Arbitrum Distributes $81 Million in Grants Through STIP to Boost Ecosystem

One of crypto’s significant market strengths is tokens.

The ability to create billions in digital tokens quickly and use them as grants for attracting users and developers has become integral to the Web3 growth strategy. However, measuring the tangible benefits of these expenditures poses challenges.

Grant funding often attracts rent-seekers, leading to a cycle of transient capital that moves rapidly between projects seeking quick profits.

As a result, DAO grant spending faces considerable inefficiencies.

Since November 2023, Arbitrum has allocated 71 million ARB (approximately $81 million) to ecosystem projects through the Short-Term Incentive Program (STIP), representing about 3-4% of Arbitrum’s total treasury.

Karel Vuong, co-founder of Treasure DAO, opted out of STIP due to its misalignment with gaming applications, describing the grant as a “double-edged sword.” He noted that while it contributed to ecosystem growth and provided learnings for future DAO-led programs, it also increased sell pressure on ARB and diminished value capture post-ArbOS Atlas upgrade.

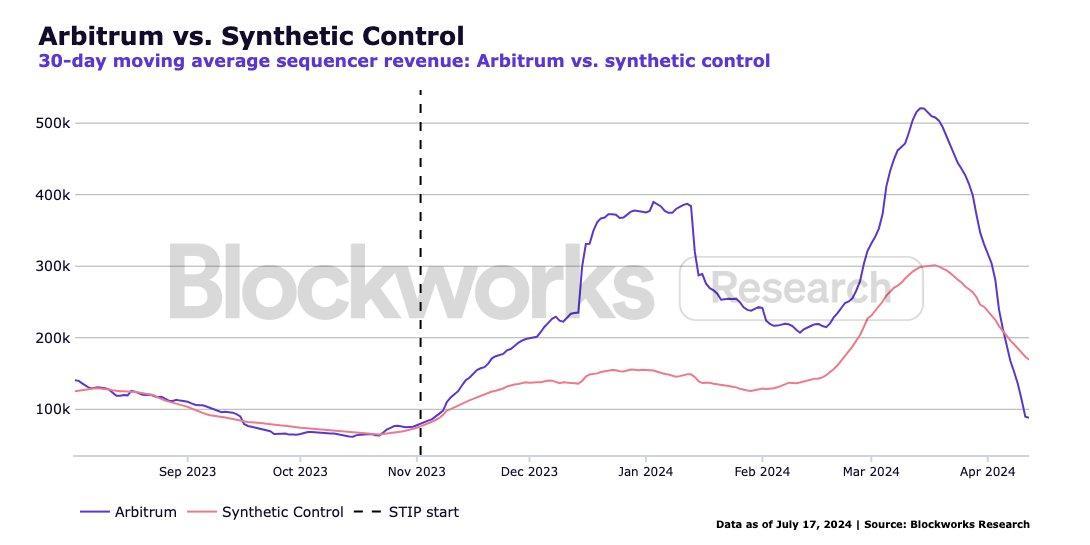

Blockworks Research, part of the Arbitrum Research & Development Committee (ARDC), analyzed STIP’s impact on 17 Arbitrum projects using an econometric method called “synthetic control.” This method compared real-world Arbitrum to a simulated version without grants. STIP generated $15.2 million in sequencer revenue against an $85.2 million marketing spend from November 2023 to March 2024, indicating that sequencer revenues would have been 43% lower without STIP.

