1 0

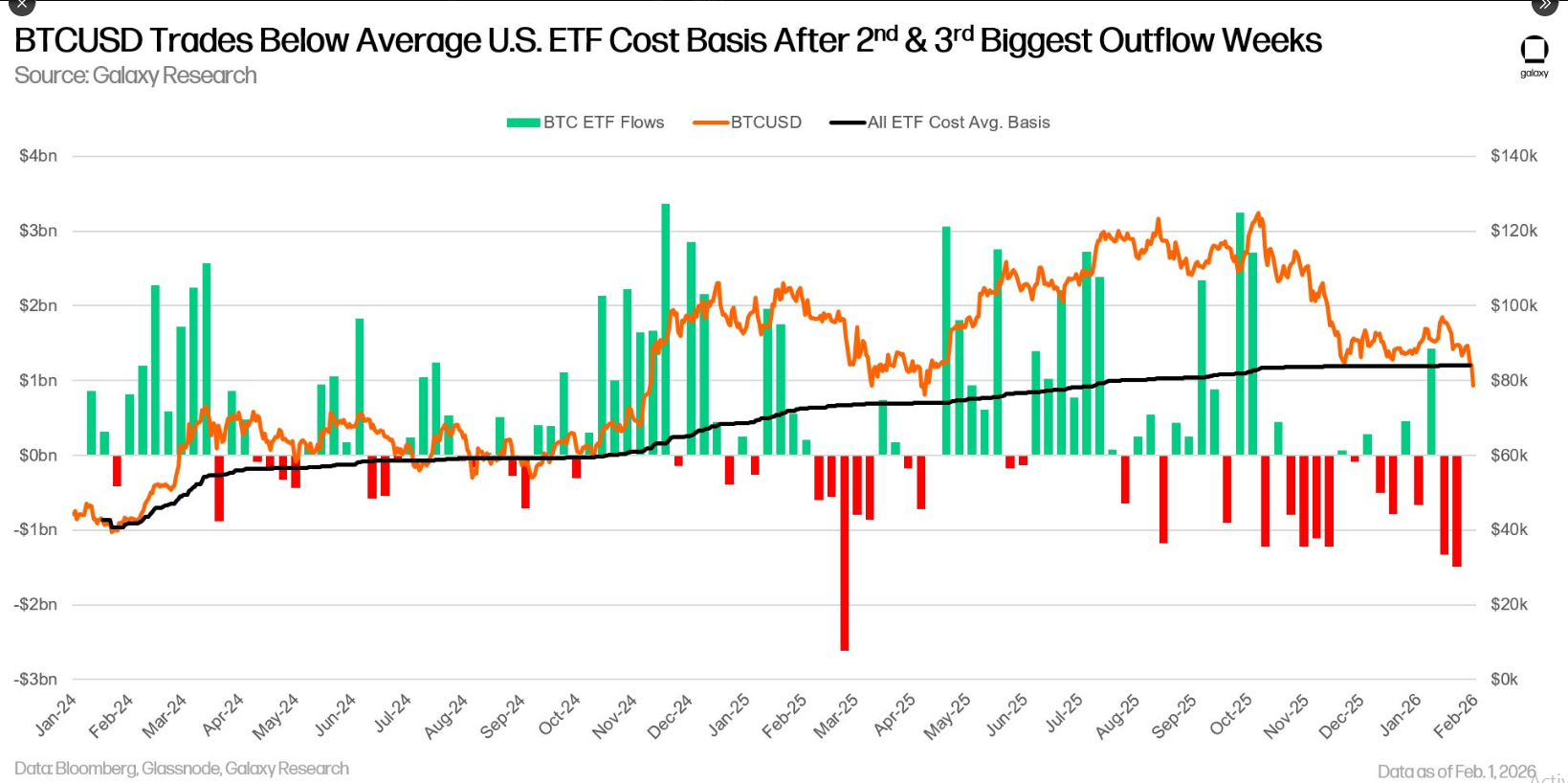

BEARISH 📉 : Bitcoin ETF Investors Withdraw $3 Billion Amid Market Decline

Bitcoin experienced a significant drop over the weekend, falling from approximately $84,000 to about $74,600. This decline erased recent gains and heightened market uncertainty, influenced by concerns over Federal Reserve leadership, job worries, and geopolitical tensions.

Average ETF Price Above Market

- US spot Bitcoin ETFs hold assets worth around $113 billion, with an estimated 1.28 million BTC.

- The average ETF buying price is about $87,830 per coin, above current trading levels, leading to paper losses for many positions.

Outflows Pick Up

- Investors pulled close to $3 billion from 11 spot ETFs over the last two weeks.

- This suggests profit-taking or exposure reduction after recent price increases.

- Cumulative ETF inflows remain lower than past peaks, indicating restrained buying interest.

Technical Signals And Bear Fears

- Spot BTC fell roughly 40% from its October peak; ETF AUM decreased by about 31%.

- Analysts warn that weak demand may lead to further downtrends.

- Technical charts indicate ongoing sell pressure, potentially extending declines if demand doesn't recover.

Policy, Politics, And Market Mood

- Uncertainty around monetary policy and geopolitics has contributed to market volatility.

- The US Clarity Act stalled in Washington, adding to the uncertainty.

- Tensions in the Middle East and trade issues have driven investors towards traditional safe havens like gold and the dollar.

Liquidity And The Road Ahead

- Institutional holders are largely holding on, providing some market stability.

- However, when ETF cost bases are higher than market prices, confidence can waver.

- Thinned liquidity could amplify price swings; a recovery needs renewed buying from retail and institutional investors alike.