0 0

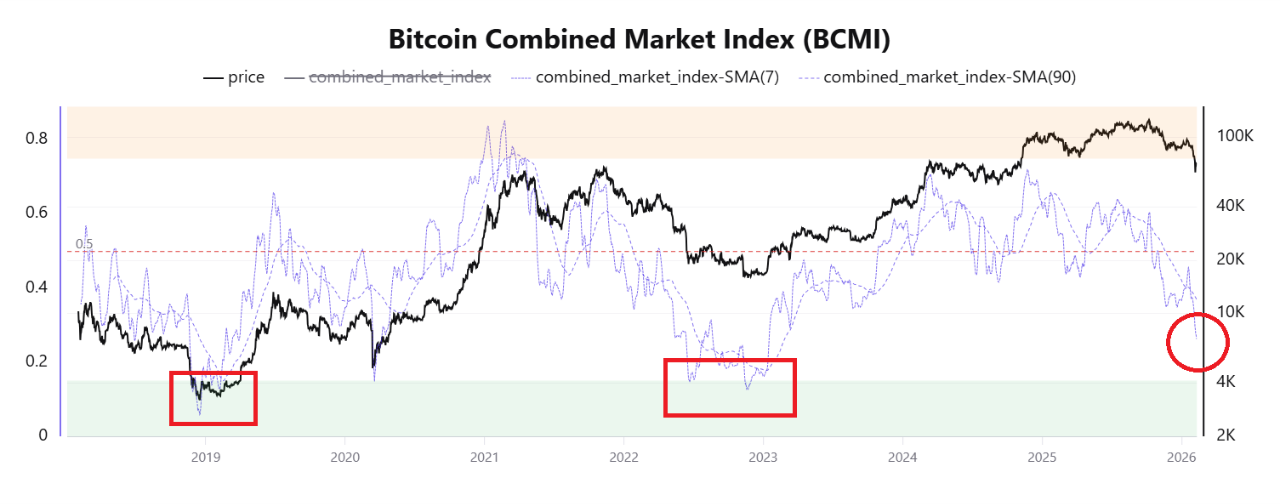

BEARISH 📉 : Bitcoin BCMI Signals Structural Weakness in Bear Market Transition

Bitcoin is experiencing significant selling pressure, with market momentum weakening and investor caution increasing. The current environment reflects uncertainty, as the market searches for direction rather than maintaining an upward trend.

- The Bitcoin Combined Market Index (BCMI) has dropped to around 0.2, suggesting a shift towards early bear market phases seen in 2018 and 2022.

- Previously, BCMI was near 0.5, indicating equilibrium between bullish and bearish forces. The decline suggests this balance has broken down.

- The report indicates a deterioration in Bitcoin's market structure, moving away from consolidation into a defensive regime.

- Current BCMI levels remain above past cycle bottoms, implying partial but not complete capitulation.

- BCMI's decline reflects shrinking unrealized profits, rising realized losses, and deteriorating sentiment.

Bitcoin Tests Long-Term Support

- Bitcoin's weekly chart shows structural pressure after losing the $70,000 level, retreating to mid-$60,000.

- The price movement indicates weakening bullish momentum and a transition to a defensive phase.

- A pattern of lower highs since the peak near $120,000 suggests a corrective market environment.

- Elevated trading volume implies distribution or forced deleveraging, complicating recovery attempts.

- The $60,000–$62,000 zone serves as critical support; holding this could stabilize Bitcoin.

Bitcoin's future direction is closely tied to liquidity conditions, institutional flows, and broader macroeconomic sentiment affecting risk assets.