1 0

BEARISH 📉 : Tether CEO Paolo Ardoino Scales Back $20B Investment Plan

Summary of Recent Developments in Crypto Investments

- Tether CEO Paolo Ardoino is reducing a $20B investment plan to strengthen liquidity reserves, indicating a change in venture capital risk strategy.

- Investment focus is shifting from general tech sectors to Bitcoin infrastructure, particularly Layer 2 solutions addressing scalability and programmability.

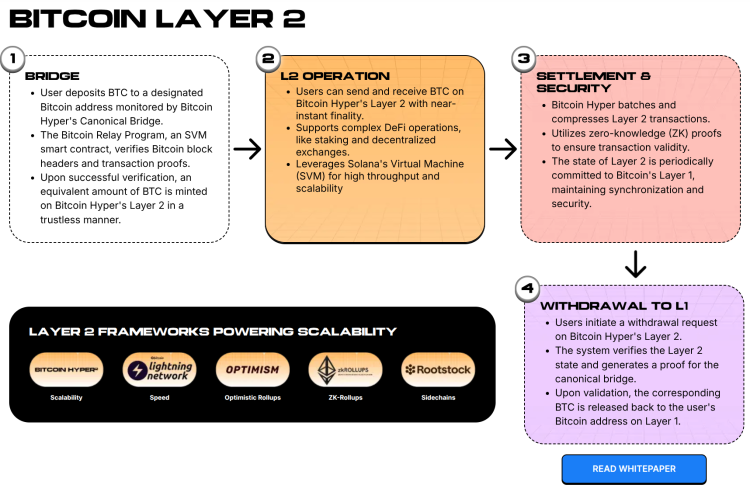

- Bitcoin Hyper integrates the Solana Virtual Machine (SVM) on Bitcoin's Layer 2, enabling high-speed smart contracts and attracting over $31.2 million in its presale.

The recalibration by Tether suggests a strategic pivot towards conserving liquidity rather than expanding into broader tech fields like AI and data mining. This move might impact peripheral sectors due to reduced liquidity inflow.

However, the market is actively channeling funds into enhancing Bitcoin's foundational infrastructure rather than seeking alternatives to it. This trend highlights a preference for 'Bitcoin enablers' over speculative ventures.

Technological Advances

- Bitcoin Hyper’s integration of SVM offers a modular blockchain environment where Bitcoin Layer 1 ensures security, while Layer 2 enables execution with sub-second finality and minimal gas costs.

- This advancement makes high-frequency trading and complex DeFi applications feasible on Bitcoin, previously limited to platforms like Solana or Ethereum.

- A decentralized Canonical Bridge facilitates trustless $BTC transfers into this ecosystem, expanding opportunities for developers using Rust to build dApps on Bitcoin.

Presale Insights

- Bitcoin Hyper’s presale surpasses $31M, showcasing significant early investor interest and aligning with the broader market shift towards scalable Bitcoin Layer 2 solutions.

- Current token price of $0.0136751 and staking rewards of approximately 37% are attracting substantial participation, emphasizing a shift towards yield and utility within the Bitcoin ecosystem.