Aerodrome Finance Market Cap Reaches $1.56 Billion with 15.50% Surge

The DeFi sector is experiencing increased buying pressure, with the total market cap surpassing $177 billion. Aerodrome Finance leads with a 15.50% rise in the past 24 hours.

Aerodrome Finance Network Records Significant Growth

Aerodrome Finance's market cap stands at $1.56 billion, with trading volume increasing by 15.57% to $114.29 million within the same period. This uptrend indicates potential for reaching new all-time highs.

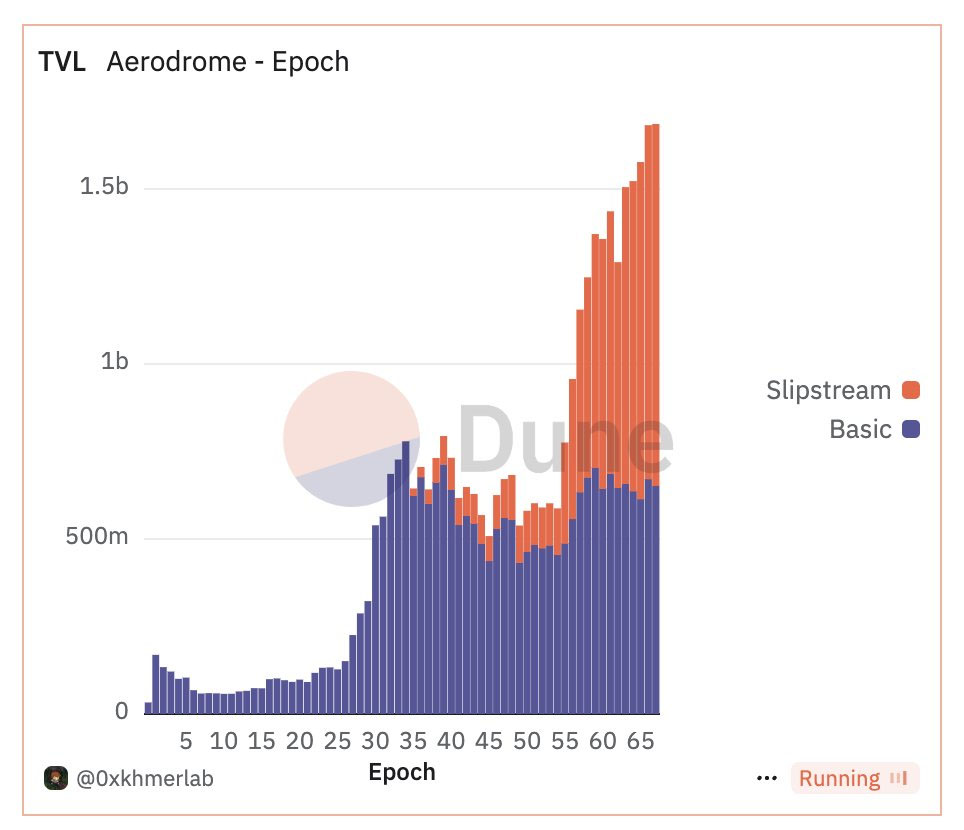

The platform's total value locked (TVL) has hit an all-time high of $1.618 billion, reflecting user confidence and capital influx.

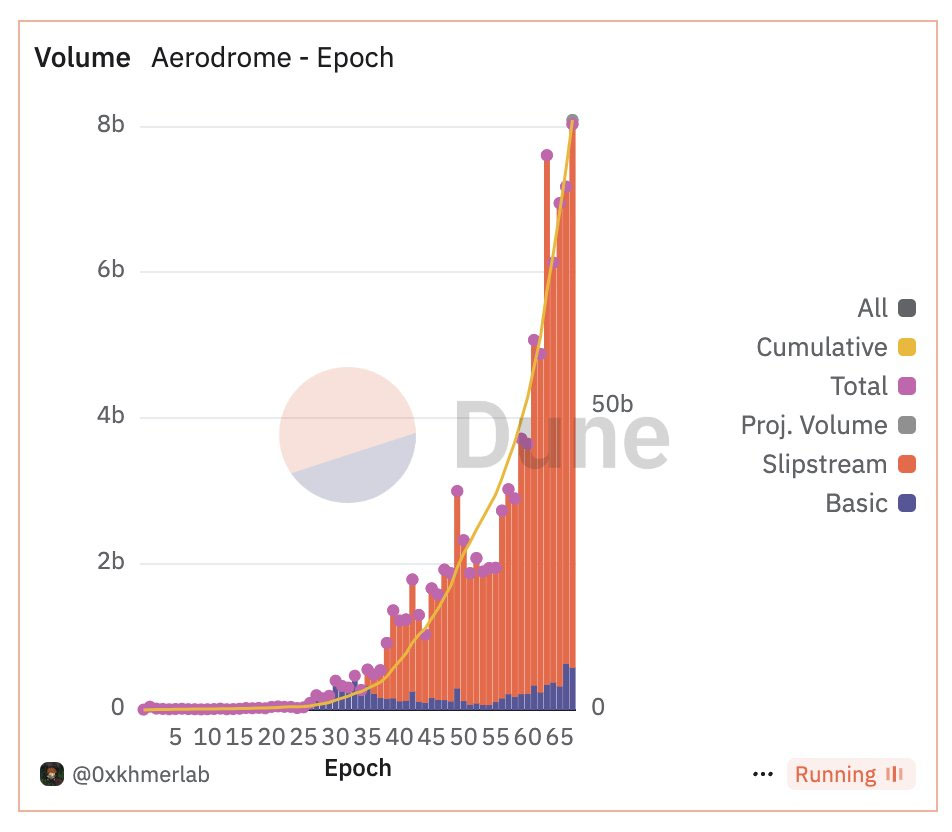

Increased liquidity during this bull market enhances Aerodrome Finance's position in DeFi, with weekly trading activity reaching $8.2 billion.

Aerodrome Finance aims to be a leading platform for traders and liquidity providers, with Epoch fees totaling $8.2 billion.

Voting rewards have reached $9.8 billion, indicating strong community engagement and value generation for users and stakeholders. The AERO token lock-up amounts to $14 million.

This reflects a significant commitment from Aerodrome users, positioning it as a strong contender in the DeFi market.

Aerodrome Finance Price Trend Analysis

The Aerodrome Finance price trend shows a rounding-bottom reversal pattern. Last week's surge of 38.88% formed a bullish engulfing candle, creating a new swing high of $2.3378.

While the price did not exceed the previous all-time high of $2.3748, it closed above the 100% Fibonacci level at the $2.00 mark. Currently, the AERO token trades around $2.20 after bouncing from the 78.60% Fibonacci level at $1.70.

The ongoing uptrend suggests potential to exceed the 1.272 Fibonacci level at $2.4379, with a possible new all-time high targeting the 1.618 Fibonacci level at $2.9583. The recent three-week positive trend resulted in a cumulative increase of 64.35%, indicating strong underlying demand.

A retest of the $2.00 psychological mark may occur if market volatility increases.