7 0

Analyst Warns Massive Liquidity Wave Could Boost XRP Significantly

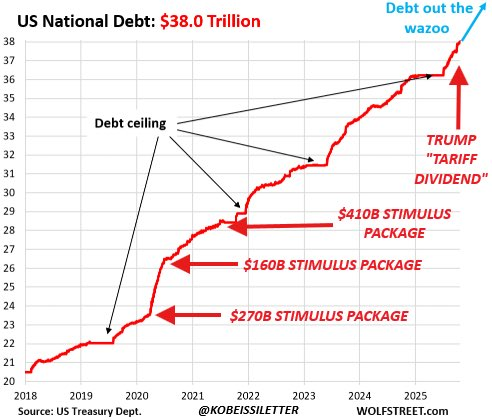

An analyst, Pumpius, predicts a significant liquidity wave in global markets, with XRP positioned to benefit. He points to a chart showing the US national debt exceeding $38 trillion, suggesting that government stimulus, monetary easing, and corporate spending will flood markets with capital akin to the 2020 pandemic surge.

Liquidity and Stimulus Insights

- The US government plans to inject over $400 billion in new stimulus, marking the first round since 2021.

- The Federal Reserve is reducing interest rates despite inflation being above 3% and a cooling labor market.

- President Trump proposes a $2,000 dividend for Americans, sourced from tariff revenue.

- The national debt is projected to exceed $38 trillion, potentially indicating another liquidity growth phase.

Pumpius also highlights substantial private-sector investment, with major tech companies investing over $100 billion quarterly into AI infrastructure.

XRP as a Global Capital Bridge

- Pumpius argues XRP is uniquely suited for instant cross-border transactions, ideal for managing incoming liquidity.

- Ripple’s technology connects banks, fintechs, and payment systems, facilitating rapid fund movement during liquidity expansion.

XRP remains a top-traded digital asset, with market participants closely monitoring its price movements. Ripple continues to expand through partnerships and acquisitions to enhance XRP's global adoption, currently trading at $2.45, down 1.4% in the last 24 hours.