8 0

Bitcoin Reaches $110,000 Ahead of U.S. Jobs Report Release

Crypto Daybook Americas will not be published on July 4 due to the holiday, returning on July 7.

Key updates include:

- Bitcoin reached $110,000, close to its all-time high of $112,000 from May 22.

- Bitcoin's market dominance decreased to 65%, with a market cap of $2.2 trillion.

- The U.S. jobs report is anticipated, with nonfarm payrolls expected to rise by 110,000, the lowest increase in four months.

- Unemployment rate projected to rise to 4.3%, the highest since October 2021.

- Markets are pricing in a 75% likelihood that the Federal Reserve will maintain interest rates at 4.25%-4.50% during the July 30 meeting.

- On-chain flows indicate major players are awaiting labor data for market direction.

What to Watch

- Crypto

- July 15: Lynq to launch a real-time, interest-bearing digital asset settlement network.

- Macro

- July 3: U.S. Bureau of Labor Statistics to release employment data.

- July 4: Various economic data releases from Brazil and Mexico.

- Token Events

- Voting on governance proposals for Arbitrum, Compound, and Polkadot this week.

- Zilliqa hosting an AMA session on July 3.

Market Movements

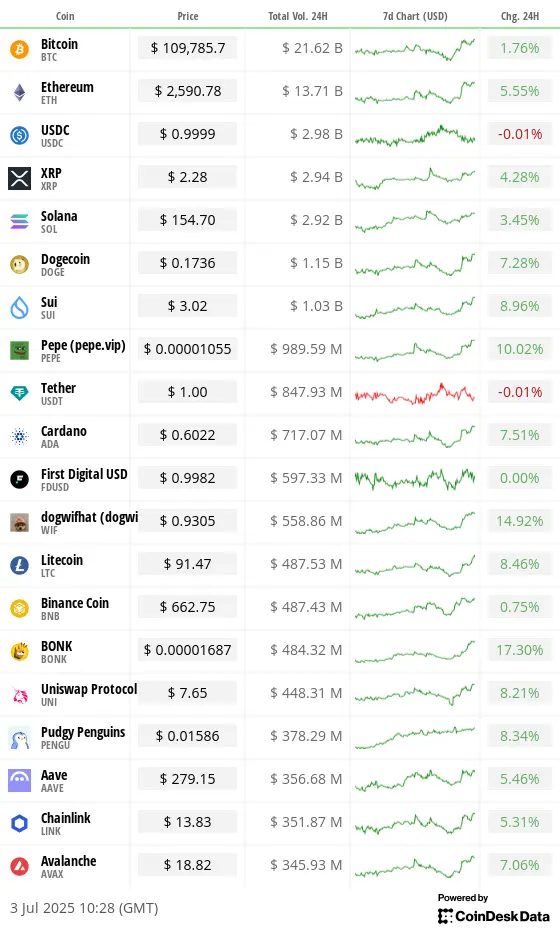

- BTC at $109,970.87 (+0.72%)

- ETH at $2,599.77 (+0.33%)

- CoinDesk 20 index up 1.51% at 3,149.61

Technical Analysis

- BTC perpetual futures open interest indicates renewed demand as prices rise above $110K.

Derivatives Positioning

- DOGE, LTC, XMR show increased open interest in perpetual contracts.

- TRX and BCH favor short positions.

ETF Flows

- Spot BTC ETFs see daily net inflows of $407.8 million; cumulative net flows reach $49.02 billion.

- Spot ETH ETFs record outflows of $1.9 million; total ETH holdings around 4.13 million.

Overnight Flows

Chart of the Day

- Market anticipates potential job losses based on trader perceptions regarding June's nonfarm payrolls report.

- Weaker labor data may strengthen chances of Fed rate cuts, potentially increasing bitcoin volatility.