8 0

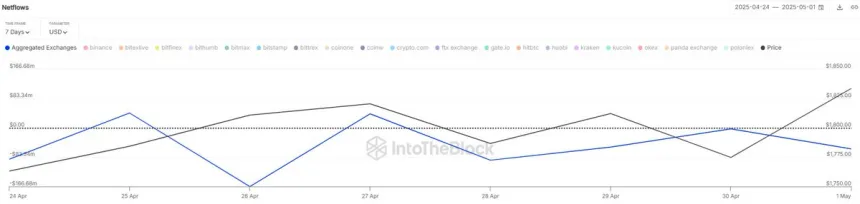

$380 Million in Ethereum Exits Exchanges in One Week

Ethereum (ETH) trades just below $2,000, showing signs of recovery amid reduced selling pressure. Key observations include:

- ETH stabilizes above $1,800, indicating a potential bullish short-term structure.

- Net outflows from centralized exchanges exceed $380 million in the past week, suggesting accumulation and less sell-side pressure.

- A confirmed breakout above $2,000 may trigger a broader altcoin rally.

Despite trading over 55% lower than December highs, ETH is attempting to gain momentum against significant supply resistance. Recent data indicates:

- Centralized exchanges report consistent net outflows, reinforcing accumulation trends.

- Market sentiment remains mixed; some analysts predict a breakout while others warn of potential corrections due to macroeconomic uncertainties.

Currently at $1,837, ETH faces strong resistance around $1,850, which has historically acted as both support and resistance. Key points include:

- Volume remains stable but lacks high conviction for a breakout.

- Must close above $1,850 to confirm a trend reversal; failure may lead to retests of $1,700 or lower.

- A successful breakout could target the $2,000–$2,200 zone.