Updated 16 December

Aave Achieves 45% Market Share in DeFi Lending Sector

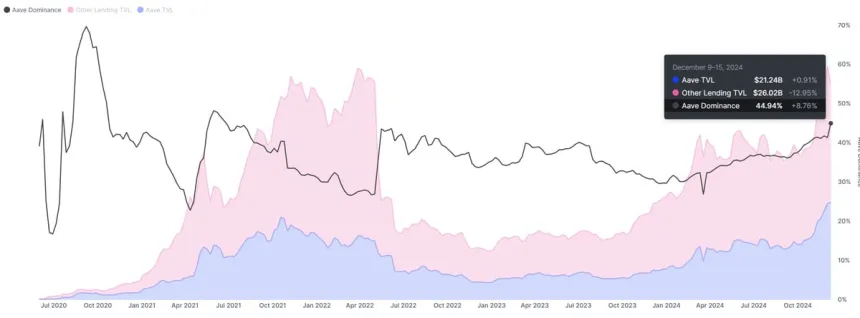

Aave (AAVE), a leading decentralized finance (DeFi) lending protocol, has increased over 200% since November 5, reaching its highest levels since 2021. It holds a 45% market share, making it the top choice for decentralized borrowing and lending solutions.

With AAVE trading at multi-year highs and strong on-chain activity, investor focus remains on whether it can sustain this momentum and achieve new all-time highs.

AAVE Keeps Growing

Aave has consistently expanded in the past year, solidifying its leadership in the DeFi lending sector. The platform allows users to earn interest on supplied and borrowed assets through innovative non-custodial liquidity markets. Its success is reflected in its dominant market position, supported by metrics indicating a 45% market share in DeFi lending.

Aave’s total value locked (TVL) stands at $21.2 billion, nearly equal to the combined TVL of all other lending protocols. This underscores its critical role in the DeFi ecosystem and positions it favorably for potential future growth as the sector evolves.

Price Targets Fresh Supply Levels

Aave is currently trading at $366, after peaking at $396. It approaches the significant $420 resistance level last seen in September 2021, which is crucial for its next price movement.

If AAVE maintains its current levels, breaking above $420 could indicate a continuation of its multi-month rally. Conversely, failing to hold support above the $320–$340 range may lead to a broader correction, erasing recent gains and affecting bullish sentiment.

AAVE's performance near these key levels will determine whether it sustains its upward trend or experiences a pullback.

Featured image from Dall-E, chart from TradingView