4 0

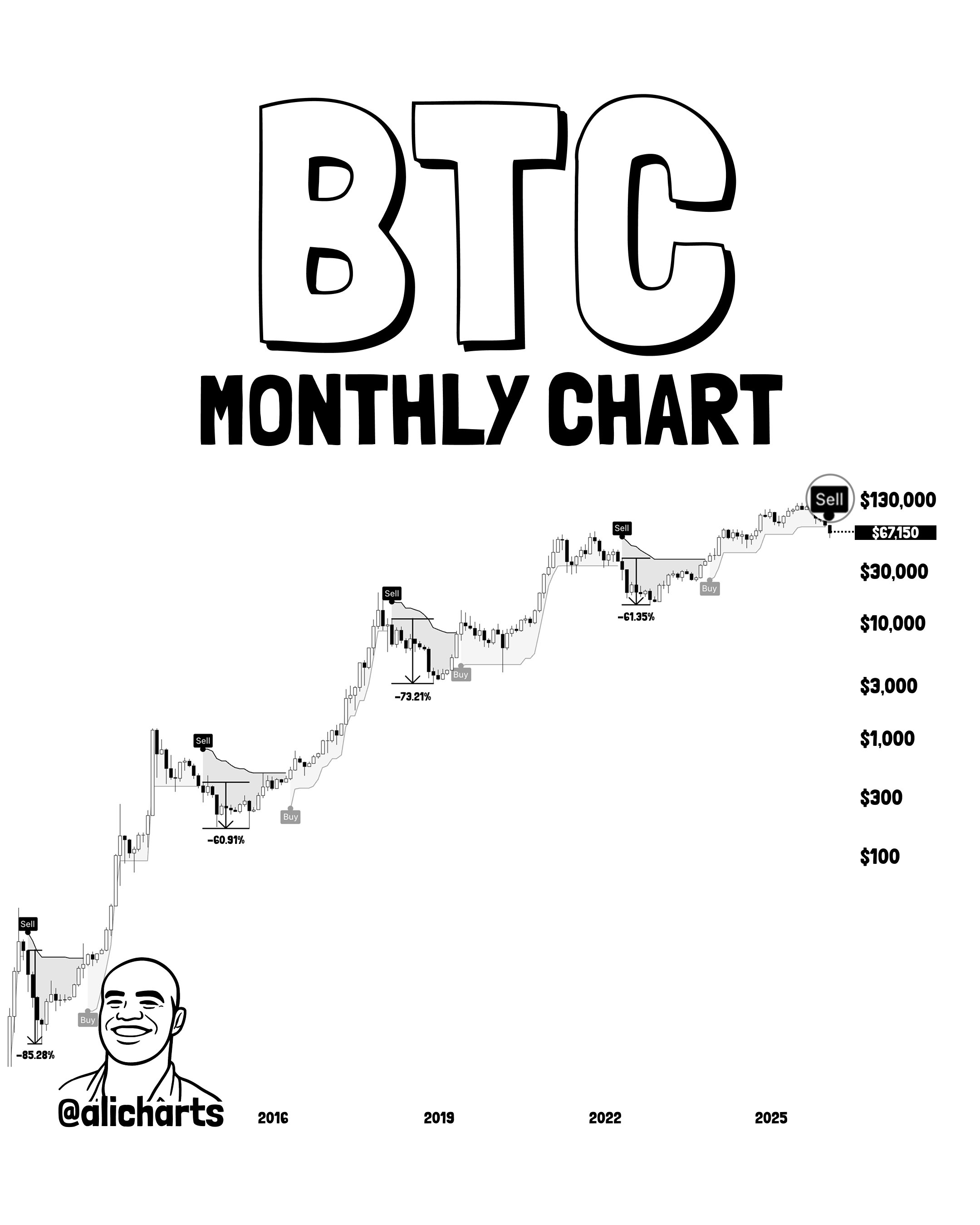

BEARISH 📉 : Bitcoin SuperTrend Indicator Signals Potential Long-Term Bear Market

Bitcoin experienced a 5.4% price increase on February 13th, offering short-term relief for traders. However, technical analysis suggests potential long-term bearish trends.

SuperTrend Indicator Signals

- The SuperTrend Indicator is signaling a possible market shift for Bitcoin towards a bearish trend.

- Historically, similar signals have preceded bear markets, such as in 2014-2015, 2018, and 2022.

- If the monthly candle closes below the SuperTrend line, it may indicate a long-term retracement.

Despite past patterns, current market dynamics differ due to institutional involvement and ETFs, which could impact future trends.

Market Implications

- If the bearish signal aligns with broader market activities, Bitcoin might face a devaluation of at least 60%.

- Conversely, new demand could mitigate the bearish outlook, making it a temporary warning.

Bitcoin Price Overview

- Current valuation: $68,984, marking a 4.5% rise in the last 24 hours.

- Monthly decline: Approximately 29%, according to CoinGecko data.