7 1

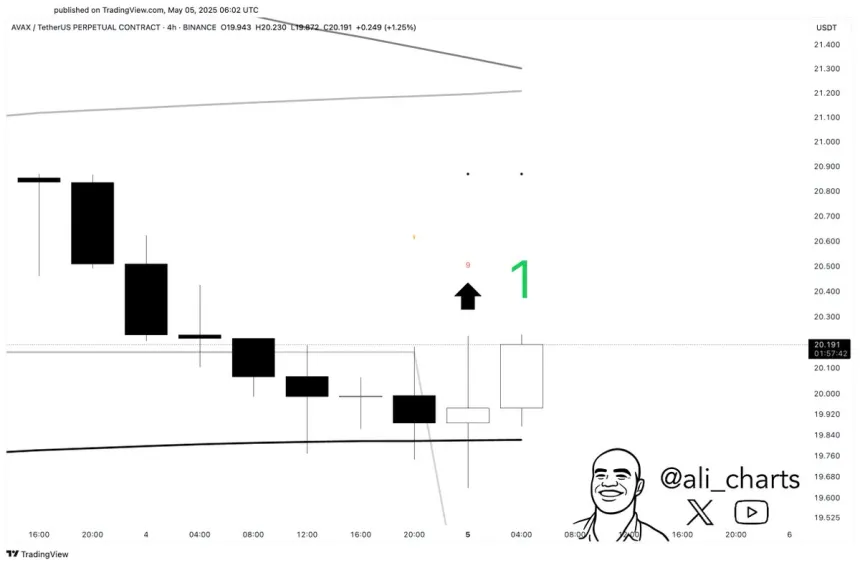

Avalanche Tests Key Support Level at $20 After 55% Surge

Avalanche (AVAX) is testing the $20 support level after a 55% surge from early April lows. This level is crucial for maintaining bullish momentum.

Current challenges include:

- Macroeconomic tensions and global market volatility affecting investor sentiment

- Continued pressure on altcoins like Avalanche due to rising geopolitical uncertainty and interest rate concerns

Analyst Ali Martinez indicates that AVAX is bouncing off its 200-day Simple Moving Average (SMA) on the 4-hour chart, which could signal a pivot point for bulls. An increase in trading volume and a confirmed break above short-term resistance could reignite AVAX’s upward trend.

Key points about AVAX's price action:

- Currently trading at $19.98, still below significant moving averages (200-day SMA at $29.80 and EMA at $26.30)

- Resistance noted at $22–$23, with sellers currently in control

- Volume is decreasing, indicating weakening momentum

- Consolidation range between $18 and $23; failure to hold $20 may lead to a drop to March lows near $16

- A breakout above $26 could attract bullish interest and indicate a potential trend reversal

The next few days are critical in determining AVAX’s trajectory amid ongoing macroeconomic uncertainties.