7.8 Million Ethereum Withdrawn from Binance in Two Months

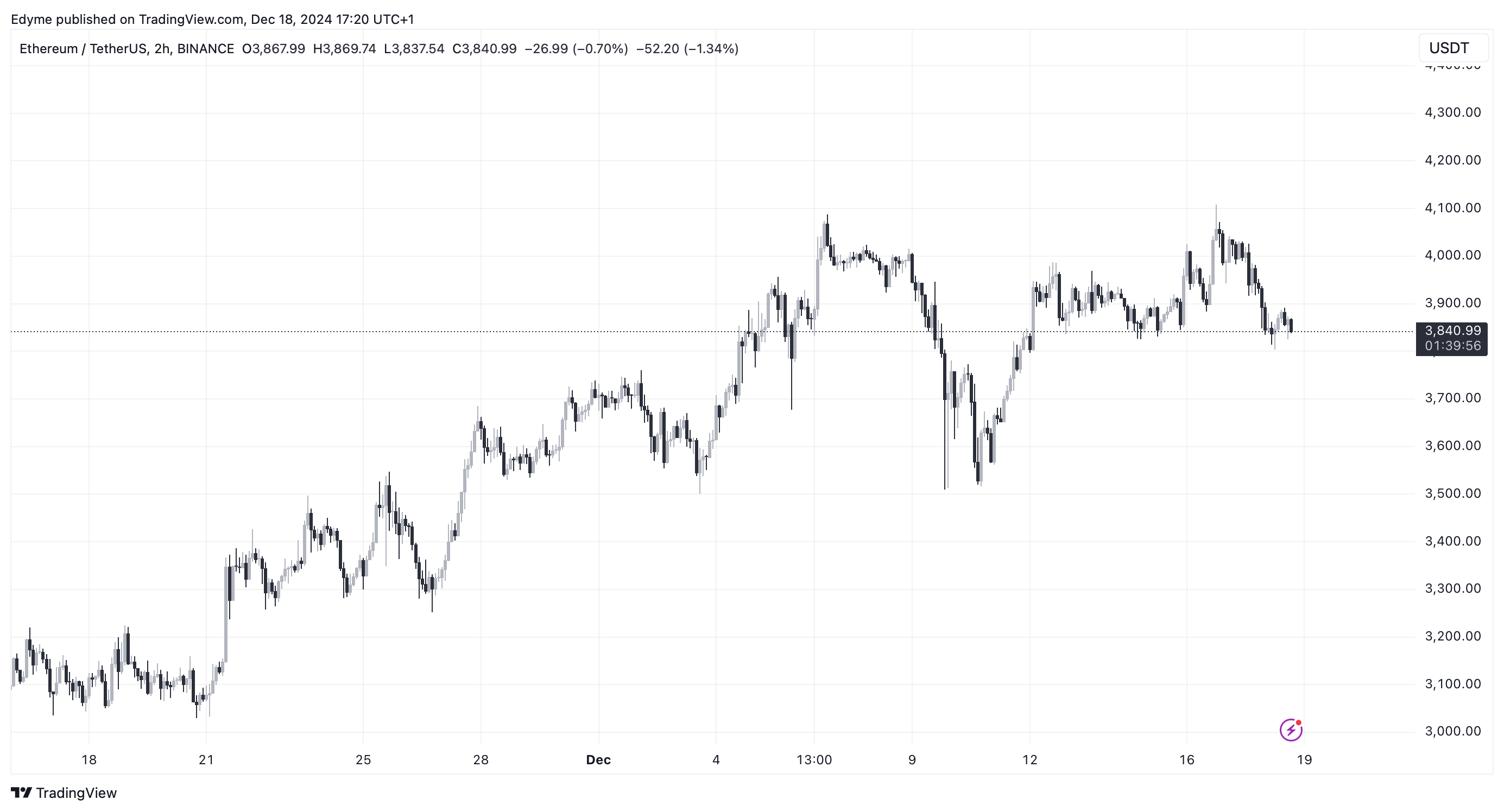

The Ethereum market has experienced significant outflows from centralized exchanges, raising discussions about its future trajectory. Currently, Ethereum is trading at $3,858, reflecting a 2.4% decrease in the past 24 hours and a 21.1% drop from its all-time high of $4,878 reached in 2021.

Ethereum Withdrawals from Binance Surpass 7.8 Million ETH

According to CryptoQuant, approximately 20.8 million ETH have been withdrawn from centralized exchanges over the last two months, reminiscent of trends during the 2021 bull market. Binance has contributed over 7.8 million ETH, representing 33-39% of total outflows.

These withdrawals may suggest that investors are accumulating ETH for long-term holding or staking purposes. Analyst Crazzyblockk noted:

These significant outflows from Binance indicate the platform’s continued influence on the cryptocurrency market, especially in balancing supply and demand for Ethereum.

Binance's role is underscored by its 250 million global user base and $21.6 billion in deposits this year. The substantial outflows align with bullish market sentiment, as large withdrawals often indicate investor confidence. This reduction in available ETH on exchanges can create upward pressure on prices if demand remains steady or increases.

Ethereum Market Performance and Outlook

Ethereum has struggled to achieve notable price increases since the latest crypto market bull run began. Despite Bitcoin consistently reaching new highs, Ethereum has not gained enough momentum to surpass the $4,000 level.

This underperformance occurs alongside positive developments in the crypto space, such as Deutsche Bank reportedly working on its own layer-2 blockchain on Ethereum using ZKsync technology.

JUST IN: Deutsche Bank building its own Layer-2 on Ethereum – Bloomberg pic.twitter.com/5O5K3R1fRg

— Radar

(@RadarHits) December 18, 2024

Despite this news, ETH has seen only a 2.3% increase over the past week, compared to Bitcoin's 5% rise. Analysts suggest that Ethereum may experience further corrections, with bearish signals indicating a potential decline to $3,400.

$ETH has formed a bearish double top, with RSI showing bearish divergence and a MACD crossover confirming the trend. A short-term correction could bring it to $3,400, with major support at $3,200 and $3,000. #Ethereum #CryptoTrading #eth pic.twitter.com/iWaPh1vwrr

— crypto vulture Trader

(@crypto_vulture1) December 18, 2024

Featured image created with DALL-E, Chart from TradingView