7 0

8.3 Million BTC to Become Illiquid by 2032, Says Fidelity

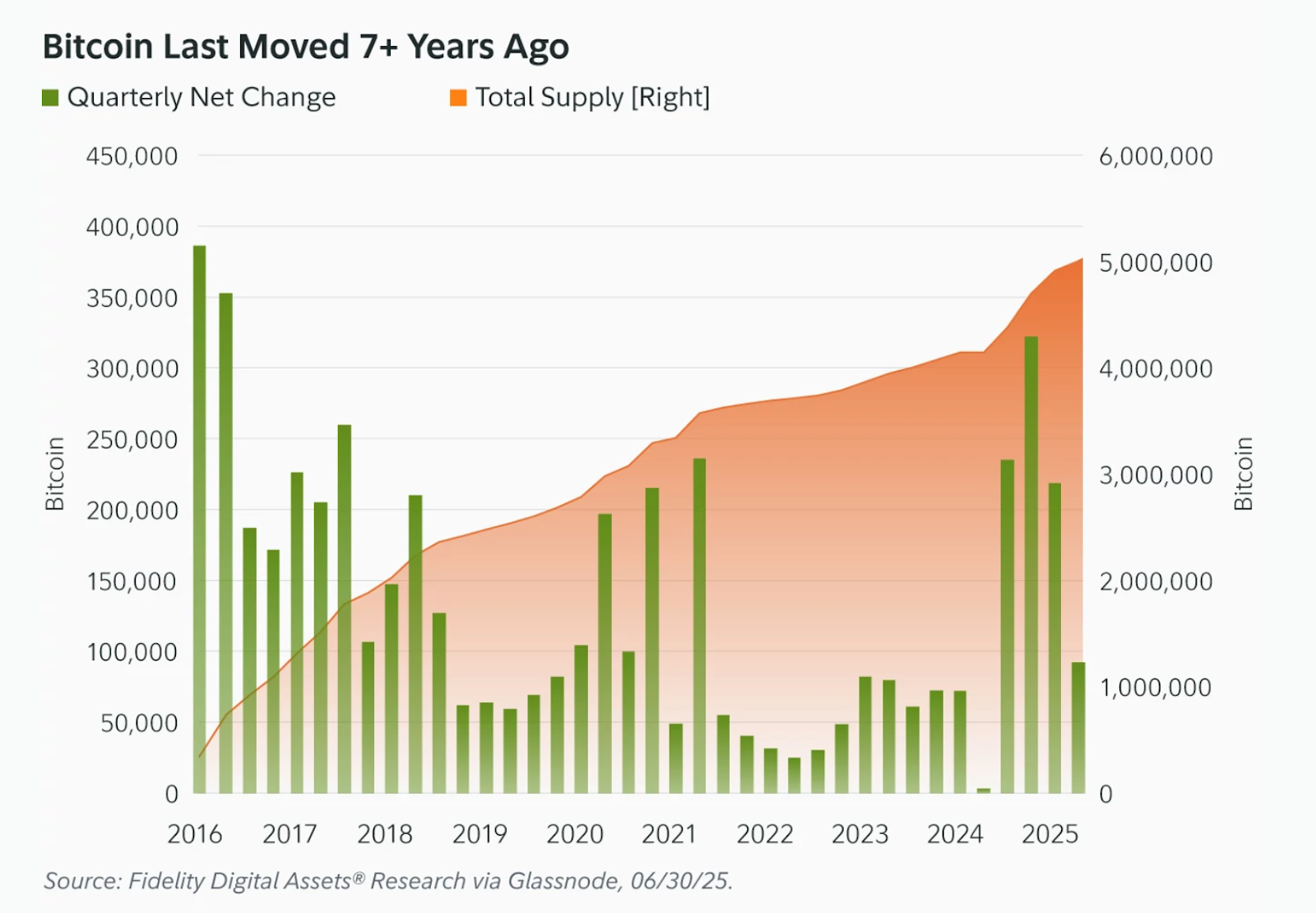

Fidelity predicts a significant reduction in Bitcoin's liquid supply, with over 8.3 million BTC potentially becoming "illiquid" by 2032 due to long-term holding trends.

Key Points from Fidelity's Report

- By Q2 2025, entities like long-term holders and public companies could control more than 6 million BTC, about 28% of the total supply.

- Projected increase to 8.3 million BTC by 2032, reducing available market supply.

- Currently, public companies hold nearly 1 million BTC, approximately 4.6% of the supply.

The decrease in liquid supply could influence upward price pressure but also concentrates ownership, posing risks if large holders sell.

Market Dynamics

- Recent data shows Bitcoin whales sold $12.7 billion in the past 30 days, leading to a 2% price drop.

- Despite recovery fueled by ETF inflows and macro factors, spot market weakness and profit-taking create sell pressure.

- Glassnode reports that rising RSI levels and softening demand for leveraged longs indicate market fragility.

Calm Risk Environment

- CryptoQuant’s Bitcoin Risk Index is at 23%, indicating low probability of sudden liquidations.

- Market stability mirrors previous periods, with attention on upcoming Federal Reserve policy announcements.

Analysts suggest US monetary easing might trigger rallies in Bitcoin and Ethereum by Q4, impacting investment decisions.