Updated 12 December

Altcoin Leverage Drops by $12.8 Billion Amid Major Liquidation Event

Brutal week for altcoins.

The stock market typically experiences a Santa Claus rally in late December into early January. The potential for a similar trend in crypto remains uncertain.

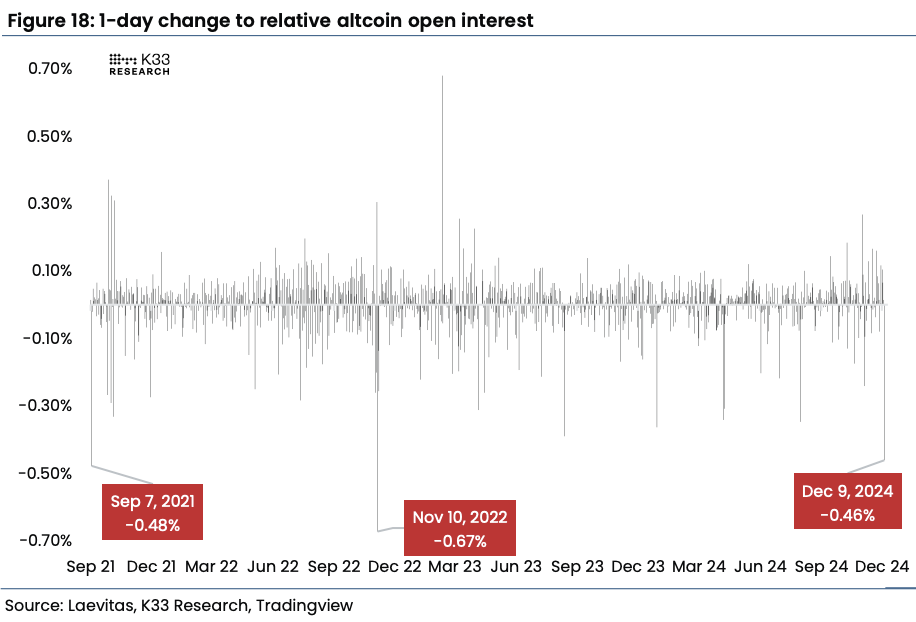

Altcoin leverage held until December 5, but Monday experienced the largest daily long liquidation event since May 2021, according to K33 analysts. This situation emerged after a period where long bets were profitable since the election, allowing open interest to increase relative to the total altcoin market cap. Open interest rose from 3.57% to 4.42% from the election until December 9 during a high funding rate environment. The liquidation event on Monday caused altcoin leverage to decrease by $12.8 billion, lowering the ratio to 3.96%.

This situation marked the largest relative decline in altcoin leverage since the FTX collapse.

BitOoda analysts predict continued sideways trading through year-end, characterized by low liquidity and volatile price movements due to highly leveraged products.

Despite the recent downturn, many maintain a bullish outlook for 2025, leaving some hope for a Santa rally.