1 0

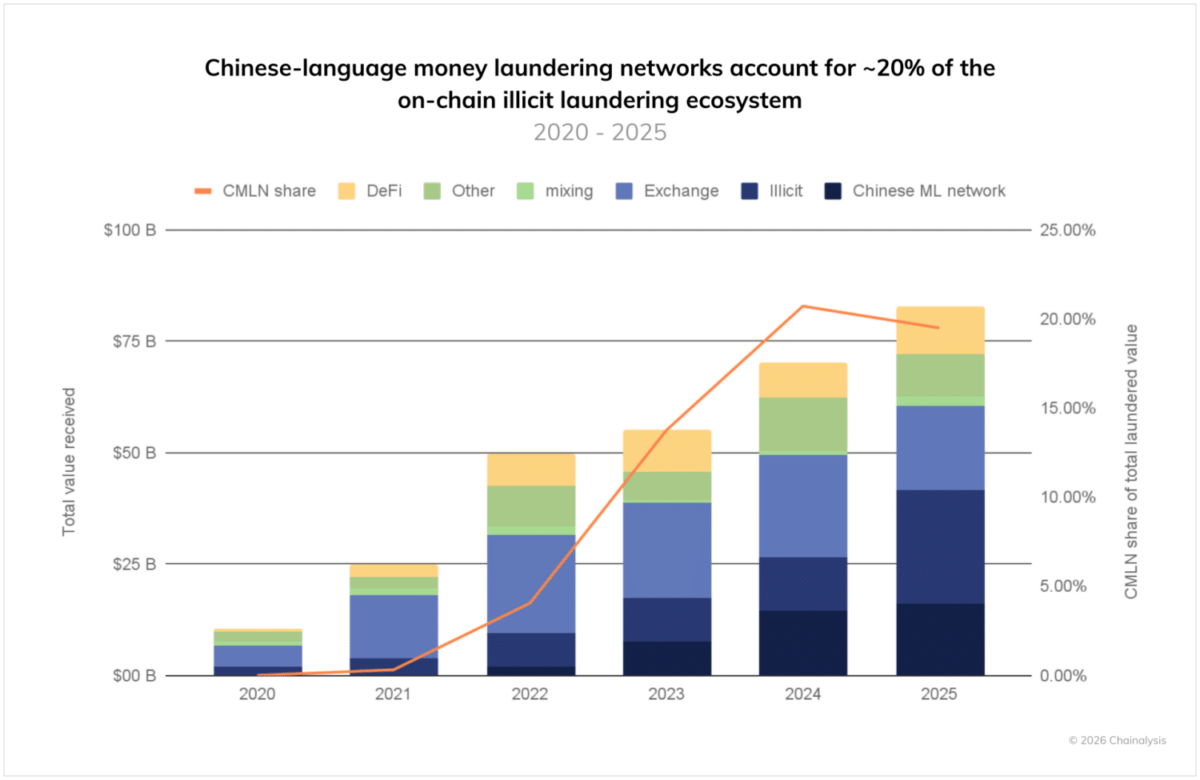

BEARISH 📉 : Crypto money laundering reached $82 billion in 2025

Illicit cryptocurrency money laundering surged to over $82 billion in 2025, an eightfold increase from $10 billion in 2020, as reported by Chainalysis.

- Chinese-language money laundering networks (CMLNs) are now major players, processing $16.1 billion annually with over 1,799 active wallets.

- CMLNs account for about 20% of known illicit laundering activities, growing 7,325 times faster than inflows to centralized exchanges since 2020.

Key Operations of CMLNs

- Comprised of six service types: running point brokers, money mules, informal desks, Black U services, gambling platforms, and money movement services.

- Exploit China’s capital controls, providing liquidity for organized crime groups.

- Shifted rapidly to using cryptocurrencies over traditional systems.

Crackdown and Resilience

- Despite China's 2021 ban on cryptocurrency trading, underground operations continue.

- In 2024, Chinese authorities prosecuted 3,032 individuals linked to crypto laundering cases.

- In January 2026, South Korea dismantled a $102 million crypto remittance ring.

- Cambodia has become another focus, with $49 billion in transactions linked to Huione Guarantee.

Combating these resilient networks requires public-private cooperation, combining law enforcement and blockchain analytics expertise to increase operational costs and risks for criminals.