4 1

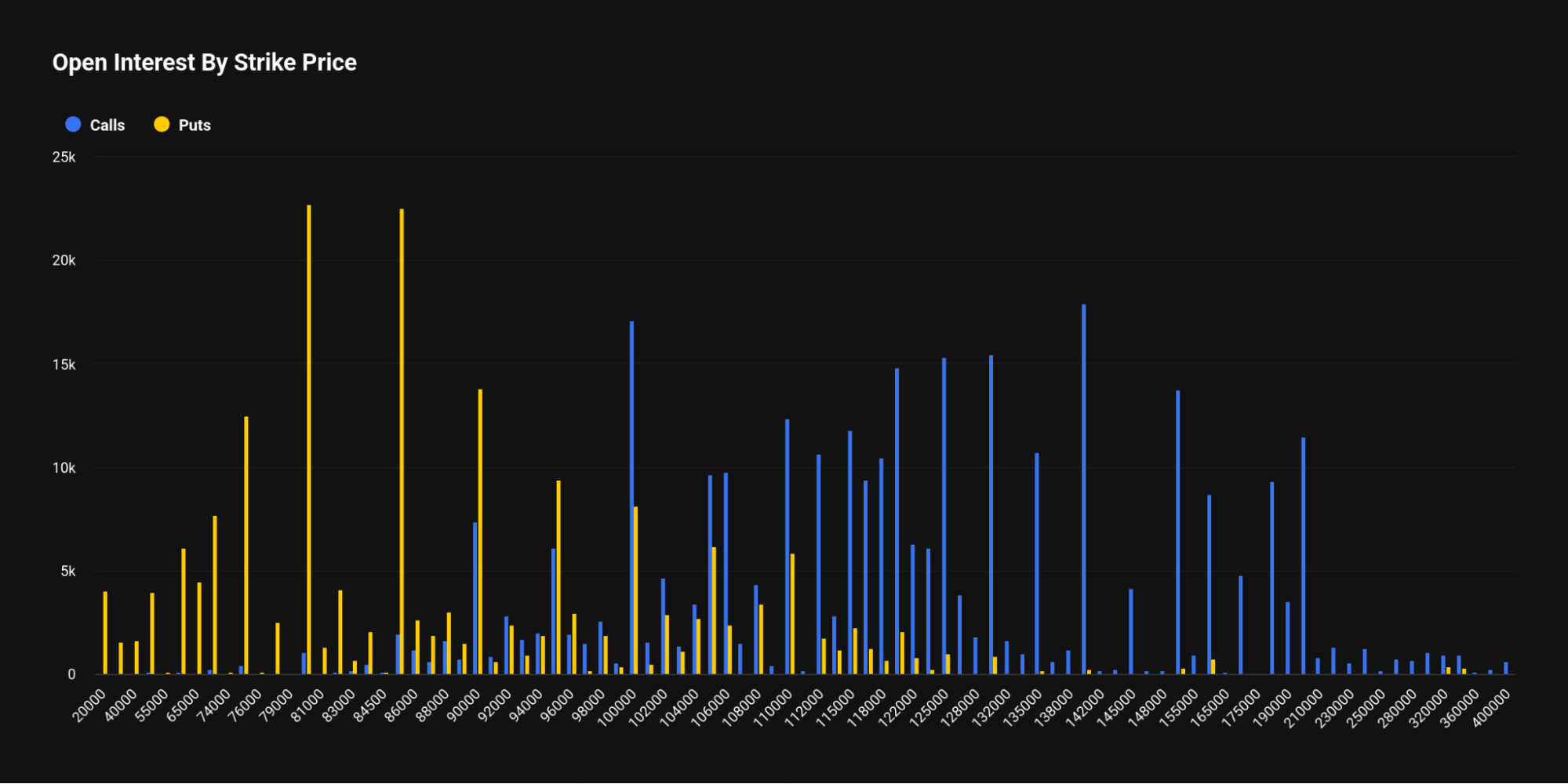

Bitcoin $80,000 Put Option Dominates with Over $2 Billion Interest

The Bitcoin options market is leaning towards a bearish outlook, with the $80,000 put option becoming the most popular contract on Deribit, holding over $2 billion in open interest. This surpasses the $85,000 put at $1.97 billion.

- Open interest for the $140,000 call has decreased to $1.56 billion.

- Increased put demand suggests expectations of Bitcoin dropping below $80,000.

Market Setup Insights

- On-chain data from CryptoQuant indicates short-term holder capitulation, potentially forming a bottom if this is a correction.

- If a bear cycle starts, the decline might persist, with $80,000 as a critical level.

- Swissblock notes historical momentum-driven drops to clear liquidity between $80,000 and $82,000, setting up for a potential upward move.

- Analyst Ted Pillows warns that failing to reclaim $88,000-$90,000 soon could lead to new monthly lows.

- CryptoQuant's sSOPR metric shows a rebound, suggesting a new uptrend may be forming.

ETF Influence on Market Dynamics

- US-listed spot Bitcoin ETFs processed over $40.32 billion in volume last week, with BlackRock’s IBIT contributing nearly 70% of this volume.

- Bitcoin's price has dropped 23% over the past month, reaching $86,700 and briefly falling to nearly $80,000 on some exchanges.

- Market still reflects "Extreme Fear," but analysts doubt a catastrophic drop similar to previous cycles.