CryptoQuant CEO Reports Altcoin Season Driven by Stablecoin Activity

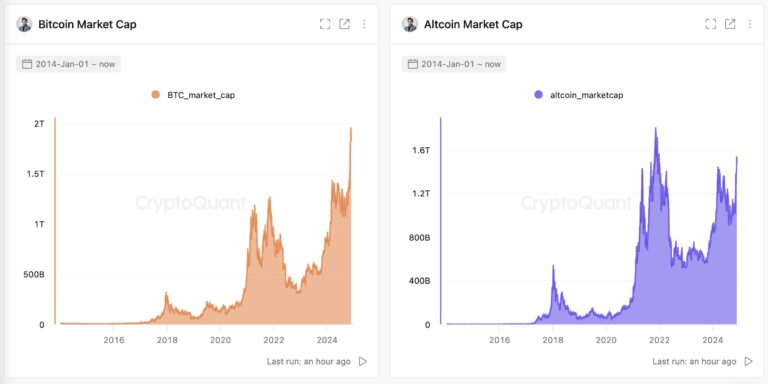

The crypto market may be nearing a significant shift, indicating a potential altcoin season. This phase, characterized by alternative cryptocurrencies outperforming Bitcoin, is traditionally driven by capital rotation from Bitcoin into altcoins.

Ki Young Ju, CEO of CryptoQuant, points out that this pattern is changing. He emphasizes a new driver for the possible altcoin surge: increased trading activity in stablecoin and fiat currency pairs. In a Dec. 2 post on X, he stated:

“Altseason is no longer defined by asset rotation from Bitcoin.”

Altcoin Trades Shift to Stablecoins

Current trends indicate that altcoin trading volumes against Bitcoin pairs are consistently low. Even with rising Ethereum prices, Bitcoin pairs for altcoins show minimal movement. Notably, altcoins such as XRP and Solana approach their all-time highs.

In contrast, trading volumes for altcoins against stablecoins have increased significantly. Ki notes that this trend indicates “real market growth rather than asset rotation,” highlighting the growing role of stablecoins in the market dynamics. He states, “Stablecoin liquidity better explains the altcoin markets,” emphasizing their importance.

This increase in altcoin volume suggests a more sustainable market evolution. Stablecoins provide liquidity and price stability, enhancing altcoin demand and reducing reliance on Bitcoin as a trading benchmark.

Stablecoin Liquidity Reshapes Crypto Market

Institutional capital is also reshaping the market landscape. Unlike previous cycles dominated by retail investors, the current bull market is witnessing substantial investments in Bitcoin spot exchange-traded funds (ETFs).

Source: Ki Young Ju

This transition marks a shift from speculative, retail-driven momentum to a more credible and stable investment environment, potentially benefiting the broader crypto ecosystem, including altcoins.

Despite these positive indicators, the market capitalization of cryptocurrencies excluding Bitcoin remains significantly below its all-time high, indicating that additional fresh capital is needed for altcoins to reach new peaks. Ki noted:

“For altcoins to reach a new all-time high market capitalization, they will require a significant influx of fresh capital to crypto exchanges.”

The altcoin season index, tracked by Blockchain Center, provides further insights. It identifies an altcoin season when 75% of the top 50 coins outperform Bitcoin over a 90-day period. Currently, 73% of the leading 50 altcoins have outperformed Bitcoin in the last 90 days. This figure is steadily increasing, suggesting that the threshold for an official altcoin season is approaching.