Price Surge and Market Liquidations

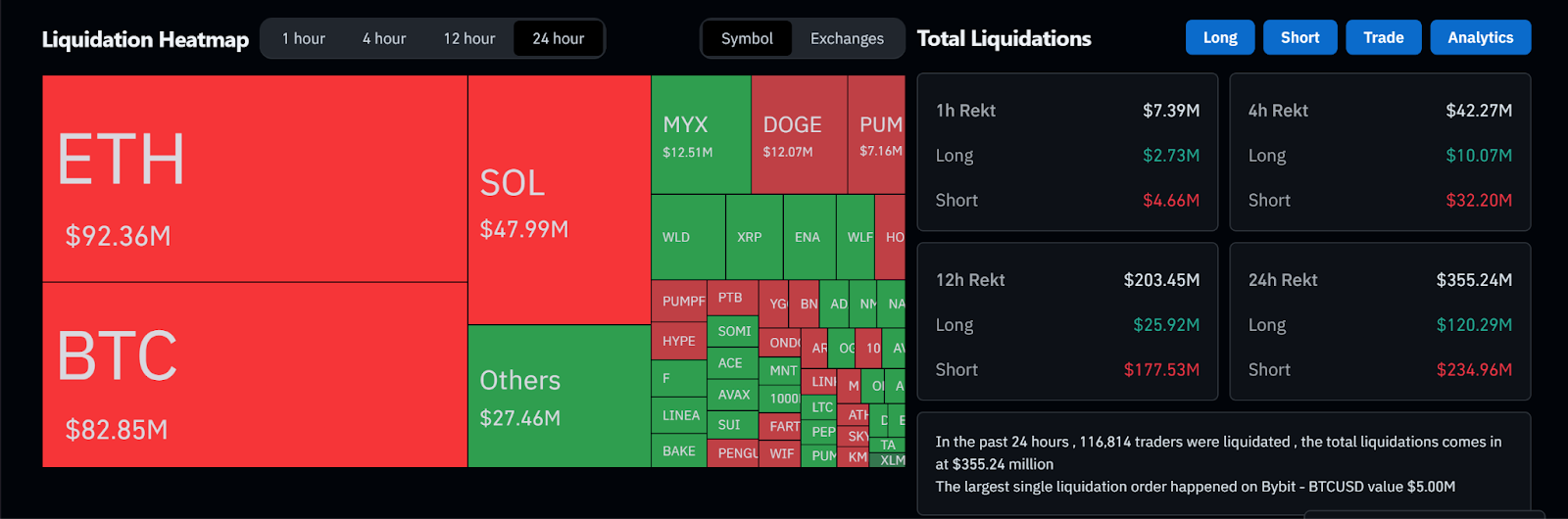

- Bitcoin's recent price increase led to over $354 million in market liquidations, with $121 million from longs and $233 million from shorts.

- The price reached a daily high of $116,317, marking a nearly 3% weekly gain.

Federal Reserve Rate Cuts Anticipated

- A Reuters survey indicates that 105 out of 107 economists expect a 25 basis point rate cut by the Federal Reserve on September 17, setting the range to 4.00%-4.25%.

- Weak labor market data, such as stalling job growth, has influenced expectations for aggressive rate easing.

- Markets are pricing in up to three rate cuts by year-end; some analysts predict a possible 50 bps cut next week.

- President Trump pressures Fed Chairman Jerome Powell for more aggressive rate cuts.

Bitcoin Rally vs. Bearish Signals

- The CryptoQuant Bull Score Index shows eight out of ten indicators as bearish, with only "demand growth" and "technical signal" bullish.

- Past trends show similar bearish signals led to significant price drops, though July saw Bitcoin peak at $122,800 when indicators were favorable.

- The CoinGlass Bull Run Index is at 74, suggesting the bull cycle is about three-quarters complete, but lacks confirmation of a peak.

Potential Impact of Fed Decisions on Bitcoin

- Despite technical indicators cooling, macroeconomic factors like Fed rate cuts could support Bitcoin's rally.

- If the Fed adopts a dovish stance, liquidity might drive risk assets, including Bitcoin, higher.