Bitcoin Aims for $100,000 as $96,400 Support Level Tested

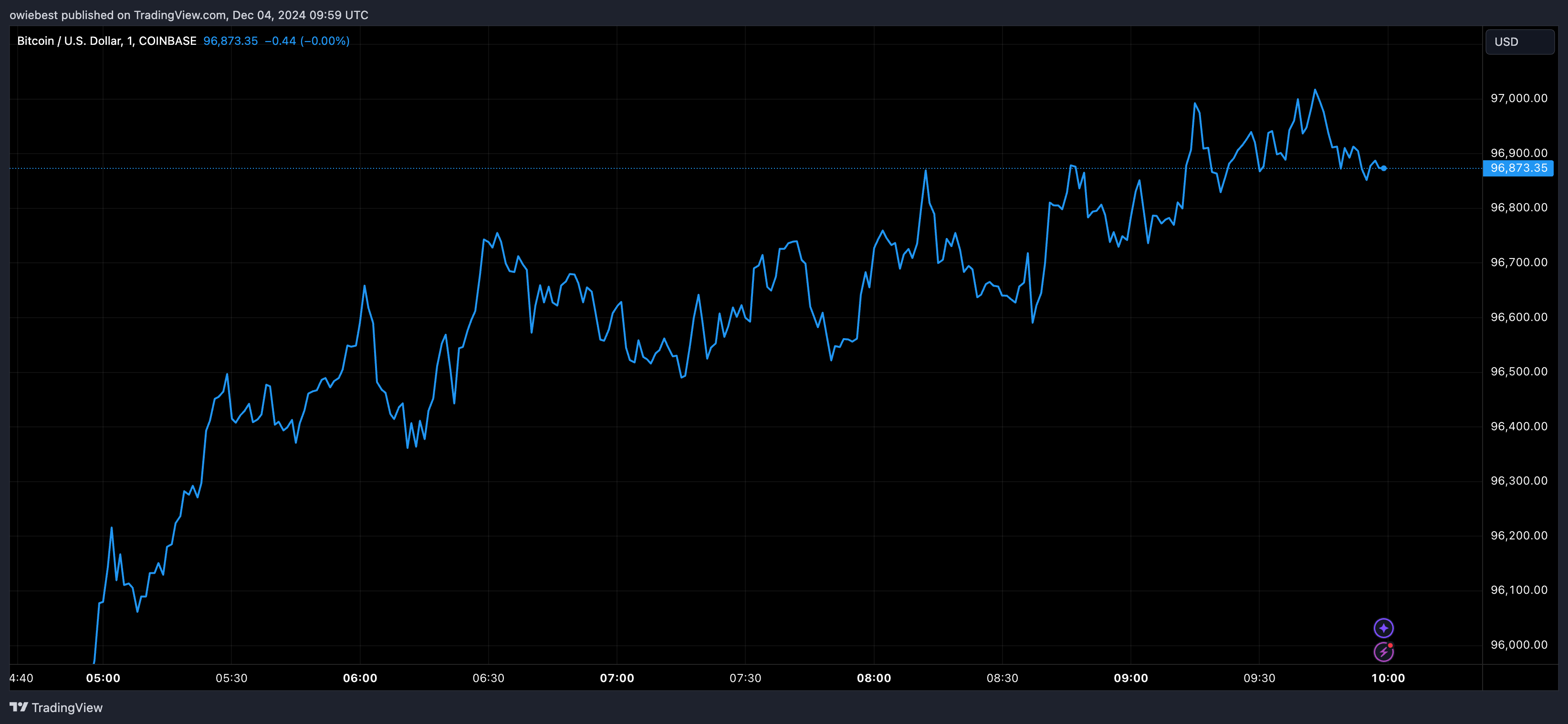

The Bitcoin price is attempting to establish the $96,400 level as support after surpassing a bearish trend line. A crypto analyst emphasizes the significance of this support for Bitcoin's potential rally towards retesting the $100,000 All-Time High (ATH).

Bitcoin Price Retests $96,400 To Trigger Surge To $100,000

Crypto analyst Rekt Capital informed his followers on December 4 that if Bitcoin successfully tests the $96,440 support level, it could trigger a price increase to $100,068.

Rekt Capital shared a price chart showing that Bitcoin has consistently retested its series of Lower Highs, indicating a key support level. Lower Highs refer to each successive high point being lower than the previous one, typically seen during a downtrend. However, treating these lower highs as support suggests a market shift and stabilization following declines.

Rekt Capital noted that Bitcoin is producing longer downside wicks, indicating significant price declines followed by buyer intervention. This behavior shows liquidity being grabbed at lower prices without breaking below the key support trendline.

A liquidity grab occurs when large volumes of orders at key price levels are triggered unexpectedly, allowing substantial players to execute trades. Rekt Capital stated that as long as this trend continues, Bitcoin is likely to reclaim the $96,440 level, facilitating movement toward or beyond the $100,000 milestone.

Bitcoin’s Bear Case Scenario

Rekt Capital's price chart highlights several support levels that Bitcoin could fall to if it fails to reclaim the $96,440 mark. While current action suggests a potential rise to $100,000, failure to hold the $96,440 support may lead to a retest of around $91,070.

The red line on the chart indicates that $91,070 is critical; falling below this level could result in a drop to new lows around $87,325. As of now, Bitcoin is trading at $96,737, reflecting a 3.24% increase over the past week. A drop below $87,300 would signify more than a 10% decline from the current value.