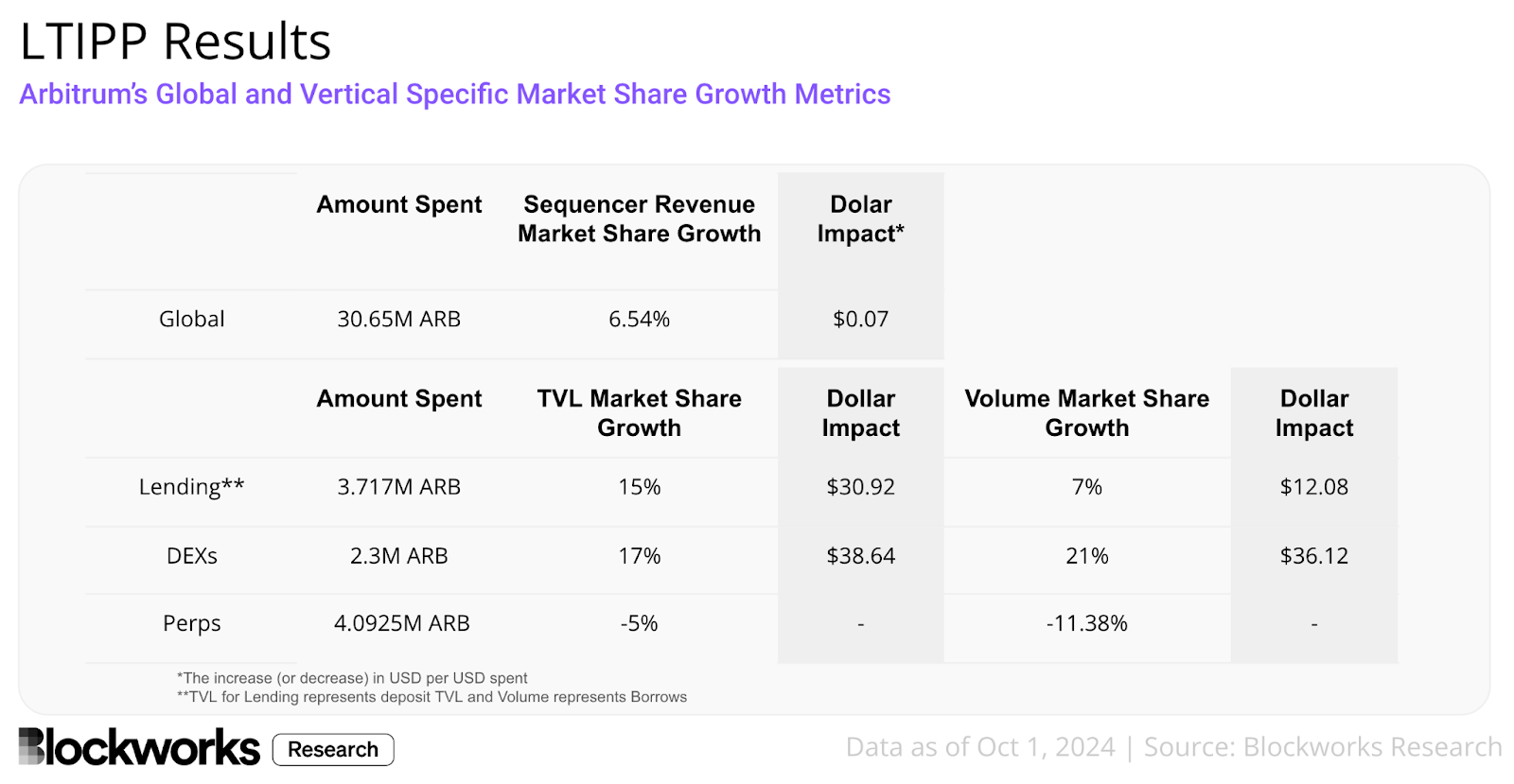

A subsequent program, the Long-Term Incentive Pilot Program (LTIPP), distributed 22.87 million ARB (about $26 million) to users over 12 weeks.

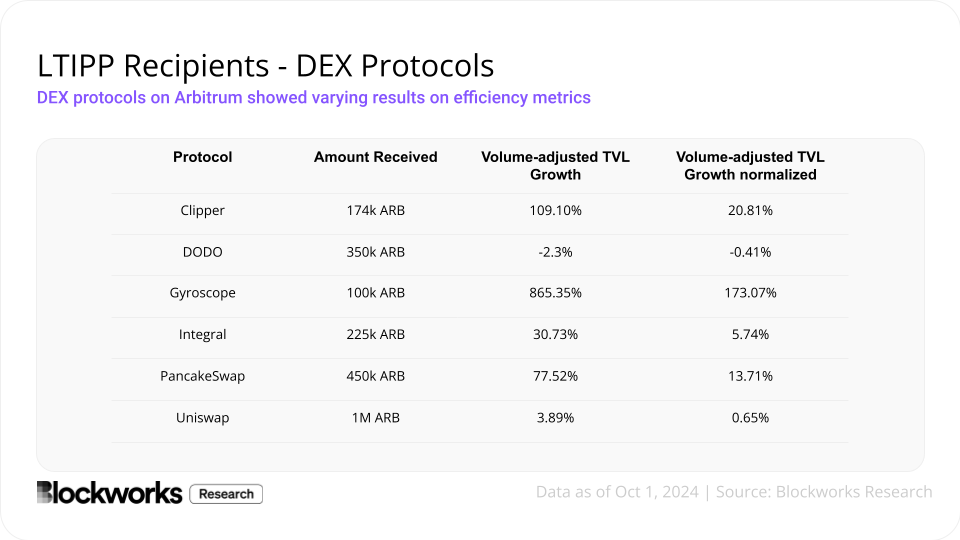

To assess impact, “volume-adjusted TVL” was introduced to better reflect growing TVL numbers correlating with actual activity. This metric prioritizes protocols when trading volumes exceed TVL growth.

Based on Blockworks Research studies, LTIPP positively impacted sequencer revenues and Arbitrum’s DEX and lending markets but not its perps markets:

TVL market share grew by 25% for lending, 17% for DEXs, and decreased by 5% for perps. Volume market share increased by 7% for lending, 21% for DEXs, and dropped by 11.38% for perps. Sequencer revenue market share rose by 6.54%. While incentives improved DEX, lending, and sequencer revenues, they did not benefit perps.

For further details, refer to Blockworks Research's latest report on incentive programs.