10 0

A16Z Invests $50M in Solana Staking Protocol Jito’s Native Token

Key Investment Developments:

- Andreessen Horowitz (A16Z) invested $50 million in the JTO token of Solana staking protocol Jito, marking a significant institutional investment in the platform.

- This transaction is the largest single commitment by an investor in Jito's history and involves a long-term cooperation structure with potential discount incentives.

- The deal represents a private token acquisition rather than an equity stake, a common approach for institutional investors seeking liquid blockchain exposure.

- A16Z has been active in similar deals, previously investing $55 million in LayerZero and $70 million in EigenLayer.

Solana Staking Insights:

- Solana’s staking ecosystem generates approximately $5 billion annually in rewards, positioning it among the top proof-of-stake networks.

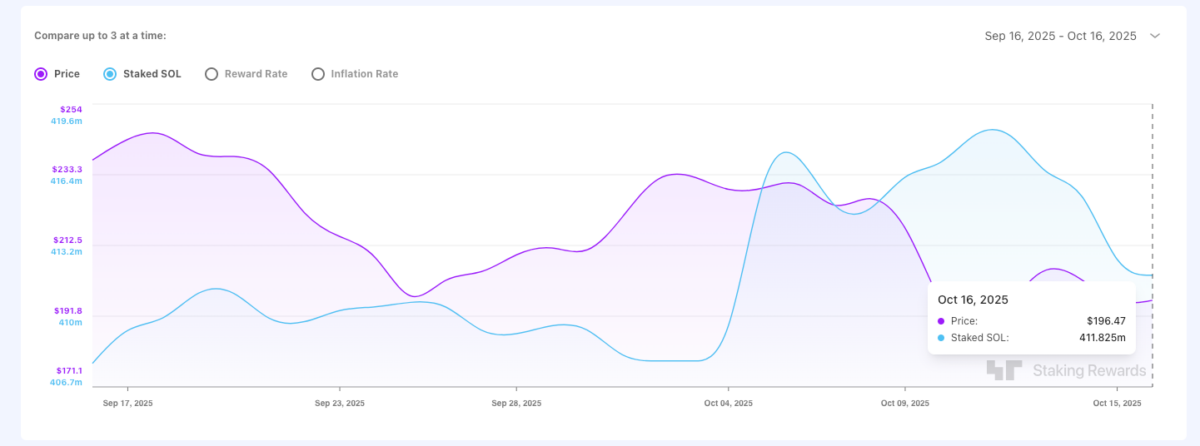

- Despite A16Z's investment, Solana's aggregate staking flows have been negative since a market crash last week, with a withdrawal of 7.1 million SOL worth over $1.4 billion.

- Recent withdrawals have increased Solana's circulating supply, applying bearish pressure on its price, which remains below $200.

- Nonetheless, A16Z's investment indicates long-term confidence in Solana's tokenomics, suggesting potential recovery from current market conditions.

Emerging Projects:

- The SUBBD presale, benefiting from renewed interest in Solana projects, has raised over $1.2 million, nearing its $1.4 million target.

- SUBBD focuses on AI-driven personalization and creator monetization, supporting influencers and brands in building fan communities.