0 0

BEARISH 📉 : Bitcoin RSI plummets to 23, signaling oversold conditions

Bitcoin's Technical Dislocation

- Bitcoin's RSI dropped to 23.3, the lowest since August 2023, indicating oversold conditions.

- The breach of the 200-day SMA puts Bitcoin in a structurally significant position, suggesting potential accumulation despite bearish pressure.

- Historically, such RSI levels have indicated buying opportunities for long-term holders.

- Bitcoin is trading near $67,000, below its recent consolidation range.

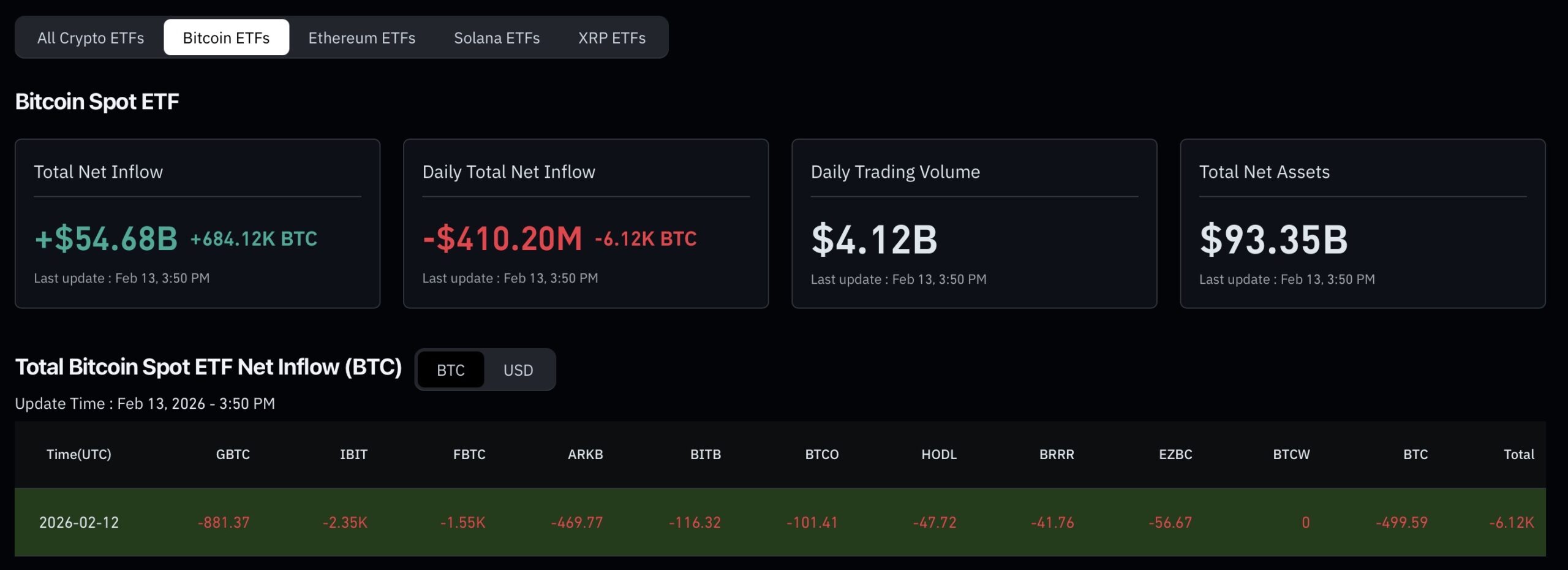

- Institutional activities show mixed signals with $410 million outflows from Bitcoin ETFs, while firms like Goldman Sachs hold substantial positions.

Market Outlook and Price Analysis

- Key support is being watched at $60,000, with risks of testing lower levels if the 200-day SMA is not reclaimed.

- A reclaim above $70,000 may validate a bottoming scenario.

- Caution is advised as low RSI can sometimes predict longer bear trends.

- Confirmation signals like volume spikes or higher lows are needed to confirm trend reversal.

Bitcoin Hyper Development

- Bitcoin Hyper ($HYPER) is developing infrastructure for enhanced BTC utility.

- The project has raised over $31.4 million in presale, with tokens priced at $0.0136755.

- Potential benefits exist if Bitcoin confirms a bottom and rebounds, especially for projects linked to network growth.

While traders await confirmation signals, some investors position themselves early, seeing current oversold conditions as an opportunity.