Bitcoin Faces Potential 20% Drop Linked to M2 Money Supply Trends

Bitcoin’s potential for new price peaks faces a significant obstacle, with analysts predicting a 20% or greater decline if its established link with the global M2 money supply persists. The M2 money supply, which includes cash and short-term deposits, has historically indicated Bitcoin’s price trends. Joe Consorti, head of growth at Theya Bitcoin, predicts a price pullback to $70,000 if this pattern continues.

Source: Joe Consorti

Consorti issued a cautionary statement on social media platform X, noting the correlation's accuracy. He expressed uncertainty over whether Bitcoin would follow the M2 supply’s trajectory downward or find support beforehand. Since September 2023, Bitcoin has shown a 70-day delay in mirroring the global M2 money supply movement.

Bitcoin Trends Mirror Global M2 Shifts

Bitcoin's value has historically risen alongside the global M2 money supply, especially during inflationary periods. Expanding M2 often signals inflation, prompting investors to view Bitcoin as a hedge against rising prices. Similar patterns were observed during past bull runs. However, Consorti anticipates a 20-25% drop in Bitcoin’s value due to ongoing trends that could lead to significant declines.

On November 25, 2024, Consorti highlighted Bitcoin's tendency to follow M2 movements with a 70-day delay, observing this correlation consistently since mid-2023. He warned of potential corrections if the trend continues, noting the historical reliability of this relationship.

“I don’t want to alarm anyone, but if it continues, Bitcoin could be in for a 20-25% correction,” Consorti stated.

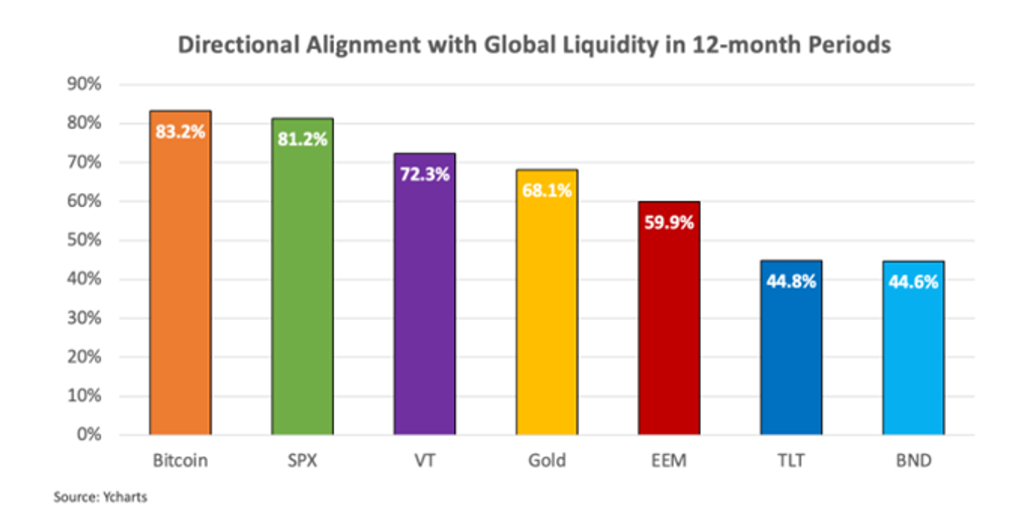

Contrasting views exist among experts. Macroeconomist Lyn Alden noted in a September 2024 report that Bitcoin aligns with global liquidity trends 83% of the time over a 12-month period, moving alongside M2. Despite this observation, some remain skeptical. Analyst David Quintieri dismissed such correlations, highlighting Bitcoin's extreme volatility, which he argued undermines its connection to any metric.

Source: Lyn Alden

“Bitcoin is too volatile to track it against anything. All of these are just distractions. You could do it with the stock market, and it’s more realistic,” said David.

Glassnode’s lead analyst, James Check, offered a different perspective, explaining that much of the recent decline in M2 was due to dollar strength, effectively “devaluing” the M2 of other countries.

Bitcoin Defies Trends amid US Tariff Concerns

Analysts express concerns about external influences, such as potential US tariff changes, affecting Bitcoin. On November 22, crypto analyst Sam KB highlighted an anomaly in market behavior. Historically, Bitcoin rallies have aligned with peaks in M2 money supply. However, during the current cycle, despite M2 reaching its lowest level, Bitcoin continues to surge.

“Despite M2 being at its lowest point this cycle, Bitcoin has continued to rally, leaving many to question the disconnect between the two. ‘M2 is nearly at the lowest point this cycle… but BTC is rallying. What am I missing?’” he wrote.

Additionally, President-elect Donald Trump’s plans to impose tariffs on imported goods could further strengthen the US dollar. Hedge fund manager Scott Bessent addressed this issue in a Bloomberg interview, noting that “Tariffs cause a stronger dollar,” which could present challenges for Bitcoin.