BEARISH 📉 : Bitcoin faces volatility with potential drop to $42K

- Bitcoin's price has dropped towards the mid-$60Ks, raising concerns about a potential decline to $42K amid unstable liquidity and sentiment.

- Spot Bitcoin ETFs have experienced volatile flows, with significant outflows in late January and erratic rebounds in early February.

- The term 'crypto winter' is resurfacing in mainstream media, potentially leading to increased selling and deleveraging cycles.

- Maxi Doge ($MAXI) is capitalizing on high-volatility trading culture through competitions and staking mechanisms to maintain user engagement.

Bitcoin has shifted from a 'buy-the-dip' approach to defensive risk management, trading near $66K after a sharp drop. Ethereum is around $1.9K. The narrative across finance is more cautious, with discussions of a severe downturn.

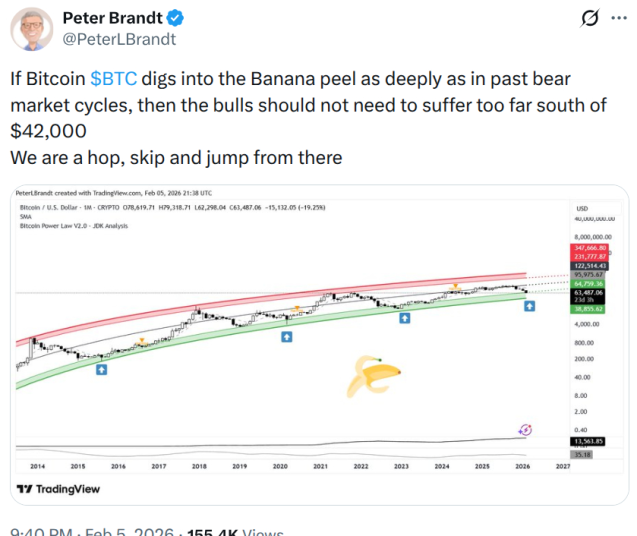

Peter Brandt's mention of a $42K target for Bitcoin is gaining attention as such round numbers influence market strategies and options hedging during liquidity constraints.

Market volatility leads traders to either hold cash or pursue meme coins like Maxi Doge, which offer potential for high returns despite risks.

Maxi Doge ($MAXI) Embraces Volatility

Maxi Doge, an Ethereum ERC-20 meme token, targets retail traders with limited capital by offering a community-driven risk-taking experience. It includes trading competitions and rewards to attract users.

The presale of $MAXI has raised over $4.5M, with tokens priced at $0.0002802. There is a planned price increase soon, attracting traders looking for low-cost investment opportunities.

Significant whale investments, such as a $314K purchase, indicate interest in the token. Maxi Doge offers dynamic APY through a 5% staking pool, incentivizing holding.

Note: This summary is not financial advice; cryptocurrency investments are highly volatile, and presales carry risks.