3 0

BEARISH 📉 : Bitcoin’s Recovery Hinges on Improved Liquidity, Analysts Warn

Bitcoin Market Update

- Bitcoin found support above the mid-$80,000s, preventing a market collapse.

- Improved liquidity is crucial for a sustained recovery, with on-chain measures being key indicators.

Market Structure and Liquidity

- Approximately 22% of circulating Bitcoin is below its purchase price, increasing the risk of selling pressure if support fails.

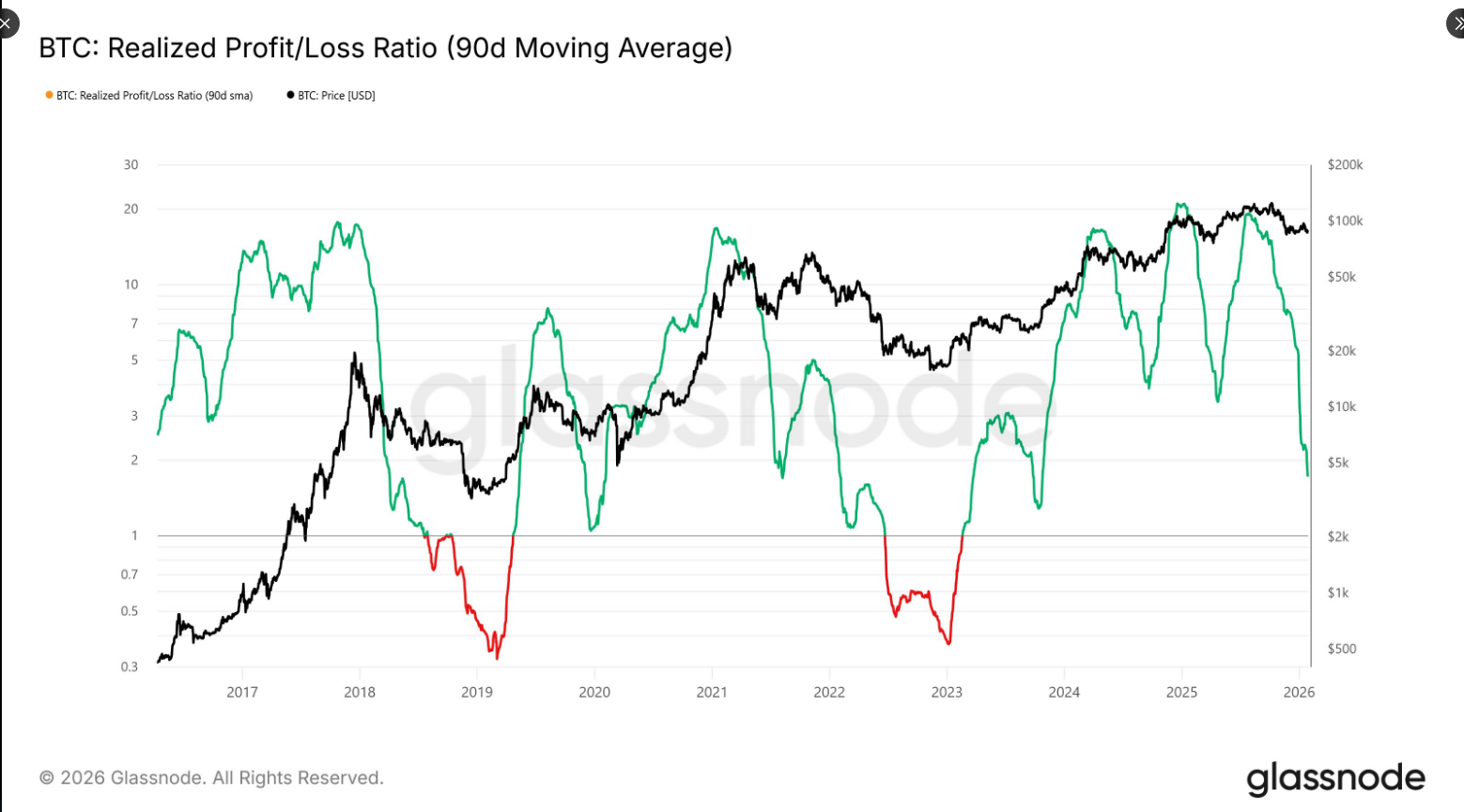

- The Realized Profit/Loss Ratio (90D-SMA) is critical; a sustained rise above ~5 historically signals renewed liquidity inflows.

- Current focus is on liquidity signals after Bitcoin defended the $80,700 to $83,400 support zone.

Bitcoin Price Action and Geopolitics

- Bitcoin trades cautiously near the high-$80,000s amid geopolitical concerns affecting risk appetite.

- Increased volatility leads to muted buying even at higher price levels, with potential short-term moves to the low-$90,000s.

Exchange Flows and Futures Market

- Exchange inflows remain low, indicating less immediate selling pressure as holders keep coins off exchanges.

- Futures markets hint at a possible short-term liquidity grab near the low-$90,000s, which could result in brief, volatile price movements.