12 0

Altcoin Dominance Hits Record Lows Suggesting Potential Market Rebound

The crypto market is showing signs that a new altcoin season might be on the horizon. Analysts are looking at historical patterns and technical signals that suggest a potential rebound.

Key Points

- Altcoin dominance has reached historically low, oversold levels.

- Crypto analyst Javon Marks highlights this as an indication of a potential market reversal.

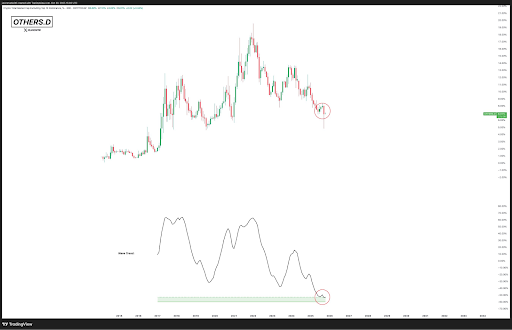

- The OTHERS.D chart shows a significant decline in altcoin market dominance from its 2021 peak of around 20% to about 7% currently.

- A wave trend indicator suggests selling pressure is waning, possibly signaling a strong rebound for altcoins.

- Marks believes this could be one of the best accumulation phases for altcoins in years.

Fed’s Monetary Policy and Crypto Liquidity

- Analyst Ted Pillows compares current conditions to the 2019-2020 cycle when the Fed shifted from quantitative tightening (QT) to quantitative easing (QE).

- Pillows notes a 42% market cap decline after QT ended in late 2019, followed by a recovery post-QE initiation in March 2020.

- Ending QT might ease financial pressure but doesn't inject liquidity needed for altcoins to rally.

- The release of Treasury General Account (TGA) funds is seen as the most feasible method to boost liquidity and drive altcoin growth.

- Potential TGA-driven liquidity release could occur once the US government resolves its fiscal impasse.