Binance Coin Price Surges 5% to Break $600 Barrier

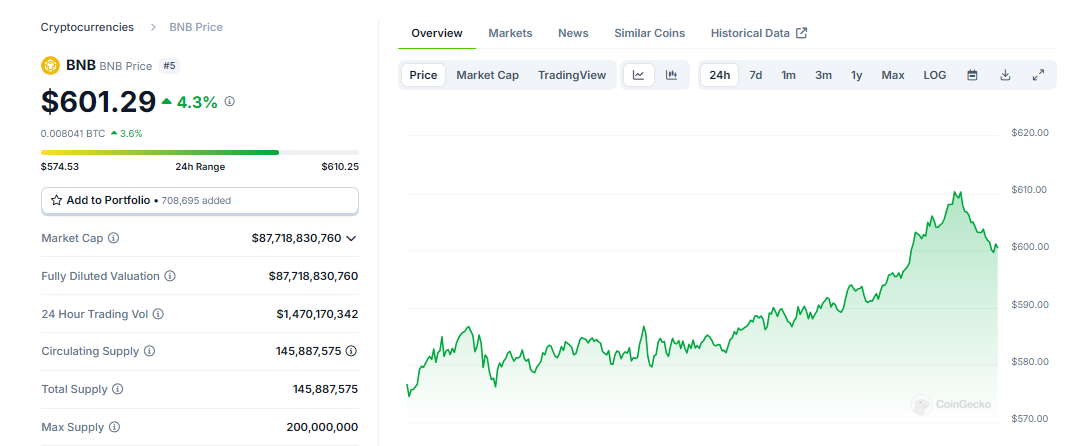

In the past 24 hours, the price of Binance Coin (BNB) increased by 5%, indicating consistent upward movement. BNB recently surpassed the $600 mark, attracting market attention due to bullish momentum.

Data from CoinCheckup indicates that BNB is trading approximately 20% below its expected price for the next month, suggesting potential for near-term profits if this trend persists.

Binance Coin: Mixed Sentiment & Cautious Optimism

Technical indicators show cautious optimism regarding market sentiment. The Relative Strength Index (RSI) hovers around 50, reflecting a balanced sentiment without significant pressure from buyers or sellers.

This neutrality suggests BNB could experience price fluctuations without an outstanding trend. The Chaikin Oscillator is currently at -35K, indicating minimal buying accumulation.

