Binance Accused of Manipulating XRP Price to Protect Market Position

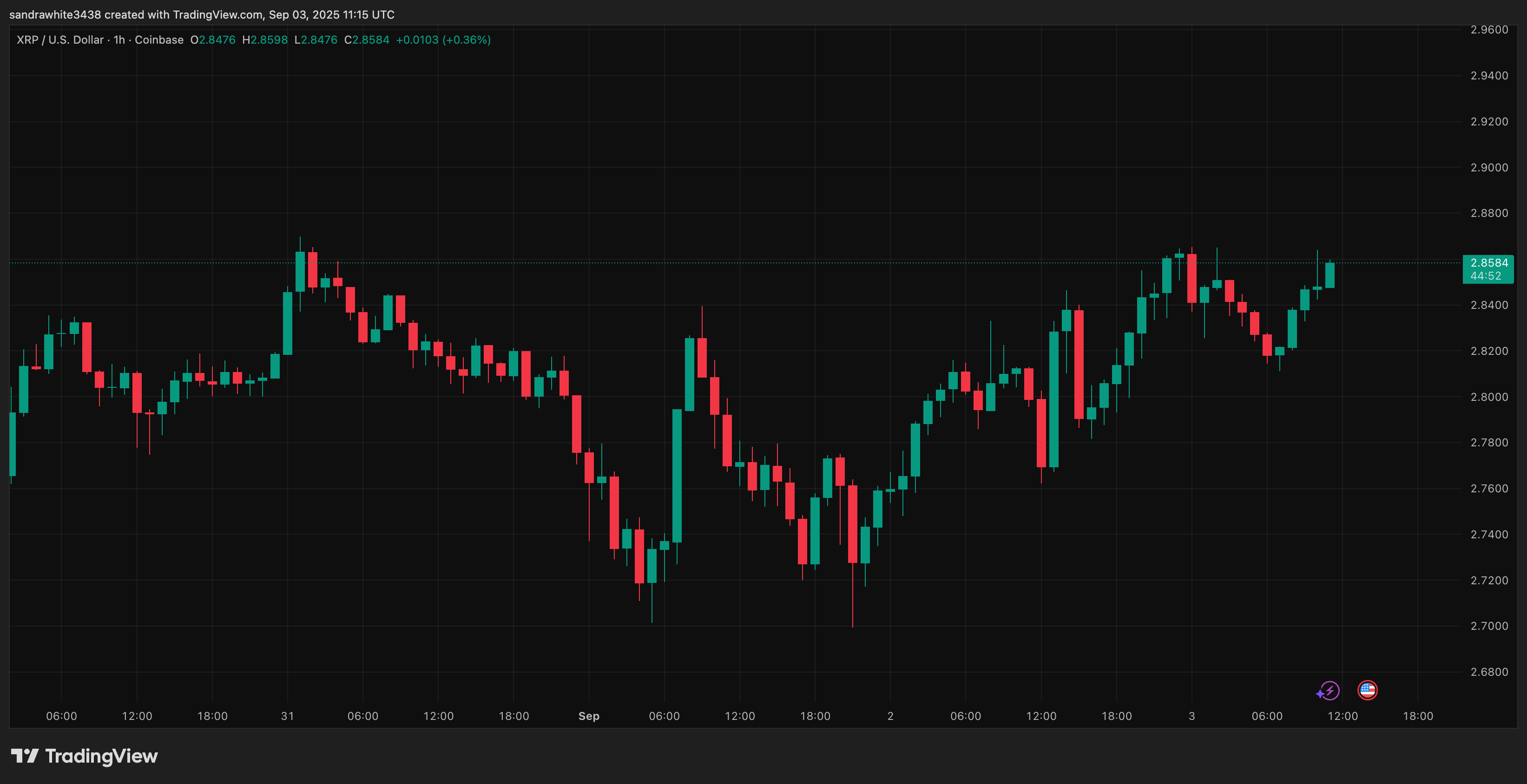

Crypto analyst Pumpius claims that the recent decline in XRP prices is a result of intentional actions by Binance, aimed at protecting its business model. He argues that Binance is not just liquidating XRP but actively manipulating market conditions to suppress its price.

Allegations Against Binance

- Binance accused of selling XRP and coordinating market manipulation.

- Observations include sudden liquidity drops and increased sell pressure during positive news for Ripple.

- Pumpius suggests this strategy prevents XRP from gaining traction as a payment infrastructure.

Pumpius further asserts that powerful investors and legacy financial institutions view XRP as a threat due to its transparency, which could expose hidden financial flows. As a result, they resort to price suppression tactics.

Potential Backfire of Suppression

- Pumpius believes the continued pressure on XRP could backfire.

- Strengthening fundamentals include new payment corridors in Japan and the UAE.

- Projects utilizing the XRP Ledger are emerging, indicating growing utility.

He notes that every instance of Binance selling leads to a rise in self-custody wallets, further decentralizing XRP ownership. This may position XRP favorably when real utility drives demand beyond speculative trading.

Pumpius concludes that while Binance may appear to be winning now, the ongoing suppression could reveal the true potential of XRP as a cornerstone of a new financial system.