0 0

BEARISH 📉 : Bitcoin liquidations surge while $HYPER shows resilience

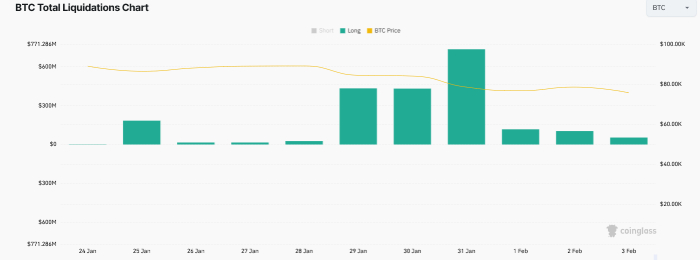

The crypto market is experiencing significant volatility as $1.5 billion in [Bitcoin](https://holder.io/coins/btc/) leveraged long positions were liquidated between January 29-31. This has led to a sharp retracement in Bitcoin's price, resulting in double-digit losses for several altcoins.

- Market corrections are flushing out over-leveraged positions, resetting open interest levels.

- High transaction fees during network congestion highlight Bitcoin's scalability issues, opening opportunities for Layer 2 solutions.

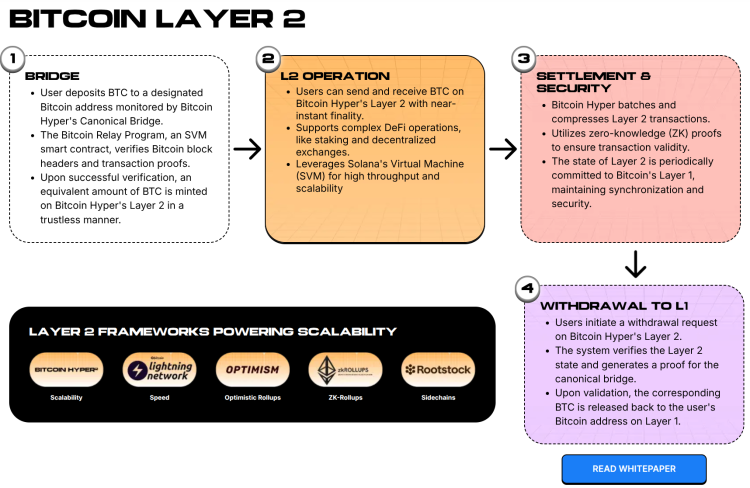

- [Bitcoin Hyper](https://newsbtc.care/box_7271b6427956901b28f9e1ee77c086e1), leveraging Solana Virtual Machine (SVM) on Bitcoin's security layer, shows resilience amid these conditions.

Integration of Solana Virtual Machine with Bitcoin Layer 2

- Bitcoin Hyper combines Bitcoin's security and Solana's speed, providing a robust environment for decentralized applications (dApps).

- Offers sub-second finality and low gas fees, enhancing capabilities for smart contracts, swaps, lending protocols, and gaming dApps.

The project addresses the 'programmability gap' by enabling efficient $BTC transfers through a decentralized bridge, reflected in its strong presale performance despite market corrections.

- $HYPER maintains technical resilience with price stability at $0.013675, even as other Layer 1s falter.

- Raised over $31.2 million, indicating strong community engagement and belief in the Layer 2 narrative as a key growth driver for the future crypto cycle.