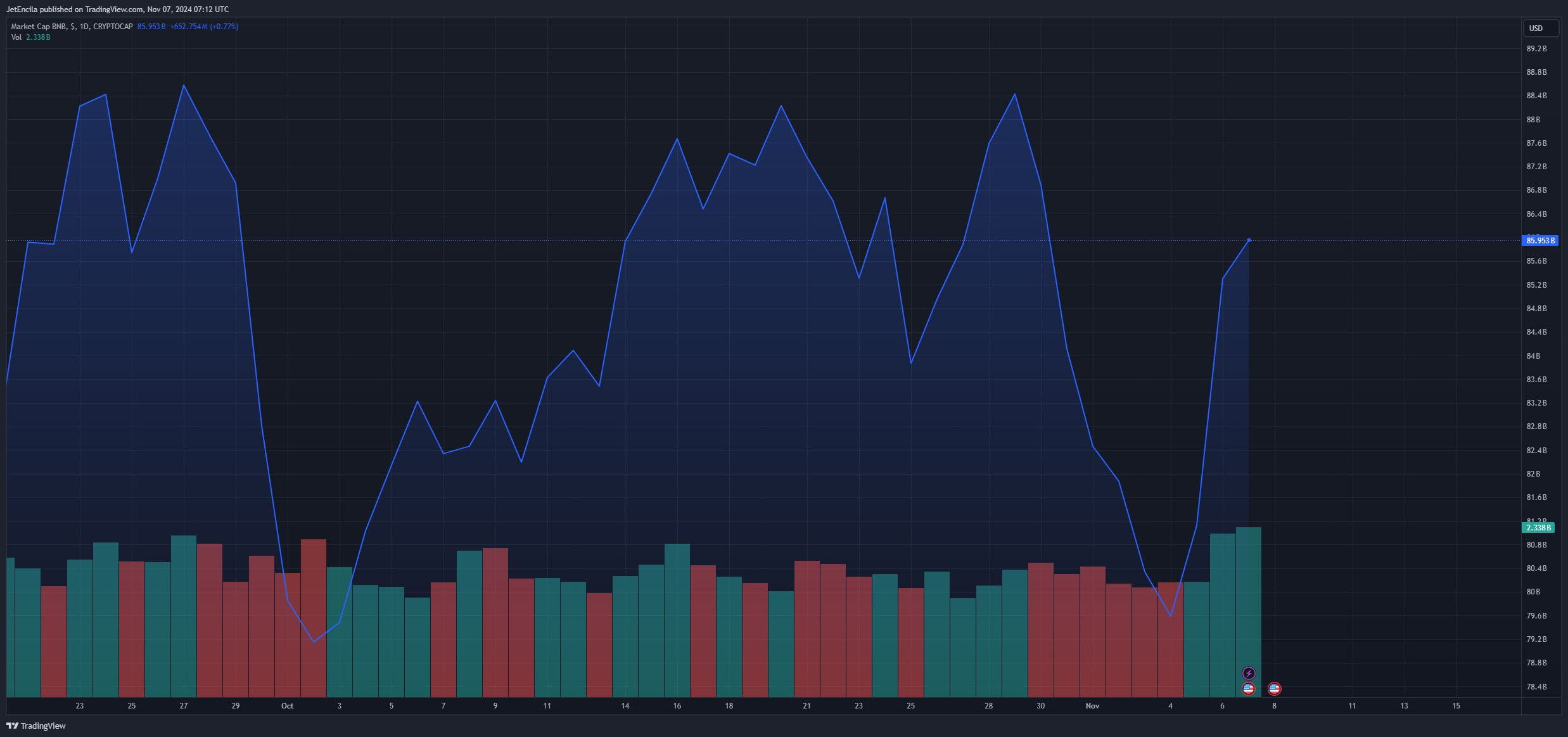

Without a shift in market sentiment to attract more buyers, the lack of capital inflow may hinder further rallies. BNB's trading volume has risen by 31% in 24 hours, signaling increasing market activity and interest. The volume-to-market capitalization ratio stands at 2.46%, raising questions about whether this interest can sustain upward price movement.

Short-Term Pressures And Trading Volatility

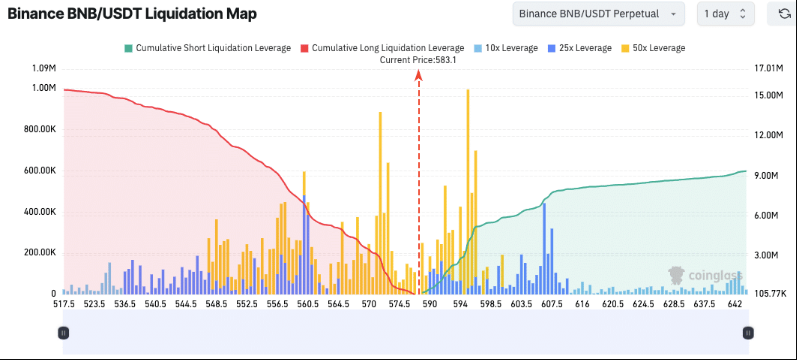

The liquidation map for BNB reveals concentration zones that may threaten price stability. Price volatility could arise if BNB surpasses $590, as short positions are concentrated around the $583 level. This situation could trigger a domino effect, pushing prices higher. Conversely, long liquidations may occur if the price falls below $570, accelerating sell-offs as positions near their end.

These levels are critical for short-term traders, as price movements around them could present either risks or opportunities.

Long-Term Forecast

Projections indicate a potential rise of 60% over the next three months and a subsequent increase of 30% over six months, suggesting an optimistic outlook for BNB. Additionally, a projected growth rate of 53% points to a robust 12-month forecast.

Recent token burn activity eliminated 1.77 million tokens, valued at approximately $1 billion, contributing to positive sentiment. This reduction in supply is crucial for price stability and long-term growth for BNB investors. Each burn enhances the value of remaining tokens, though market volatility introduces uncertainty regarding these dynamics.

Featured image from DALL-E, chart from TradingView