7 0

Altcoin Market Cap Drops Over 50%, Trading Activity Remains High

Altcoin Market Overview:

- Anticipated altcoin season for 2025 did not materialize; most altcoins experienced significant drawdowns.

- As 2026 nears, sentiment remains fragile with concerns over structural weakness and declining liquidity.

- The OTHERS index (excluding top 10 cryptocurrencies) dropped over 50% from $451 billion to around $182 billion since December 2024.

- This decline reflects aggressive de-risking, weak demand, and sustained selling pressure.

Analysts' Perspectives:

- Some analysts suggest the altcoin cycle may not be over, citing historical precedents of recovery following underperformance.

- If liquidity conditions improve, 2026 might see a resurgence in altcoin activity.

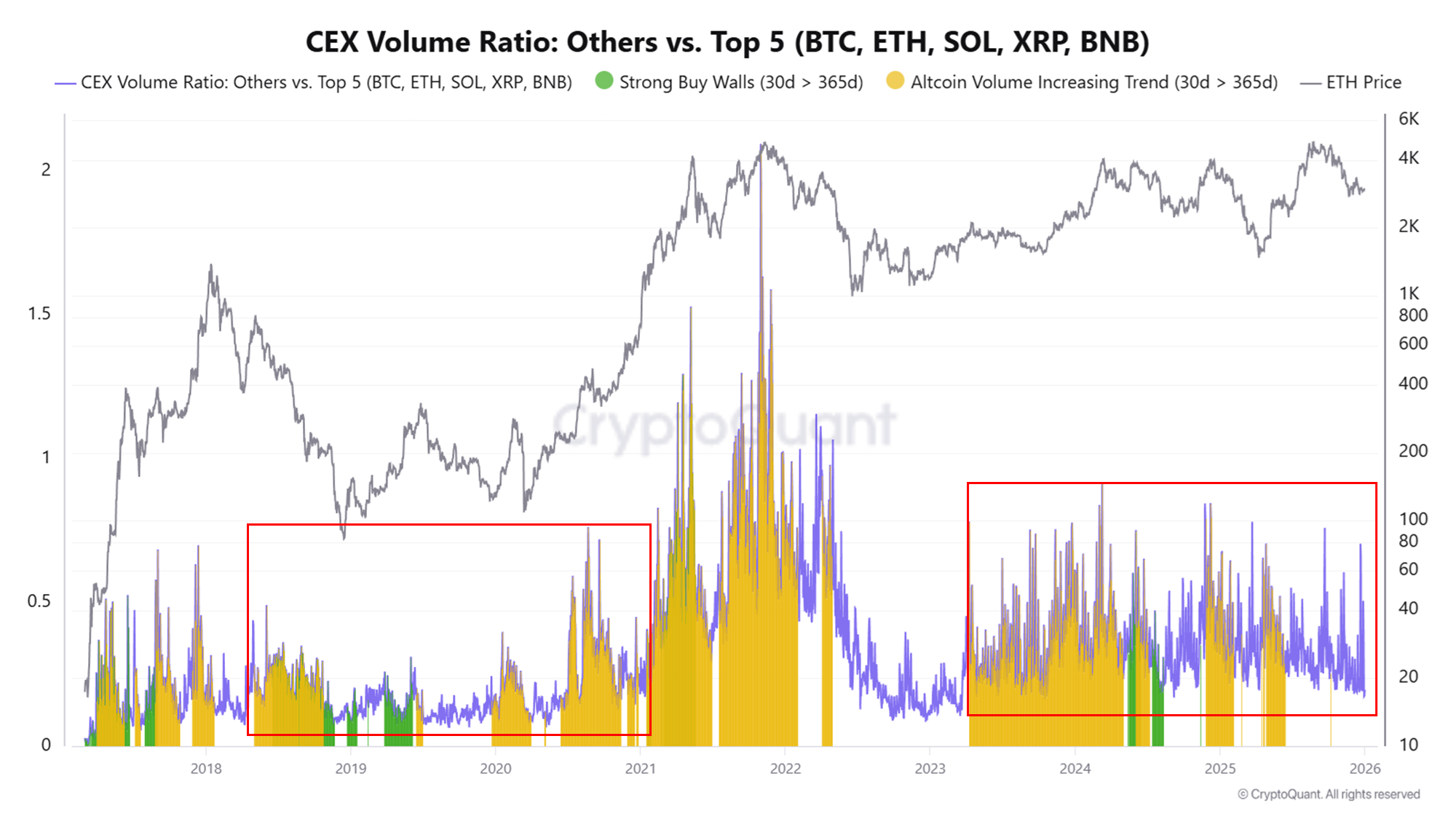

Trading Activity Insights:

- Despite price weakness, trading volumes for altcoins (excluding top five) on centralized exchanges are higher than previous cycles.

- On-chain data indicate a market shift, with whales and professional traders driving volume.

- Retail participation has decreased, but overall activity remains high.

OTHERS Market Cap Analysis:

- OTHERS index shows a prolonged correction, stabilizing around the $200–210 billion range.

- Technical analysis indicates oscillation around the 200-week moving average, suggesting a long-term equilibrium zone.

- Lack of aggressive lower lows hints at exhaustion of forced selling, but absence of higher highs keeps outlook neutral-to-bearish.

- A meaningful recovery requires reclaiming the $260–280 billion range and surpassing key moving averages.

The current phase suggests consolidation and a search for a durable bottom rather than an imminent altcoin season.