11 0

BEARISH 📉 : AVAX price plummets despite record on‑chain activity growth

A recent report by Messari highlights Avalanche's performance in Q4 2025, revealing a contrast between declining token value and record on-chain activity.

Key Highlights

- Avalanche's native token, AVAX, fell 59.0% QoQ and 65.5% YoY, from $30.00 to $12.30.

- Market capitalization dropped 58.3% QoQ and 63.9% YoY, affecting AVAX's ranking from 14th to 21st.

- Total fees in USD decreased by 11.7% QoQ, but fees in AVAX rose 24.9% QoQ.

- Daily transactions on the C-Chain increased by 63% to 2.1 million.

- A notable market event on October 10, 2025, resulted in $520,715 in transaction fees.

Record Transaction and User Activity

- Average daily transactions surged 1,162.1% YoY to 38.2 million.

- Daily active addresses increased 16,360.3% YoY to 24.7 million.

- The C-Chain saw a 69.0% QoQ rise in average daily transactions.

- Staking value in USD fell 59.9% QoQ to $2.3 billion.

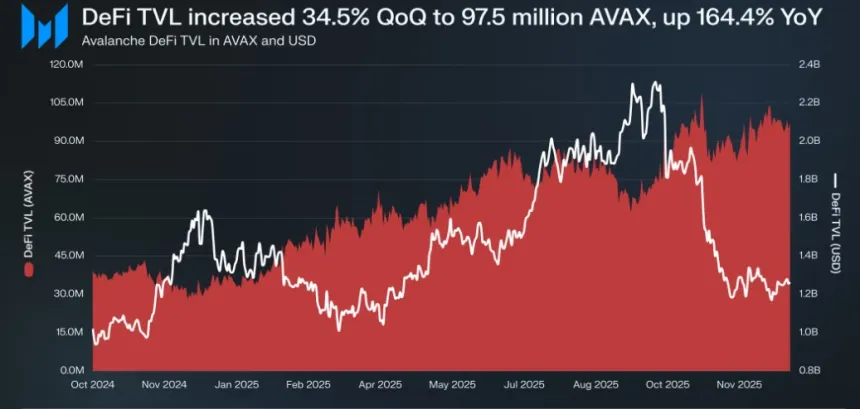

DeFi Ecosystem and RWA Growth

- DeFi Diversity Score improved by 5.9% QoQ and 63.6% YoY.

- Total DeFi TVL declined 41.9% QoQ to $1.3 billion, but stablecoin market cap rose 24.3% YoY to $1.8 billion.

- RWA TVL increased 68.6% QoQ to $1.33 billion.

Despite price declines, Avalanche's network usage and user activity reached historic levels, indicating resilience amidst market challenges.