4 0

Binance Reports Significant Ethereum Whale Outflows Amid Strong Demand

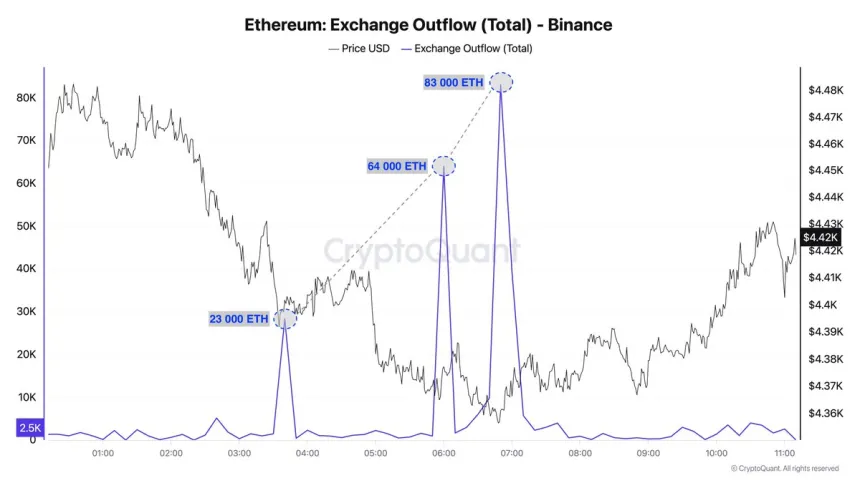

Ethereum is currently consolidating after dropping below $4,500 and is trading just above $4,250. The market is uncertain about whether ETH will decline further or gain momentum for a rally. Despite volatility, strong fundamentals are evident, with continued whale and institutional accumulation.

Key points include:

- Elevated whale activity on Ethereum, with significant outflows from Binance.

- Whales are moving ETH into decentralized finance ecosystems rather than selling.

- Recent large transactions included withdrawals of 23,000 ETH, 64,000 ETH, and 83,000 ETH, totaling nearly $750 million.

- Binance reserves now hold 4.2 million ETH, indicating a decline in centralized exchange balances.

- Whale confidence in Ethereum suggests long-term bullish sentiment despite short-term volatility.

- ETH has recently outperformed Bitcoin amid strong whale demand.

Technically, ETH is testing key support levels around $4,300, with the 200-period SMA providing structural support. Maintaining this level is crucial to avoid deeper corrections.

Resistance remains at $4,450–$4,500, which ETH has struggled to breach. A reclaim of $4,500 could signal a push towards $4,700 and $5,000, while a drop below $4,300 might lead to retests of $4,200 or lower.